Cenovus Energy Inc.’s takeover of MEG Energy Corp. appears poised to win shareholder approval later this week after the oilsands giant raised what it had said was its “best and final” offer and secured the support of one-time rival Strathcona Resources Ltd.

“Heading into this week, we thought there was going to be the potential for some fireworks,” said Patrick O’Rourke, managing director of institutional equity research at ATB Capital Markets.

Monday’s news “probably gave most a sense that this transaction should be able to get across the goal line,” he added.

The sweetened offer, made up of half cash and half stock, is worth $30 per share based on Cenovus’ closing stock price on Friday.

Earlier, it had offered $29.50 in cash or 1.240 of a Cenovus share, worth $29.65 as of Friday.

MEG shareholders are to vote on the offer, which has the support of that company’s board, on Thursday. The meeting had been scheduled for last week, but was delayed after it appeared the approval vote might have fallen short of the required two-thirds majority.

But Strathcona, which recently dropped its own hostile all-stock offer for MEG, now says it intends to vote its 14.2 per cent stake in favour of the new Cenovus bid.

“With Strathcona’s support, MEG currently expects that approximately 79 per cent of the MEG shares represented by proxy or expected to be voted in person at the meeting are for the approval of the improved Cenovus transaction,” MEG said in a statement.

Get weekly money news

Get expert insights, Q&A on markets, housing, inflation, and personal finance information delivered to you every Saturday.

Strathcona executive chairman Adam Waterous declined to comment further on Monday.

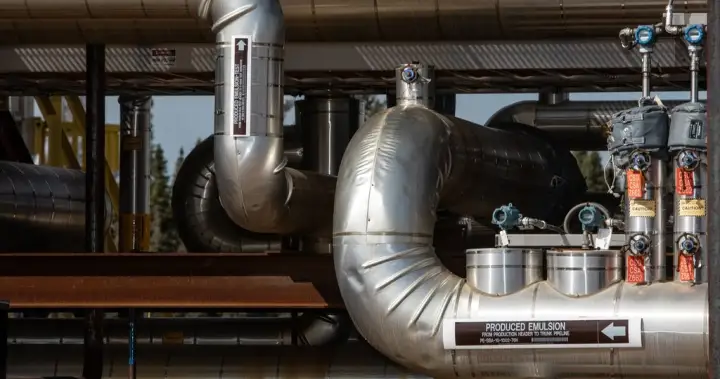

Cenovus and MEG have side-by-side oilsands properties at Christina Lake, south of Fort McMurray, Alta., and the companies have touted the cost-savings and efficiencies that would result from joining forces.

The Cenovus Christina Lake oilsands facility steam-assisted gravity drainage (SAGD) pad southeast of Fort McMurray, Alta., on Wednesday, April 24, 2024.

THE CANADIAN PRESS/Amber Bracken

Strathcona also has steam-driven operations in the region.

“We’ve got a pretty high degree of confidence in (Cenovus’) ability to operate these assets, given the results we’ve seen at their offsetting Christina Lake property,” said O’Rourke.

“I think that the outlook for the combined asset and achieving the synergies they’ve noted is pretty reasonable.”

The deal would add 110,000 barrels of daily oilsands production to Cenovus’ portfolio, bringing it to 720,000 boe/d. Cenovus has said output could grow to 850,000 boe/d in 2028.

Also Monday, Cenovus announced the sale of its Vawn thermal heavy oil operation in Saskatchewan and certain undeveloped land in western Saskatchewan and Alberta to Strathcona for $150 million including $75 million in cash paid on closing and up to $75 million more, depending on future commodity prices.

At about 5,000 boe/d, the properties are more meaningful to a smaller company like Strathcona than they are to Cenovus, where they would not get a lot of attention, said O’Rourke.

He noted that at one point, the assets achieved more than twice that level of production.

“So we know that there’s latent facility capacity there and the ability to increase the efficiencies.”

This is the second time Cenovus improved its offer after asserting it wouldn’t. Its initial bid was made up of 75 per cent cash and 25 per cent equity and had an implied value of $28.48 before it was sweetened on Oct. 8.

The saga began in April when Strathcona approached the MEG board with a cash-and-stock takeover bid. Strathcona was rebuffed and took the offer directly to MEG shareholders weeks later.

In June, MEG’s board called the bid “opportunistic” and urged shareholders to reject it as it launched a review to find a superior offer. Waterous had accused MEG of refusing to engage and taking an “anyone but Strathcona” stance.

In August, MEG announced its board had accepted the first friendly takeover offer from Cenovus. The following month, Strathcona amended its offer to be based entirely on stock, arguing that structure would give investors greater opportunity to benefit from future growth.

Cenovus upped its bid and offered a greater equity share in early October, and the companies agreed to allow Cenovus to buy up to 9.9 per cent of the target company’s stock ahead of the shareholder vote.

Strathcona abandoned its bid a few days later, saying the conditions of its offer could no longer be satisfied, while some MEG shareholders decried what they saw as unfair tactics to lock up the deal with Cenovus.

© 2025 The Canadian Press