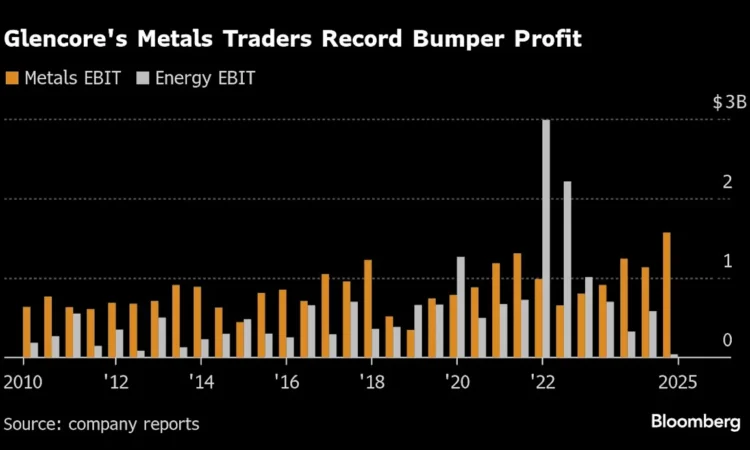

(Bloomberg) — The world’s metal traders are enjoying their most profitable ever year, after a series of supply upheavals propelled prices toward record highs and drove huge shifts in metal moving across the globe.

Glencore Plc and Trafigura Group, which have long competed as the two largest players, are both on track for their best year for metal trading, according to people familiar with the matter. IXM, the third-largest metals trader, has already surpassed last year’s profit and will report its third consecutive record year, according to Chief Executive Officer Kenny Ives.

Most Read from Bloomberg

“There have been some phenomenal opportunities this year,” Ives said at an event at Bloomberg’s London office this week. “It has been a great time to be a base metal trader in 2025. You rarely see years like 2025.”

The boom vindicates a recent push into metals by several of the world’s largest energy traders, betting that the markets would benefit from rising demand in a sector regarded by governments as increasingly strategic. Mercuria Energy Group Ltd., which expanded most aggressively, has made around $300 million in trading profits so far this year, Bloomberg reported last week.

The surge in earnings is happening at a time when trading margins for other commodities like gas, oil and grains are under pressure. For metals traders, it represents a welcome shift after a period of lackluster demand and choppy prices that crimped profits.

Oct. 2023: Metal Trader Misery Undercuts Supercycle Hype Amid Losses

Still, not all of the new entrants have fully capitalized. Mercuria’s energy-trading rivals Vitol Group and Gunvor Group, which have been more cautious in their expansion, have made only modest profits from metals this year, according to people familiar with the matter, who asked not to be identified because the figures are private.

Gunvor CEO Torbjorn Tornqvist said in an interview that the company was making money in metals, but that its profits were “not that big as we hear from others.” A Vitol spokesperson declined to comment.

Among the larger players, profits have been driven by a series of supply squeezes and upheavals.

US President Donald Trump created a huge arbitrage opportunity by threatening, but not imposing, import tariffs on refined copper. That drove US copper prices to an unprecedented premium over global benchmarks, allowing traders to make near-guaranteed profits by shipping physical metal to the US.