Neighbourhood Holdings Acquires Fisgard Asset Management, Creating One of Canada’s Largest Alternative Mortgage Lenders

VANCOUVER, BC / ACCESS Newswire / October 20, 2025 / Neighbourhood Holdings Ltd. (“Neighbourhood”) is excited to announce its landmark acquisition of Fisgard Asset Management Corporation (“Fisgard”), creating one of Canada’s largest mortgage investment entities and marking a major milestone in Canada’s alternative mortgage industry.

This transaction marks a significant consolidation and brings together two of the country’s most respected alternative mortgage lenders. The combined business will have over $750 Million in assets under management (AUM) across 1,550 mortgages, 60+ employees, and over 3000 investors, serving brokers and borrowers from coast to coast. Moreover, the combined business will unlock competitive rates and flexible solutions to the nearly5,000 mortgage brokers the two firms have collectively worked with in recent years.

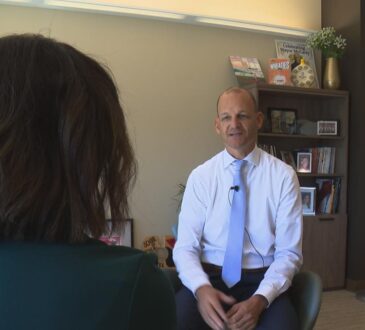

Together, Neighbourhood and Fisgard now form one of Canada’s top mortgage investment entities and are leading the charge in the changing landscape of the alternative lending industry. “Our Teams have worked tirelessly to advance this transaction, which is reflective of our shared belief in the increasing institutionalization of Canada’s alternative mortgage sector – a shift that we play a strong role in leading” said Neighbourhood’s Co-Founder and CEO, Taylor Little. “As always, we are committed to scaling responsibly and continuing to raise the bar for transparency, performance, and innovation.”

Building Scale, Reach, and Resilience

Founded in 1994, Fisgard brings a multi-decade track record and a highly regarded brand within the mortgage broker community, while Neighbourhood contributes a strong growth engine and modern infrastructure. Together, the companies are positioned to lower rates, diversify product offerings, and leverage technology to deliver better outcomes for borrowers and investors alike.

“As traditional banks tighten lending standards, alternative lenders like Neighbourhood and Fisgard are playing a growing role in Canadian housing finance,” said Little. “Since the early days of founding Neighbourhood in 2015, we’ve considered Fisgard a model of stability and integrity. Fisgard’s reputation with brokers and investors was a key driver in pursuing this transaction. We’re proud to continue its legacy as we build the future together.”

Rafer Strandlund, Fisgard’s CEO, added: “Fisgard has always been guided by a long-term commitment to our investors, borrowers, and the mortgage broker community. Joining with Neighbourhood allows us to continue that legacy with a team that shares our values, discipline, and focus on relationships. Together, we’re combining Fisgard’s decades of experience with Neighbourhood’s momentum and innovation to strengthen the alternative lending landscape in Canada.”