Stay informed with free updates

Simply sign up to the Hedge funds myFT Digest — delivered directly to your inbox.

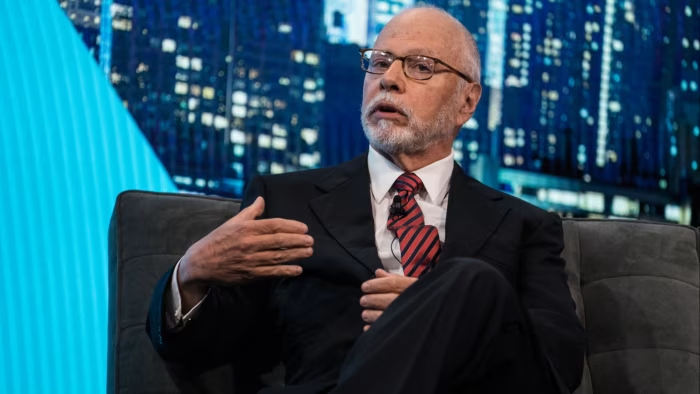

Elliott Management, the US hedge fund founded by billionaire Paul Singer, has sought to reassure investors that its vast size has not become an obstacle as its returns lag behind Wall Street stock markets.

In its latest quarterly letter to investors, seen by the Financial Times, the firm said its $78bn in assets raised the “inevitable question” of whether its scale had become a drag on performance.

The firm added that it viewed its large size as an advantage and that “any shortfall in returns” was a result of mistakes, problems with hedges, or issues with the market but “not the size of the fund”, the firm added.

However, Elliott added that it would seek to shed assets if it thought that its size had become a barrier to strong returns.

Elliott declined to comment.

The letter also showed Elliott gained 4.7 per cent net of fees in the first nine months of the year compared with a 15 per cent total return for the S&P 500.

The fund’s net annualised return since 1994, the year its Cayman Islands entity was founded, has now fallen behind that of the S&P 500 index including reinvested dividends for the first time in more than 20 years — a comparison regularly tracked by the firm in its communications with investors.

However, performance since the firm was founded in 1977 is still ahead of the S&P, and its returns come with much lower volatility than the Wall Street equity benchmark, a feature coveted by some hedge fund investors. The firm was up about 11 per cent last year, according to another letter.

Assets at Elliott have almost doubled over the past five years, prompting the firm to adjust its investment strategy to focus on larger targets and push deeper into areas such as private equity dealmaking.

Some investors worry that its growing size is holding back performance.

“The problem is they are so big that to produce [returns] like they did in the past, their playbook has to work on such a different scale,” said one large investor in the hedge fund.

One person familiar with the fund said that the fund had addressed the question of size in quarterly letters to investors on at least 15 occasions across the past five decades, and that it had consistently seen it as a benefit.

Elliott has long been one of the most feared activist investors, taking on company boards to implement changes that it sees as favourable to shareholders. Most recently it has bought stakes in Pepsi, BP and Southwest Airlines and agitated for change.

As it has grown the firm has had to take bigger positions, making it tougher to invest in smaller businesses.

This in turn meant its potential targets were much better covered by Wall Street analysts and closely monitored by investors, making it harder to spot opportunities before other market participants did, said one major Wall Street hedge fund allocator. Larger companies are also likelier to be able to hire top defence teams to advise them, a luxury that smaller companies often cannot afford.

“The bigger you get the more you narrow your opportunities,” he said.

A person familiar with the fund said that Elliott still had the flexibility to invest in smaller companies as an activist. For example, Elliott has recently invested in payments company Bill Holdings and drug research firm Charles River Labs earlier this year.

The person added that Elliott’s job wasn’t to spot opportunities that others hadn’t, but to make the changes that improved a company’s performance.

Elliott aims to offer investors steady returns compared with higher octane hedge funds, with founder Singer often saying that his focus is to never lose his investors money. Elliott has long warned that the US stock market is frothy driven by AI stocks that would struggle to justify sky high valuations.

But a second investor in the fund said it might find it harder to justify its fees given performance over the past three decades had fallen behind that of the S&P.

“There is not much else to say about that other than the fees hurt,” he said. “If Paul had just invested his own money [in the S&P 500] since 1994, I think we would all agree he would not be as wealthy as he is today running Elliott.”

Elliott is in the middle of fundraising for a $7bn drawdown fund, which will allow it to call investors for capital when opportunities arise, Bloomberg reported last month.