As we have mentioned in multiple white papers, a confluence of events has helped fuel the adoption of private markets: the market environment, product evolution and access to institutional-quality managers. The first generation of private market funds evolved to feeder funds and now registered funds. Product evolution has now provided access to private markets to a broader group of investors, at lower minimums, and more flexible features.

These new fund structures are registered with the US Securities and Exchange Commission—hence the moniker “registered funds”—and are hybrid structures that capture attributes of the first generation of private market funds (“drawdown” funds) and mutual funds. Like a mutual fund, these funds are continuously offered, have low minimums, 1099 tax reporting, and are broadly available to investors (accredited investors and below the accredited investor threshold). Like the drawdown structure, these funds invest in illiquid securities (private markets).

Registered funds are also referred to as “evergreen,” “perpetual,” or “semi-liquid,” and include interval, tender-offer, non-traded real estate investment trusts (REITs) and private business development companies (BDCs). Registered funds have experienced significant growth in both assets under management and the number of funds.

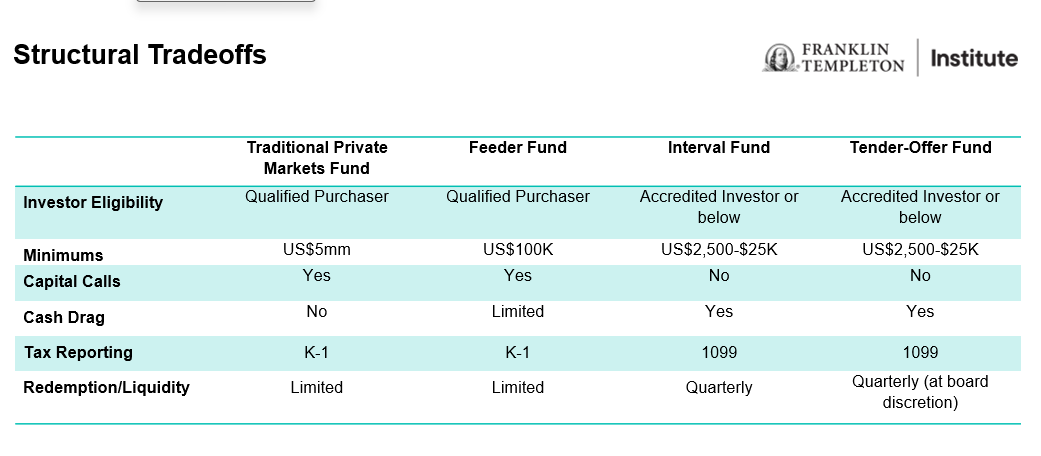

Note, there are tradeoffs with the various structures (see Exhibit 1).

Exhibit 1: Structural Tradeoffs

Investor Eligibility – Traditional private market funds and feeder funds are only available to Qualified Purchaser (US$5mm or more in investable assets), while interval funds and tender-offer funds are generally available to accredited investors and below.

Minimums – Traditional private market funds have high minimums (US$5mm), feeder funds have lower minimums (US$100K), and interval and tender-offer funds have low minimums (US$2,500-$25K).

Capital Calls – Traditional private market funds and feeder funds are subject to capital calls as opportunities are sourced, and capital is deployed. Interval and tender-offer funds do not have capital calls as money is invested upfront.

Cash Drag – Traditional private market funds do not have cash drag as capital is called from investors as it is needed and invested over time. Cash drag is the negative impact of holding liquid investments to meet redemptions. Feeder funds may have some cash drag. Interval and tender-offer funds may experience some cash drag as they keep a portion of their assets liquid to meet redemptions. Note, many fund managers have been able to mitigate the cash drag by managing their liquidity sleeve.

Tax Reporting – Traditional private market funds and feeder funds deliver K-1 tax reporting, which is often late and may be restated. Interval and tender-offer funds deliver 1099 tax reporting which is preferable to K-1 reporting.

Redemption – Traditional private market and feeder funds have limited liquidity and should be viewed as long-term investments (7-10 years). There may be some liquidity available in the secondary market. Interval and tender-offer funds offer favorable liquidity. Interval funds are required to make periodic repurchase offers, at net asset value, of no less than 5% and up to 25% of shares outstanding. For tender-offer funds, the board of trustees of the fund determines whether honoring redemption requests would harm other investors. The tender offers are at the discretion of the board of trustees and therefore cannot be guaranteed.

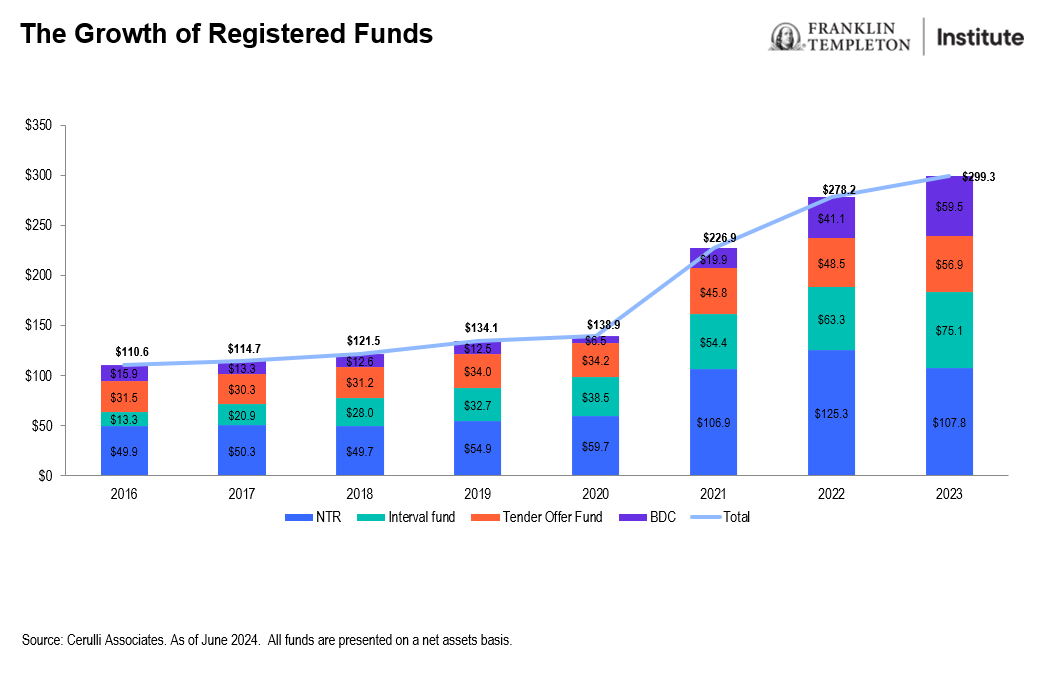

The growth of registered funds

Institutional managers entering the wealth channel for the first time have fueled the growth of registered funds. These managers recognize the size and opportunity in the wealth channel, and the new fund structures allow them to invest capital for the long term, without being forced to meet mass redemptions.

Exhibit 2: The Growth of Registered Funds

Historically, many institutional managers were leery of the wealth channel, due to concerns about “hot money.” There had been a perception that individual investors were prone to chasing returns, and they would not be patient investing in private markets, heading for the exits if they found better returns or felt uncomfortable about the markets.

The registered fund structure is available to a broader group of investors, at lower minimums, and more flexible features. We believe that the registered fund structure provides several advantages to high-net-worth investors.

- More accessible – with lower minimums and accreditation standards, more investors can access private markets.

- Greater liquidity – with quarterly liquidity provisions, investors can access their money if there are any unforeseen changes in circumstances.

- Tax reporting – with 1099 tax reporting, investors don’t have to wait for delayed K-1s that are often restated.

- Evergreen – these funds are generally available, so investors don’t need to make quick decisions about allocating within the subscription window.

- Fully invested – unlike the drawdown structure, where capital is drawn down over several years as opportunities are sourced, these funds are fully invested when capital is invested.

While the evolution of registered funds has helped to democratize access to the private markets, they haven’t replaced the first-generation drawdown structure, which still represents the lion’s share of the assets and funds. We believe there are advantages and tradeoffs with both types of structure, and in fact, they can serve as a complement to one another.

By combining registered funds and drawdown funds, an investor can benefit from gaining exposure to the underlying asset class more quickly via a registered fund and allowing the drawdown fund manager to source capital as they find opportunities. There is also a likely diversification advantage with exposures across industry, geography and vintage. Combining them can also be beneficial as the drawdown fund distributes capital, the proceeds can be invested in a registered fund to maintain the exposure to the asset class.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment.

An investment strategy focused primarily on privately held companies presents certain challenges and involves incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity. Diversification does not guarantee a profit or protect against a loss.

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.