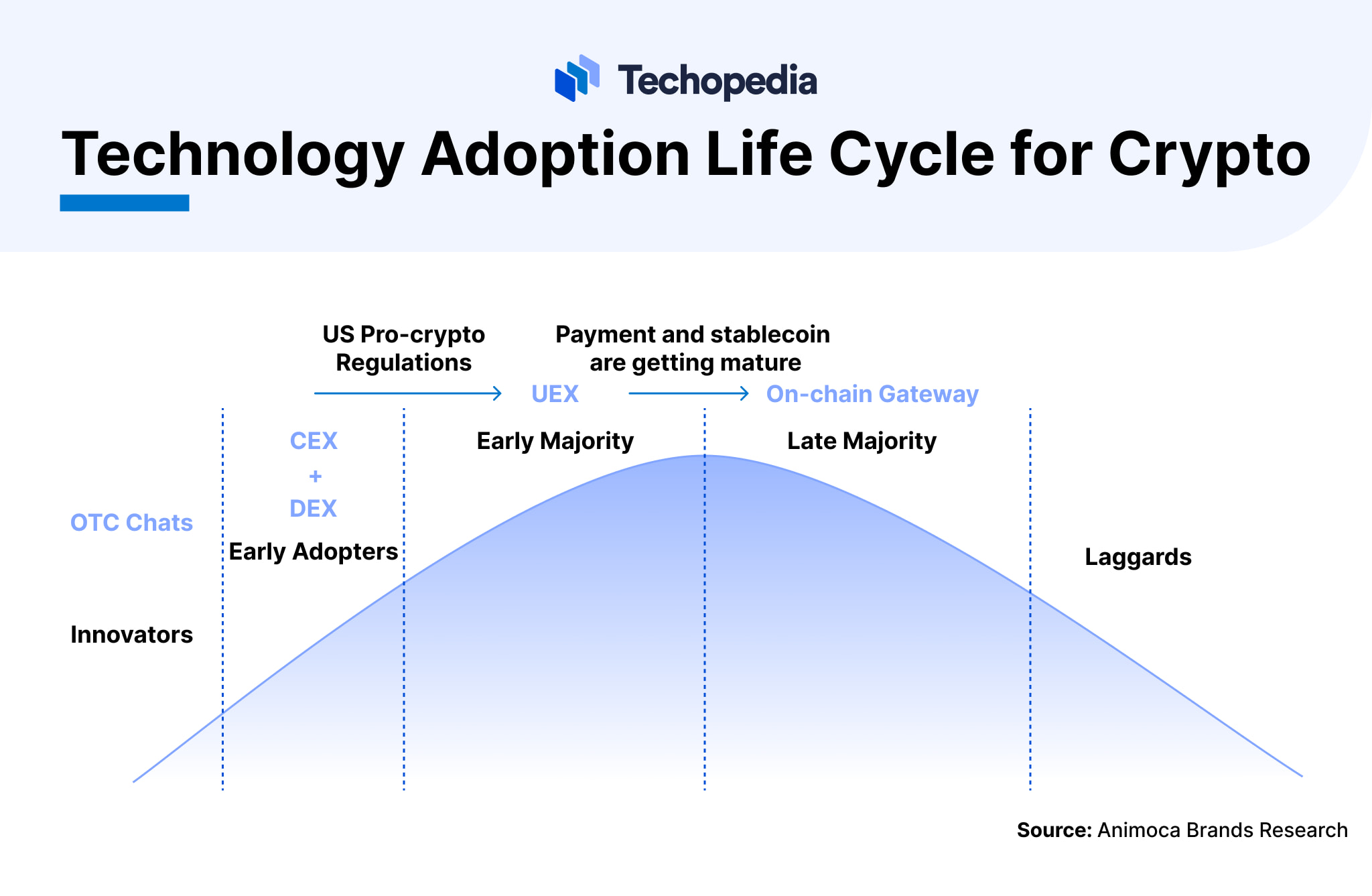

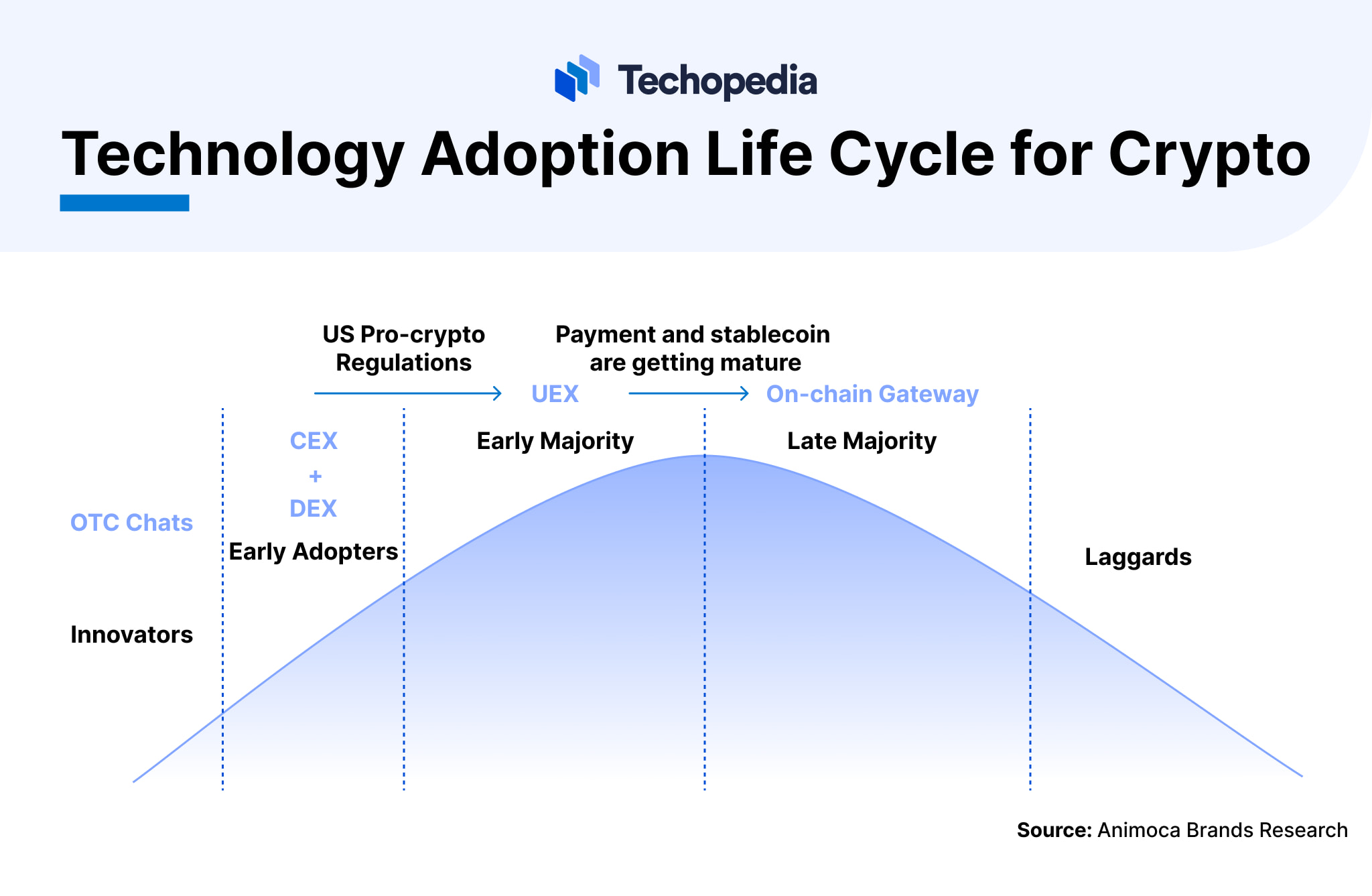

After years of volatility, skepticism, and experimentation, cryptocurrency appears to be transitioning from the “early adopters” phase to the “early majority.” This shift signals a new stage in crypto market growth defined less by speculation and more by utility, regulation, and integration with traditional financial systems.

Centralized exchanges (CEXs) have a key role to play in bringing mainstream users into the crypto space, according to an Animoca Brands report, Exchanges’ Next Phase: Reaching the Mainstream. CEXs can act as a gateway to the on-chain world, building super apps that connect users to the broader crypto ecosystem by providing day-to-day on-chain services such as payment and incubating a vibrant on-chain application ecosystem.

What are the signs that crypto is maturing, and how can crypto exchanges attract mainstream users?

Key Takeaways

- Crypto is transitioning from early adopters to the early majority, as mainstream users demand stability, usability, and regulatory clarity over speculation.

- CEXs face increased competition from DEXs as the crypto-native population reaches saturation and more activity moves on-chain.

- Decentralized innovation, such as meme coin launchpads and tokenized social platforms, is changing user behavior, drawing liquidity and attention toward on-chain ecosystems.

- To stay competitive, CEXs are evolving into “universal exchanges,” integrating wallet services, DEX access, and on-chain trading within unified platforms.

- Exchanges can serve as gateways between traditional finance and the decentralized economy, enabling the early majority to access crypto safely and seamlessly.

Understanding the Adoption Curve

The technology adoption lifecycle describes how different groups embrace innovation over time:

- Innovators: the risk-takers and technologists who build and experiment early

- Early Adopters: visionaries who see the potential before the mainstream

- Early Majority: pragmatic users who adopt when value and stability are proven

- Late Majority: cautious adopters who follow when a technology becomes standard

- Laggards: the final group, often resistant to change

Cryptocurrency has spent most of the past decade in stages one and two. Innovators and developers created and refined blockchain technology. Early adopters were the investors, tech enthusiasts, and libertarians who saw Bitcoin (BTC) as a hedge against centralized finance (CeFi), and who were willing to tolerate high risk for high potential reward.

The crypto trading and exchange business has evolved through several stages.

The Experimental Era: Innovators & Miners Lead the Way

In crypto’s earliest phase, adoption was driven almost entirely by technologists and miners experimenting with new digital tools. These innovators conducted transactions through forums and over-the-counter (OTC) chat rooms before the first exchanges appeared.

2013 – The Rise of Centralized Exchanges

By 2013, growing demand for convenient fiat conversions accelerated the rise of centralized exchanges as an electronic upgrade.

2017 – The ICO Boom & the Surge of Retail Traders

The 2017 initial coin offering (ICO) boom brought a surge of retail traders and early adopters, eager to participate in token launches and new investment opportunities. Exchanges expanded to meet this demand with features like margin trading and perpetual contracts, laying the foundation for more sophisticated market behavior.

2020 – DeFi & Institutional Investors Transform the Market

The next major wave arrived in 2020, when low interest rates and the rise of decentralized finance (DeFi) attracted professional investors, trading houses, and market makers. Exchanges began offering structured products, yield tools, and advanced analytics, delivering a professional-grade trading experience.

2022 – Market Plateau & the Crisis of Confidence

However, after the explosive growth of 2020–2021, the market entered a plateau phase. By 2022, with the collapse of the FTX exchange and Luna token, user growth stagnated and confidence waned.

Most early adopters were already active, but the early majority remained cautious, waiting for proven stability and clearer value propositions before entering.

2025 – A Turning Point Toward the Early Majority

Today, the industry stands at a turning point. With infrastructure maturing and mainstream players entering, crypto is ready to move beyond the early adopter crowd toward the early majority – a broader audience that values usability, compliance, and proven returns over novelty and speculation.

According to the Animoca report:

“Aligning this development with the technology adoption lifecycle, we are transitioning from the ‘early adopters’ stage (stage two) into the ‘early majority’ stage (stage three). Crypto-native users and ‘degens’ have driven exchange growth for the past five years. Now, the early majority, who adopt innovation only after clear benefits are evident, will be the new growth engine.”

Signs of a Shift Toward the Early Majority

Rather than ideology or technological curiosity, the early majority is motivated by proven value, convenience, and trust. Several indicators suggest crypto is now crossing this threshold.

Institutional Adoption Is Maturing

Traditional financial institutions are no longer sitting on the sidelines. BlackRock’s Bitcoin ETF approval, Fidelity’s crypto investment products, and PayPal’s stablecoin launch have signaled that digital assets are here to stay.

This institutional participation legitimizes crypto, bringing the compliance, custody, and investor protection frameworks that mainstream users expect.

Regulatory Clarity Is Emerging

Regulatory uncertainty has long been a barrier between early adopters and the mainstream. However, 2024 and 2025 have seen significant progress toward clearer frameworks in the US, Europe, and Asia.

With MiCA in the EU, stablecoin guidance in the UK, and US regulators signaling a friendlier stance on crypto under the Trump administration’s “Project Crypto” agenda, crypto markets are gaining the legal infrastructure needed to support mass participation.

Real-World Use Cases Are Expanding

The focus is shifting from speculation toward real-world utility – cross-border payments, tokenized real-world assets (RWAs), decentralized identity, and Web3 gaming.

Better User Experience and Infrastructure

The early crypto experience was defined by complex wallets, gas fees and confusing interfaces. But with new smart contract wallets, account abstraction, and integrated exchange apps, blockchain interactions are becoming more intuitive, a necessary step for mass adoption.

Cultural Normalization

Crypto is no longer dismissed as a niche hobby. It’s part of pop culture, integrated into sports sponsorships, fashion collaborations, and even national financial strategies. As mainstream audiences see crypto embedded in familiar contexts, psychological barriers to participation begin to fall.

Crossing the Chasm

Moving from early adopters to the early majority is often called “the chasm.” Here, visionary enthusiasm are replaced by pragmatic trust. Technologies that fail to bridge this gap fade into obscurity. Those that succeed, such as smartphones or streaming platforms, drastically change our daily lives.

For crypto, crossing the chasm requires three key ingredients: trust, simplicity, and integration.

- Crypto should blend with the financial tools people already use.

- Users must feel their assets are safe, transactions are legal, and systems are reliable.

- The average person shouldn’t need to understand private keys or block explorers.

Companies that meet these criteria, whether through compliant stablecoins, user-friendly wallets, or integrated payment apps, will be the ones to drive mass adoption.

The early majority wants utility, not ideology. They’ll adopt crypto because it’s useful: cheaper cross-border payments, instant settlements, transparent financial tracking, and digital ownership models that make sense in a connected world.

In response, CEXs are moving beyond simple trading platforms and building full ecosystems, referred to as “universal exchanges” (UEXs) by the Bitget exchange, offering trading on everything to everyone, the Animoca report states.

The Next Stage of CEX Growth

CEX growth faces challenges as well as opportunities.

A major challenge is that the pool of crypto-native users has largely reached saturation, causing growth to slow down in recent years. At the same time, emerging innovations are pulling more traders toward decentralized trading.

Facing increased competition from DEXs, centralized exchanges are expanding by offering wallets and experimenting on social platforms.

The growth of DEX-traded tokens – led by the popularity of meme coin launchpads and platforms like Hyperliquid, which offer a CEX-like experience with greater transparency – has lured more risk-taking users away from CEX trading. This has kept more liquidity and users in the on-chain trading space and prompted CEXs to integrate self-custody wallets and DEX trading to retain crypto-native users.

At the same time, there are opportunities for CEXs to expand their user base as crypto ownership continues to grow.

The report stated:

“A pro-crypto stance from the US administration, the debasement of the US dollar, and geopolitical competition driving stablecoin adoption are all fueling a wave of mass cryptocurrency adoption and on-chain transactions.”

As DEXs gain traction, CEXs have been expanding their on-chain offerings. They have introduced wallets that unify multiple accounts into a single interface, making fund transfers and cross-chain swaps seamless for users. They also allow trading of spot tokens and early-stage meme tokens, and they have added support for integrated staking and DeFi earning modules to let users put assets to work. Task-based rewards guide users to explore new features and interact more deeply with the ecosystem to keep them engaged.

This will help them tap into the new user base that will enter the market as crypto adoption matures.

“We can further predict that the latter half of growth, driven by the ‘later majority,’ will come from exchanges becoming the primary gateway to the on-chain world,” the report stated.

Exchanges are broadening the kinds of assets users can trade, the report noted. Pro-crypto policies in the US are making it easier to put real-world assets on-chain, such as money market-backed tokens, tokenized stocks, and private company shares.

While universal exchanges capture the early majority, on-chain gateways are likely to bring the late majority into crypto.

Animoca researchers said:

“Mainstream users may not require extensive trading features, but will need financial services such as payments, deposits, and yield. Exchanges, with their existing wallet and custodian services, coupled with robust organizational capabilities, are well-positioned to become the entry point for all on-chain services.”

While efforts continue to attract new users to start engaging with cryptocurrency, “the next S curve, the period with dramatic user growth [is] still yet to be unlocked. In Q2 2025, 6.9% of people held crypto, while 15–30% of people traded stocks in the world.”

Although the concepts of a universal exchange and a gateway to the on-chain world hold potential, full realization will not be straightforward, according to the report. “Mainstream adoption hinges on establishing trust and reliability in crypto exchanges.”

Regulatory complexity may create barriers to exchanges providing a full range of services, as there are still diverse licensing requirements and varying levels of difficulty across jurisdictions. Some regulations may even prohibit integrated financial services, mandating firewalls or business segregation.

The Bottom Line

Cryptocurrency is no longer just the domain of early adopters and visionaries. The industry is entering its early majority phase – one where practical value, regulation, and integration matter more than hype.

As infrastructure improves and institutions commit, digital assets are evolving from speculative instruments into everyday financial tools.

FAQs

What does “Project Crypto” mean for US digital asset regulation?

Project Crypto is the SEC’s initiative to modernize US digital asset regulation by providing clearer rules, reducing enforcement uncertainty, and creating pathways for compliant tokenization and blockchain innovation.

How is exchange wallet usage driving crypto adoption?

Exchange wallets simplify access to digital assets by offering secure custody, integrated trading, and DeFi features, helping onboard users who might find self-custody too complex.

Why are tokenized real-world assets gaining traction?

Tokenized RWAs are growing in popularity because they make traditional assets like real estate or bonds more liquid, transparent, and accessible to a broader range of investors.

What risks and challenges remain for the early majority entering crypto?

The biggest challenges are security, regulation, and user trust – but improved compliance, insurance, and user-friendly platforms are steadily lowering these barriers.