A new report from the Capgemini Research Institute has detailed where the world’s high-net-worth individuals (HNWI) invest their money — and just as importantly, how it changed in the last year.

The report classified high-net-worth individuals as people whose wealth was at least $1 million.

Most Read from MarketWatch

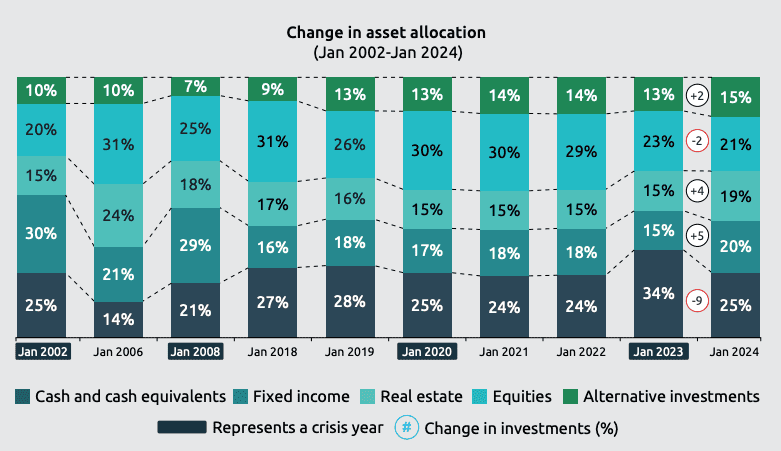

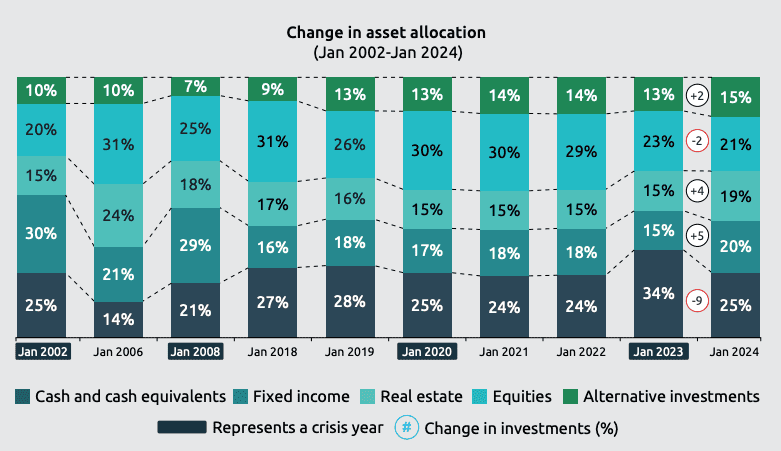

The 2024 World Wealth Report gave a detailed look at the total asset allocation of HNWIs and how it changed from January 2023 to January 2024.

At the start of 2023, HNWIs had 34% of their assets in cash and cash equivalents (which include savings deposits and money-market funds), 23% in equities, 15% in fixed income (which includes bonds and fixed annuities), 15% in real estate and 13% in alternative investments (which include commodities, currencies, private equity, hedge funds, structured products and digital assets).

By January 2024, they had 25% in cash, 21% in equities, 20% in fixed income, 19% in real estate and 15% in alternative assets.

One of the report’s contributors believes the decrease in cash allocation for this group is largely due to an investment strategy that centers around growth over minimizing risk.

“Everyone went into wealth preservation — things were very confusing last year,” Elias Ghanem, the global head of Capgemini Research Institute, told Yahoo about the report on Friday. “Last year, you throw all your money in cash: ‘Let’s wait and see what’s happening.’ What we are observing this year is cash and cash equivalent is down, back to 25%.”

“People are slowly but surely moving from wealth preservation [and] ‘Let’s be safe,’ to wealth growth,” Ghanem added.

Cash and cash-equivalent levels among total assets for HNWIs dropped in early-2024 data from the year prior, but they fell from record highs to levels that were mostly in line with Capgemini’s historical data, the report showed.

“HNWIs, especially those with $10 million and above, prioritize utilizing fixed-income instruments and tax optimization in their wealth-management strategies,” Greg Gatesman, head of international client development at UBS, wrote in the report. “They engage in bond ladders and seek specialized advice to leverage tax rules effectively.”

A deeper look at bond ladders — a portfolio of bonds that mature at regular intervals on different dates — can be found here.

Alternative-investment asset allocation grew for HNWIs over the last year too, and has been on an upward trend since Capgemini began tracking these figures in 2002.

“2024 is not expected as a year of huge growth, although interest rates are expected to start going down with inflation being under control. Bonds and private credit shall be attractive for preserving wealth,” Pierre Ramadier, chief executive of BNP Paribas Wealth Management International Markets, said in the report. “For growing wealth, private-equity investments are bound to be more attractive than equity markets owing to their volatility.”

The June survey details the views of 3,119 HNWIs with backgrounds in wealth management, banking, brokerage and other areas in North America, Asia and Europe. The report was administered in January 2024.