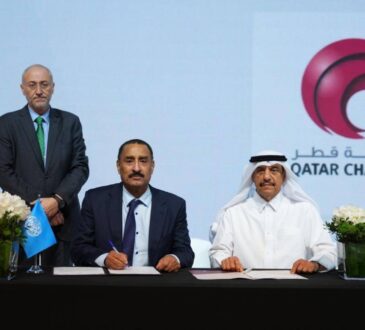

Businesses may only discover they’re under-insured when a disaster such as flooding hits them

Getty Images

Is your business under-insured? New research from the insurance company Hiscox suggests the answer is very likely to be yes. Almost three-quarters of small businesses worldwide are not properly protected from the everyday risks they face, Hiscox warns.

That conclusion is based on a survey of 6,250 small business owners based in the UK, the US, France, Germany, Spain and Portugal. American small businesses are the most exposed, Hiscox found, with 77% reporting at least some level of under-insurance. In Spain, France and the UK, 74% of small businesses came up short; in Germany and Portugal, the equivalent figure was 70%.

Now, you might conclude that Hiscox’s research is somewhat self-serving – after all, this is a company that is in the business of trying to sell more insurance. But its survey is certainly not an outlier – other research into small business practices in multiple countries has reached a similar conclusion.

In the US, for example, data published last year by NEXT Insurance found 90% of small business owners weren’t confident their businesses were adequately insured. In the UK, research published earlier this year by Towergate claimed as many as 80% of small businesses were not fully protected from risk. Countless surveys reach the same conclusion. And maybe that’s not surprising – small business owners often find themselves struggling with cashflow challenges as they pursue growth. Insurance premiums offer a tempting target for those trying to reduce costs. Owners and managers may recognise they’re potentially storing up trouble for the future, but they’re naturally focused on the problems of today.

Still, Joanne Musselle, group chief underwriting officer at Hiscox, thinks another problem is that small businesses don’t always appreciate what specific insurance policies do and don’t cover. “The lack of understanding among small businesses as to what insurance protects them against is leaving too many businesses potentially vulnerable to avoidable financial and operational shocks,” she says. Professional indemnity cover and cyber insurance are particularly common blind spots, Hiscox’s analysis suggests.

In practice, the risks that small businesses face vary enormously from one firm to the next – that requires owners and managers to think carefully about the insurance they need. Working out how much cover you need – and navigating through insurers’ small print – can be challenging, so take professional advice from a broker or adviser if you’re struggling. Intermediaries can also help you reduce the cost of cover.

In the meantime, however, here are seven areas of insurance where research suggests small businesses frequently come up short:

Public liability insurance

This type of insurance covers you in the context of the legal responsibilities your business has towards its customers and the general public. For example, if a customer is injured because you or a member of your staff have done something wrong, failed to take health and safety precautions, or broken the law, the business may have to pay significant compensation. Public liability insurance covers the cost of such pay-outs, as well legal fees.

Employers liability insurance

This cover is a legal requirement in many countries for all businesses that have employees. It provides protection if one of your employees is injured at work or falls ill as a result of the work they do for you, with pay-outs to cover the cost of compensation to a claimant and legal fees.

Professional indemnity insurance

This insurance covers the cost of compensation to clients if your professional advice or services have caused them to lose money – potentially even if you’ve not made a mistake. Professionals such as solicitors, accountants, financial advisers, architects and surveyors may be required to have this insurance by their industry regulator. But any business could be sued by a customer claiming it has delivered its services negligently.

Cyber insurance

This cover is designed to help meet losses when small businesses are hit by data breaches, security failures, scams and cyber attacks. It can also make payments for related costs, such as data recovery and notifying customers that their data may have been compromised. Tread carefully with cyber insurance, which is an area of insurance that is evolving rapidly and may come with unexpected exclusions or pay-out limits.

Property insurance

Your business’s buildings and their contents are critical to your trade. It’s therefore vital to have financial protection so that you can claim support when your property is damaged through events such as burglary, fire or flooding. Business interruption insurance, meanwhile, will cover you for any periods when you cannot do business as normal because of damage to your property. And don’t overlook insurance for any vehicles your business uses.

Protection against financial risk

Businesses face all kinds of different financial risks. Common insurance policies include trade credit insurance, which protects your business if your customers cannot pay what they owe, and fidelity guarantee insurance which covers your business against losses caused by an employee stealing money or stock.

Protection for employees

Many small businesses see insurance protection as an important part of the compensation package they offer employees. Examples include life insurance, medical insurance, income protection policies and critical illness insurance. It’s also possible to insure the business against the loss of a vital member of staff – key person insurance pays out in the event of their death or long-term absence.