Triple Flag Precious Metals Corp (TSX:TFPM) Q3 2025 Earnings Report Preview: What to Expect

This article first appeared on GuruFocus.

Triple Flag Precious Metals Corp (TSX:TFPM) is set to release its Q3 2025 earnings on Nov 4, 2025. The consensus estimate for Q3 2025 revenue is $131.43 million, and the earnings are expected to come in at $0.29 per share. The full year 2025’s revenue is expected to be $506.76 million and the earnings are expected to be $1.26 per share. More detailed estimate data can be found on the Forecast page.

Revenue estimates for Triple Flag Precious Metals Corp (TSX:TFPM) have increased from $471.98 million to $506.76 million for the full year 2025. For 2026, estimates have risen from $475.34 million to $558.22 million over the past 90 days. Earnings estimates have also seen an upward trend, increasing from $1.10 per share to $1.26 per share for the full year 2025, and from $1.23 per share to $1.57 per share for 2026 over the same period.

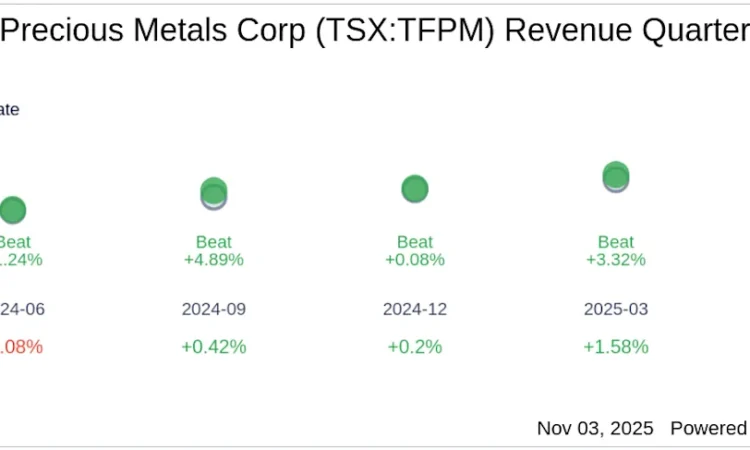

In the previous quarter ending June 30, 2025, Triple Flag Precious Metals Corp’s (TSX:TFPM) actual revenue was $131.78 million, which beat analysts’ revenue expectations of $126.11 million by 4.50%. The actual earnings were $0.39 per share, surpassing analysts’ earnings expectations of $0.29 per share by 35.17%. Following the release of these results, Triple Flag Precious Metals Corp (TSX:TFPM) saw a 1.19% increase in its stock price in one day.

Based on the one-year price targets offered by 9 analysts, the average target price for Triple Flag Precious Metals Corp (TSX:TFPM) is $47.92, with a high estimate of $66.31 and a low estimate of $38.18. The average target implies an upside of 23.03% from the current price of $38.95.

According to GuruFocus estimates, the estimated GF Value for Triple Flag Precious Metals Corp (TSX:TFPM) in one year is $39.24, suggesting an upside of 0.74% from the current price of $38.95.

Based on the consensus recommendation from 10 brokerage firms, Triple Flag Precious Metals Corp’s (TSX:TFPM) average brokerage recommendation is currently 2.3, indicating an “Outperform” status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.