We have become so used to scanning QR codes that we often forget our wallets at home, and we do not panic anymore. We know our phones can get the job done. That’s how deeply fin-tech payments have shaped our habits. But fintech today is fast becoming more than just payments.

The fintech story of India is at an inflection point-now led not by innovation and scale alone, but by resilience, governance, and long-term sustainability. A report by KPMG, India’s Fintech Evolution: From Growth to Resilience, highlights how startups are now aligning their strategies with evolving investor expectations, tighter regulatory norms, and shifting market dynamics.

Over the last decade, fintechs have bridged gaps in payments, lending, and inclusion. However, the road ahead requires integration: seamless credit, insurance, and investment across platforms are what the future will be built on. A Frugal Testing report estimates that the fintech market of India would touch $990 billion by 2032, with digital banking, UPI, and AI-driven financial solutions as the drivers.

The four stocks highlighted in this article are representative of the entire spectrum of that evolution-from consumer-facing innovation to backend infrastructure. Each one of them represents a unique layer of the fintech stack of India, combining scale, technology, and regulatory maturity in a different way. Together, they capture how the industry is evolving from payment-led disruption to an increasingly embedded, data-driven, and sustainable financial ecosystem.

#1 One 97 Communications (Paytm)

Incorporated in 2000, One 97 Communications is India’s leading digital ecosystem for consumers as well as merchants.

One 97 Communications witnessed a stronger fintech business driven by lending and merchant services during the September 2025 quarter. The company relaunched its Paytm Postpaid product with partner banks and reported early traction in credit distribution. Strong festive demand boosted EMI disbursements, lifting payment margins.

It also got approval for merging online and offline payment businesses, thus enabling unified merchant onboarding and new value-added services. The company is investing in an in-house AI stack to enhance credit analytics and build sound-based financial tools for merchants.

The company’s India-built fintech stack is now being readied for selective global deployment via partner-led models. Management said future growth will be anchored around expanding financial-services penetration, cost efficiency, and scalable technology across lending, payments, and AI infrastructure.

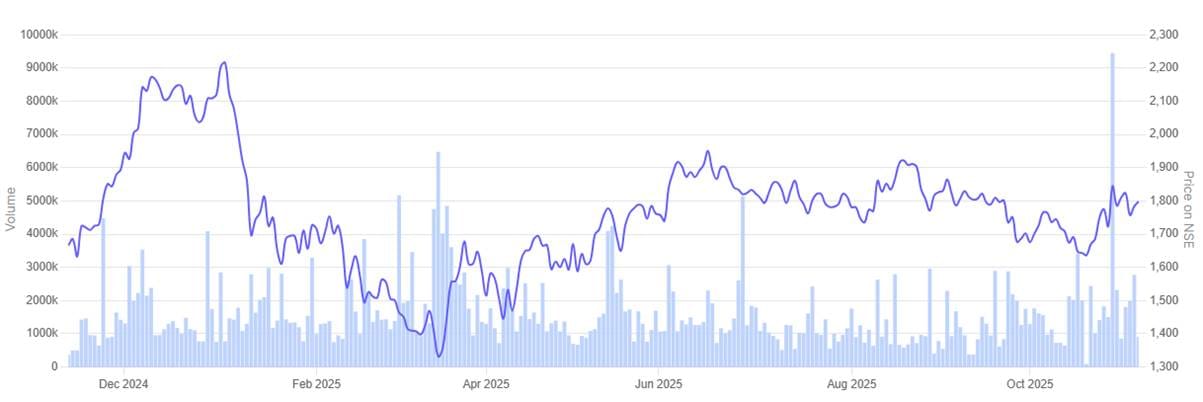

In the past one year One 97 Communications share price rallied 62.2%.

One 97 Communication 1 Year Share Price Chart

#2 PB Fintech

PB Fintech, popularly known as Policybazaar, is India’s largest online platform for insurance and lending products through its flagship brands – Policybazaar and Paisabazaar platform through which they provide convenient access to insurance, credit and other financial products.

PB Fintech said it had a strong quarter across core fintech verticals, driven by robust gains across insurance, credit, and new digital initiatives. The company’s total premium reached Rs 7,605 crore, up 40% year-on-year, led by health and term policies. Insurance renewals rose to an annual run rate of Rs 758 crore, showing steady regular income from its digital market.

The company’s credit business, which it runs through Paisabazaar, has stabilized after earlier softness. Its disbursals grew 9% quarter-on-quarter. New fintech projects also grew well, with revenue rising 61% and profits improving as PB Partners increased its agent network to 3.8 lakh advisors across India.

Internationally, the UAE insurance arm also posted profitability for the third quarter in succession, leveraging health and life products similarly to India. Management expects growth to continue with deepening digital insurance penetration and maturing hybrid distribution models.

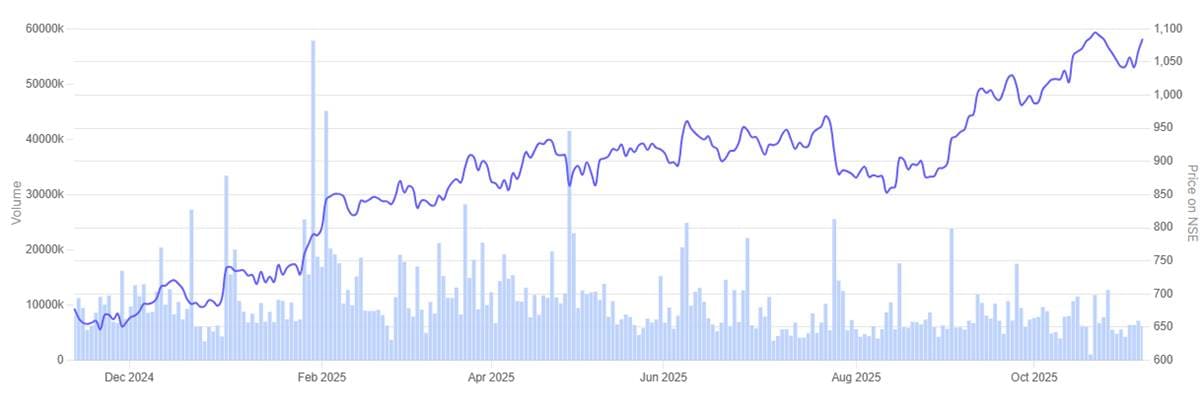

In the past one year PB Fintech share price is up 8%.

PB Fintech 1 Year Share Price Chart

#3 Bajaj Finance

Bajaj Finance (BFL) is mainly engaged in the business of lending. BFL has a diversified lending portfolio across retail, SME and commercial customers with a significant presence in urban and rural India. It also accepts public and corporate deposits and offers variety of financial services products to its customers.

Bajaj Finance continued its fintech transformation in Q2 FY26, using AI and digital tools to improve its lending and customer operations. The company’s FINAI program, identified 123 high-impact use cases, with 80 set to go live by February 2026.

Early use of AI includes 442 voice bots, which made about Rs 1,980 crore or 18% of personal loan disbursements. Around 85% of customer queries were answered through AI service bots, while 42% of loan checks were done automatically.

The company is also adding face recognition at 300 branches to make services smoother and using AI tools for marketing and compliance. Management expects these steps to lower costs and improve efficiency in the coming year, moving Bajaj Finance closer to becoming a data-driven fintech company.

In the past one year Bajaj Finance share price sky rocketed 60.3%.

Bajaj Finance 1 Year Share Price Chart

#4 Infibeam Avenues

Incorporated in 2017, Infibeam Avenues is in the business of software development services, maintenance, web development, payment gateway services, e-commerce and other ancillary services.

Infibeam Avenues reinforced its fintech focus in Q2 FY26 after transferring its e-commerce business to Rediff.com. The restructuring has given the company a sharper identity built around the two verticals of digital payments under CCAvenue and AI automation under Phronetic.AI.

Its payments arm expanded merchant services and added new clients in Saudi Arabia and Oman. It also awaits in-principle approval for the RediffPay UPI framework, which will deepen its presence in domestic payments.

To fuel this future growth in fintech, Infibeam plans to establish 12 AI-driven data centers across India at an estimated cost of $1-3 million each. These will power edge computing and fintech applications, with revenue likely to come in within two years. Management said the focus now is on scaling AI-led payments, fraud detection, and intelligent transaction routing.

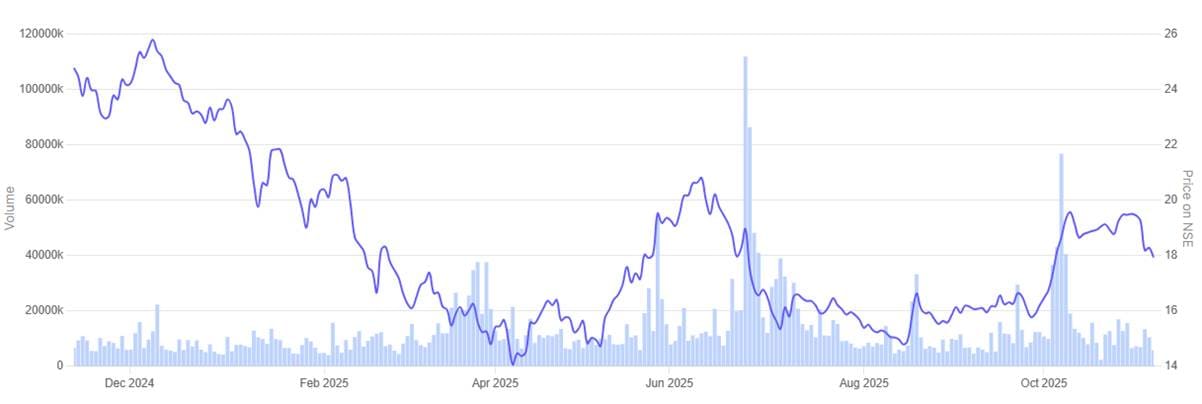

In the past one year Infibeam Avenues share price tumbled 27.8%.

Infibeam Avenues 1 Year Share Price Chart

Valuations

Let’s now turn to the valuations of the Fintech companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Fintech Companies in India

| Sr No | Company | EV/EBITDA | Respective Industry EV/EBITDA Median | ROCE |

| 1 | One 97 Communications | 95.5 | 22.1 | -10.1% |

| 2 | PB Fintech | 124.7 | 22.1 | 5.9% |

| 3 | Bajaj Finance | 20.4 | 12.7 | 11.4% |

| 4 | Infibeam Avenues | 12.8 | 22.1 | 8.6% |

Indeed, the trend reflects that most of the listed fintech players are trading well above their respective industry medians-a clear reflection of the premium investors continue to assign to technology-led financial platforms. The high multiples for newer-age fintech firms stand in sharp contrast to the rather moderate valuation levels among traditional lenders.

This higher valuation is perhaps supported by rapid digital adoption, policy support for financial inclusion, and the scale potential of AI-driven services. However, it also begs a key question: how much of the future growth is already priced in?

While the structural tailwinds remain strong, the best opportunities usually arise when the strong businesses trade at reasonable valuations. Investors must weigh each company’s technology edge and profitability outlook before taking long-term calls.

Conclusion

Now, India’s fintech revolution steps into its most defining phase– the precise confluence of technology, trust, and regulation for sustainable growth. These companies show how digital innovation is growing beyond wallets and payments to cover lending, insurance, and data-based credit systems. AI, digital partnerships, and embedded finance are helping fintechs and traditional financial firms work more closely together.

Yet, this change also means increased valuations and changing regulatory scrutiny. Investors need to look beyond the short-term momentum of these companies and start assessing their fundamentals on profitability, asset quality, governance, and scalability.

India’s fintech story is now less about disruption and more about creating strong, lasting financial systems for a digital-first economy. It would be well to remember that any investment decision in this space would need a comprehensive evaluation of business models, balance sheets, and long-term execution.

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.