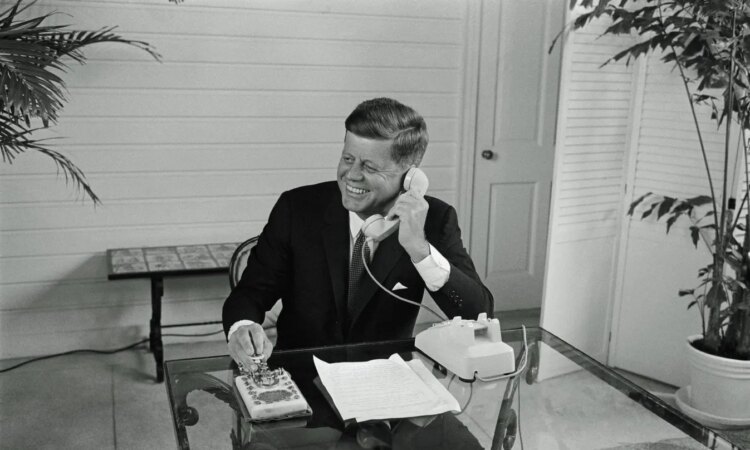

Kennedy got portfolio preference

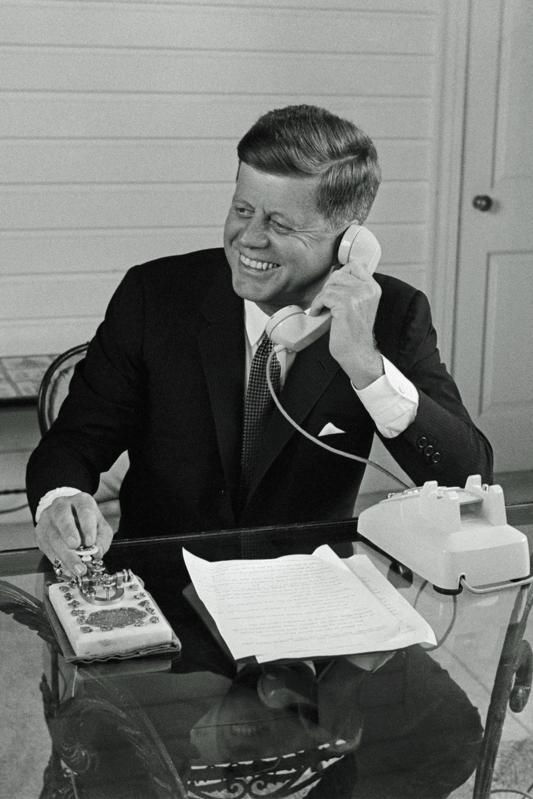

Bettmann Archive

The United States took the dollar, and the world, off the gold standard in 1971. For the last fifty some years, we have been on a fiat money standard. This era seems to be in the process of ending, as gold and Bitcoin bid for their prerogatives over fiat, over government money.

It used to be that political leadership tried to recommit to classical monetary arrangements. John F. Kennedy was the last example in the United States. He campaigned for president in 1960 on a totally unambiguous platform of maintaining the dollar’s official redemption price in gold at $35 per ounce. He said he would never “devalue” the dollar by raising the official price or otherwise break the dollar’s link to gold. Same thing throughout his presidency. He said over and over again that under his leadership, the United States would freely exchange the dollar for $35 per ounce on demand of foreign authorities.

The main policy Kennedy pursued to keep the dollar’s redeemability in gold was to cut domestic tax rates in the United States. The $35 price globally—including in the private markets—would only be maintained given robust demand for the dollar over gold. If it were the other way around, robust demand for gold over the dollar, the price would rise in private markets. An arbitrage opportunity would arise. Foreign authorities could buy gold officially from the United States at $35 and sell privately for higher. The process would go on until the prices aligned. Given that JFK said he would never devalue the dollar, he also had to make sure that privately the world over, markets did not have any reason to have the dollar float up beyond that price.

Kennedy grasped that the key point was for people to want dollars over gold. People generally want currency over gold if they want to be economically active. Lower tax rates make people economically active. In particular, lower tax rates compel people to go for it in investment, in starting a new company, plowing money into a going business, and getting cash out of tax shelters into something more promising in the real world. If there are greater after-tax gains to be made, people will want the dollar over gold.

This is what Kennedy understood about gold. He had to shift the “portfolio preference,” in the finance jargon, away from gold and toward the dollar. You do that by making using the dollar more remunerative. Tax-rate cuts in a progressive tax system are the best way to do this. In raising the after-tax rate of return at the margin, tax-rate cuts make demand for the dollar soar.

Kennedy’s main policy in this regard was his comprehensive cut in tax rates in the progressive income tax schedule, which he introduced into Congress in 1963 and became law in 1964. Tax rates were absurdly high as of the early 1960s—dozens of rates went up with income, the rates running from 20 all the way up to a ludicrous 91 percent. Kennedy got them down to a range of 14-20 percent.

The reduction in rates was enough to power money out of tax shelters, out of non-entrepreneurial doldrums such that more activity came to the economy. Economic growth doubled from the 2.5 percent per annum steady state of the 1950s to 5 percent for the duration. People wanted the dollar over gold, just as Kennedy had planned.

Larry Kudlow and I go over this most impressive history in our book JFK and the Reagan Revolution, as we also cover it in Free Money, our new book on the consonance of Bitcoin with American monetary history.

JFK opted for all sorts of expedients to suppress the demand for gold, to be sure. He set up the London gold pool to prevent the private market from taking gold over $35. He encouraged the Federal Reserve in its pursuit of “operation twist” to keep short-term interest rates high to discourage gold speculation. He went in for “interest equalization” taxes and credit restraint programs to get Americans not to send investment dollars abroad. All of this stuff was supposed to dampen the demand for gold.

None of it, however, affected the fundamentals of portfolio preference. This is where the tax-rate cut came in. We lost the gold standard, and gave ourselves an era of fiat money, because Kennedy aside, we never learned that you cannot have super-high tax rates and a gold standard. Super high tax rates destroy the portfolio preference for the dollar over gold. Obviously the gold standard is better than a fiat system. Therefore, the way to get it back is to revert to modest taxation, the kind of tax regime we had in the old days when the economy did things like launch and industrial revolution and unheard-of ages of mass prosperity.