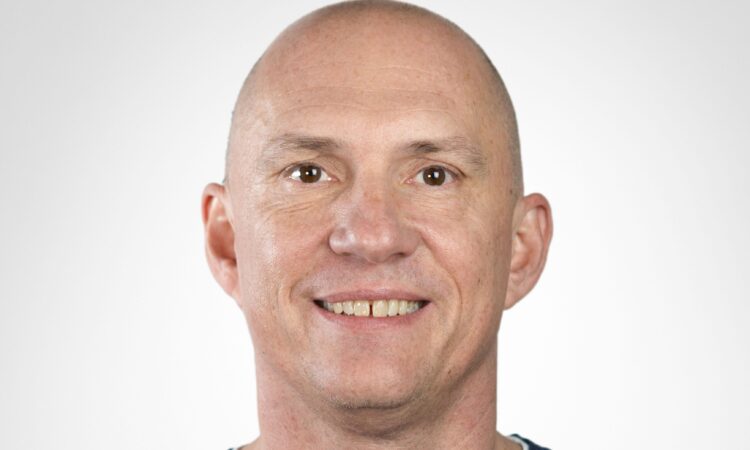

Cryptocurrency can become as prevalent in client portfolios as other alternative assets, according to Russell Barlow, chief executive at 21 Shares.

Barlow, the former global head of multi-asset and alternatives at Aberdeen, explained how crypto could grow in popularity just like how hedge funds have done over the past 30 years.

He said: “I began my career in the late 1990s at Coutts private bank, and was working on the alternatives desk when hedge funds were just starting to emerge.

“It was a time when most of the allocators around were keen to add diversification and hedge funds grew in popularity.”

His subsequent career took in spells at RBS and Aberdeen, where he became head of multi-asset and alternatives in 2023, before leaving in 2025.

One of the tasks he had at Aberdeen was to review the Global Absolute Return (GARS) strategy which was once the largest in the UK, but was closed in 2023.

After leaving Aberdeen in January of this year, Barlow joined 21 Shares, a firm which creates exchange traded notes (ETNs) which are a type of fund that owns crypto assets.

He said: “During my time at Aberdeen, I started to see some of the hedge funds that were in the markets allocating to crypto and I wanted to learn more.

“I got to understand blockchain and believe it can be transformative to technology and business.

“The way hedge funds were viewed in the nineties and how they have expanded from being institutional to being owned by high net worth’s and then into the wider market, I think that is the journey that crypto is on.”

Barlow believes some crypto has characteristics similar to gold, while some crypto assets are for those with a more venture capital mindset

But he believes crypto can work in both retail and institutional portfolios.

The exchange traded notes his firm supplies are listed on a stock exchange and file accounts.

The notes are debt instruments – an investor acquiring them is owning an asset backed by the same value of actual crypto assets.

His firm has issued 55 such instruments on to the London market.

While crypto assets are a long way from the traditions of the City of London, Barlow said the finance sector has changed since he began.

“When I started in the City, people wore frock coats to work everyday. As a new sector, crypto is less bound by that, people want to feel comfortable.”

At present, the products he operates offer exposure to individual cryptocurrencies.

But he feels the next step in the evolution of the asset class will be for products to launch which are similar to index funds, that is, being invested in a range of different crypto assets within one investment product.