Vancouver, British Columbia–(Newsfile Corp. – November 5, 2025) – Hayasa Metals Inc. (TSXV: HAY) (OTCQB: HAYAF) (“Hayasa” or the “Company“) is pleased to announce the successful completion of its 2025 drill program at the Vardenis Copper-Gold Project in central Armenia which is under option to Teck Resources Limited (“Teck“, see news release dated August 27, 2025).

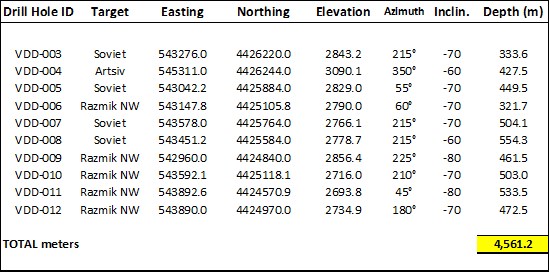

The program, which commenced in late August and concluded on October 27, comprised 10 diamond drill holes totaling 4,561 meters, completed within the planned eight-week schedule. Hayasa’s Country Manager, Hovo Karapetyan, led a safe, efficient and on budget drilling program.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3169/273261_31254f7cc4477a98_002full.jpg

2025 Drill Program Overview

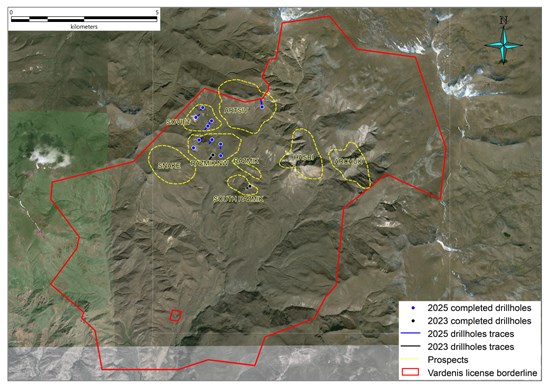

The 2025 Phase 2 drill campaign was designed to test both surface geochemical anomalies and geophysical targets identified through audio magnetotelluric (AMT) and induced polarization (IP) surveys conducted over the past 15 months. Drill holes were located in the northern section of the Vardenis permit area, within the Soviet, Razmik, and Artsiv prospects (see Figures 1 and 2). The current drill program follows from the Phase 1 program comprising 770 meters undertaken in 2023 (see news release dated November 14, 2023).

Figure 1. Image of Vardenis Exploration permit with named prospects and Hayasa drill holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3169/273261_31254f7cc4477a98_003full.jpg

Target Summaries:

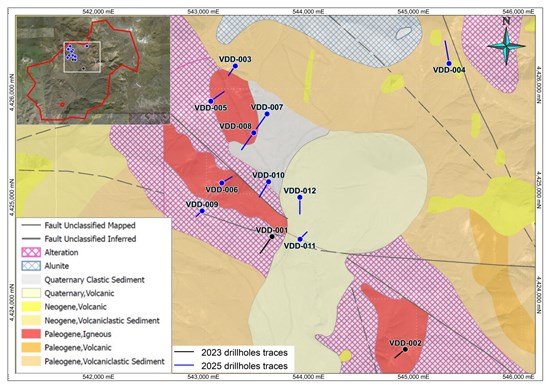

- Soviet Target: Hosts the strongest molybdenum-in-soil anomaly and exhibits extensive advanced argillic alteration (alunite, silica, topaz) at surface, coinciding with an IP chargeability anomaly at depth.

- Razmik Target: Contains the primary copper-in-soil anomaly, several AMT conductors, and porphyry-style “B and D” veins mapped at surface.

- Artsiv Target: Displays high-sulfidation epithermal characteristics, including significant vuggy silica and advanced argillic alteration at surface. This area was previously of a significant focus for Dundee Precious Metals, which drilled seven shallow holes west of the current target zone.

Hayasa President and Qualified Person Dennis Moore comments: “The recent drilling confirms that we are within a large, bona fide porphyry system. All ten holes intersected abundant quartz-sulfide veining accompanied by a range of alteration styles. Broad zones of potassic alteration-characterized by secondary biotite, K-feldspar (orthoclase), and widespread sericite-were particularly evident in the southernmost holes (VDD-010, VDD-011, and VDD-012). Notably, intervals of up to 80 meters of massive silicification containing sulfides, and narrower zones of vuggy silica with pyrite, were encountered in holes VDD-007 and VDD-004, respectively.”

Figure 2. Vardenis license area geology and alteration with 2025 campaign drill hole traces

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3169/273261_31254f7cc4477a98_004full.jpg

Hayasa CEO Joel Sutherland states: “Teck is a world class organization and an excellent partner; their geological expertise was invaluable in planning and executing the 2025 campaign and we are grateful for the partnership. More than 4,500 meters of core have now been cut and are in the final stages of logging before shipment to Bureau Veritas Minerals Laboratory in Ankara, Turkey. Given logistical complexities, we do not anticipate receiving gold assays, multi-element geochemistry, and spectral analysis results until late Q1 2026. We look forward to those results as we plan our 2026 exploration campaign.”

About Vardenis

The Vardenis exploration project is located within the Central Tethyan Belt of east-central Armenia, covering 9,399 hectares and accessible by road. In 2023, Hayasa entered into an option agreement with Mendia and its majority shareholder to acquire up to a 100% interest, now superseded by the option and joint venture agreement with Teck.

Situated 25 km from the 4.8-million-ounce Amulsar gold deposit, Vardenis lies within the same prospective belt of Tertiary volcanics. A former Dundee Precious Metals project, previous exploration defined an area of advanced argillic and QSP (quartz-sericite-pyrite) alteration 35 km2 in extent, which hosts seven alteration zones arranged in a concentric arc. Hayasa has been exploring the Vardenis license for over two years and has completed two drill programs to date.

Closing of Transaction with Teck on Vardenis Copper-Gold Project

The Company is pleased to announce that, further to its press release dated August 27, 2025, it has received final approval of the TSX Venture Exchange and closed the previously announced transaction with Teck whereby the Company entered into an amended and restated option and joint venture agreement (the “Agreement“) which grants Teck the sole and exclusive option to acquire up to an 80% interest in Mendia Resources LLC (“Mendia“), the company that owns the geological exploration license relating to the Vardenis copper-gold project located in east central Armenia. The Agreement supersedes the option agreement previously entered into by the Company to acquire up to a 100% interest in Mendia.

Revision to Previous Private Placement Disclosure

As a revision to the Company’s news release dated September 24, 2025, two officers of the Company purchased an aggregate of 738,400 units in the Company’s private placement of units, at $0.17 per unit, for aggregate proceeds of $125,528, which transactions were “related party transactions” under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). Each unit is comprised of one common share and one-half of one common share purchase warrant, with each whole warrant entitling the holder to purchase an additional common share of the Company at a price of $0.22 per share from November 23, 2025 to March 23, 2027. The Company relied on the exemptions from the formal valuation requirements contained in section 5.5(b) of MI 61-101 and the minority shareholder approval requirements contained in section 5.7(1)(a) of MI 61-101, as the Company is not listed on specified markets and the fair market value of the insider participation in the private placement did not exceed 25% of the Company’s market capitalization, as determined in accordance with MI 61-101.

Dennis Moore acquired a total of 369,200 units in the private placement, for a total purchase price of $62,764. Immediately prior to completion of the private placement, Mr. Moore owned and/or had control over an aggregate of 8,130,574 common shares, representing approximately 13.31% of the issued and outstanding common shares of the Company on an undiluted basis. Following completion of the acquisitions of units, Mr. Moore owns and/or has control over an aggregate of 8,499,774 common shares, representing approximately 11.74% of the issued and outstanding common shares of the Company on an undiluted basis, resulting in a decrease of approximately 1.57% of his holdings in the Company’s issued and outstanding common shares.

In addition, Mr. Moore also owns and/or has control over 537,500 common share purchase warrants and 780,000 stock options. If Mr. Moore exercises all of his warrants and stock options, he would then own and/or have control over 9,817,274 common shares, representing approximately 13.56% of the issued and outstanding common shares of the Company on a partially diluted basis, assuming that no further common shares of the Company have been issued.

The aggregate funds raised under the unit private placement, and all other disclosure in the Company’s September 24, 2025 news release, remain unchanged.

Qualified Person

The content of this news release was reviewed and approved by Dennis Moore, Hayasa’s President and Chairman, a qualified person as defined by National Instrument 43-101.

On behalf of the Board of Directors,

Joel Sutherland

CEO

Hayasa Metals Inc.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking statements

This news release contains forward-looking statements. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements including, without limitation, statements regarding future exploration programs at Urasar. Important factors that could cause actual results to differ materially from the Company’s expectations including the risks detailed from time to time in the filings made by the Company with securities regulations. The reader is cautioned not to place undue reliance on any forward-looking information. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by Canadian securities law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273261