Artificial intelligence will shape the future, and we’re just at the dawn of this revolution. In 20 years, we don’t want our children or friends to ask us why we didn’t invest in AI or work in AI.

Thankfully, with the Fundrise Innovation Fund, we all have the opportunity to invest in private AI companies with lower fees. No longer do you have to be an accredited investor to access some of the top AI companies in the world.

I have lived and worked in San Francisco since 2001 and have witnessed the constant technological advancements from some of the best tech companies, including Apple, Google, Meta, Nvidia, and Tesla. There are more artificial intelligence companies here than anywhere else in the world.

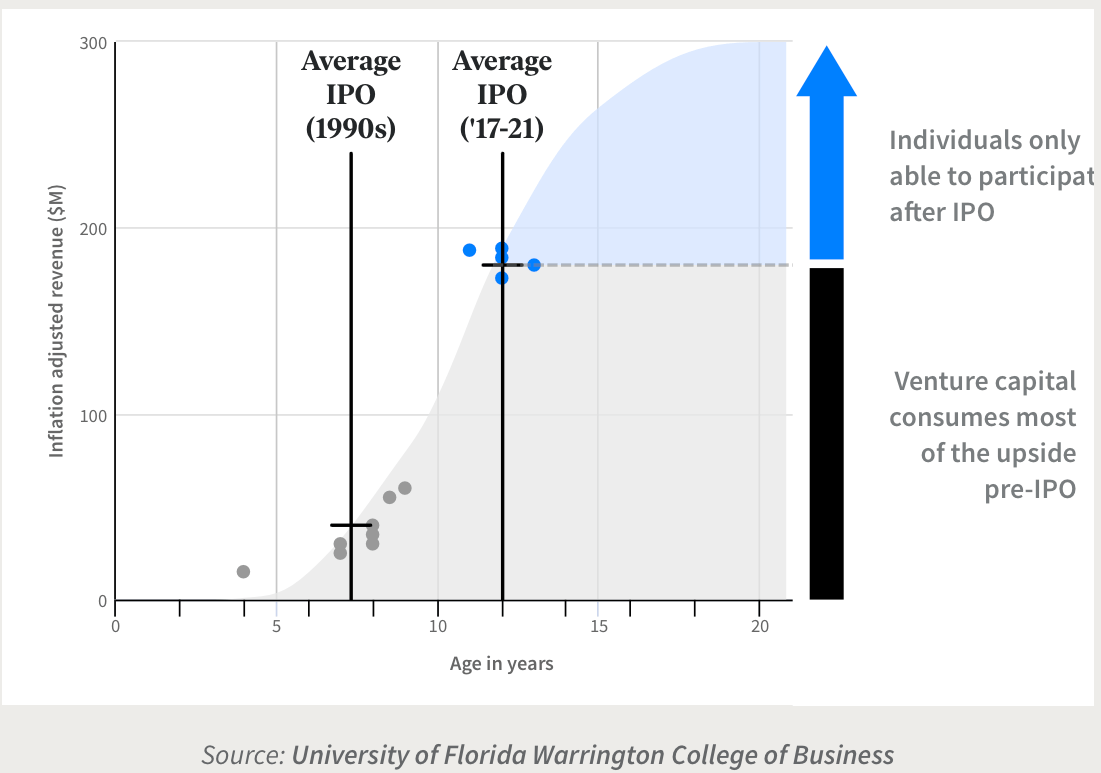

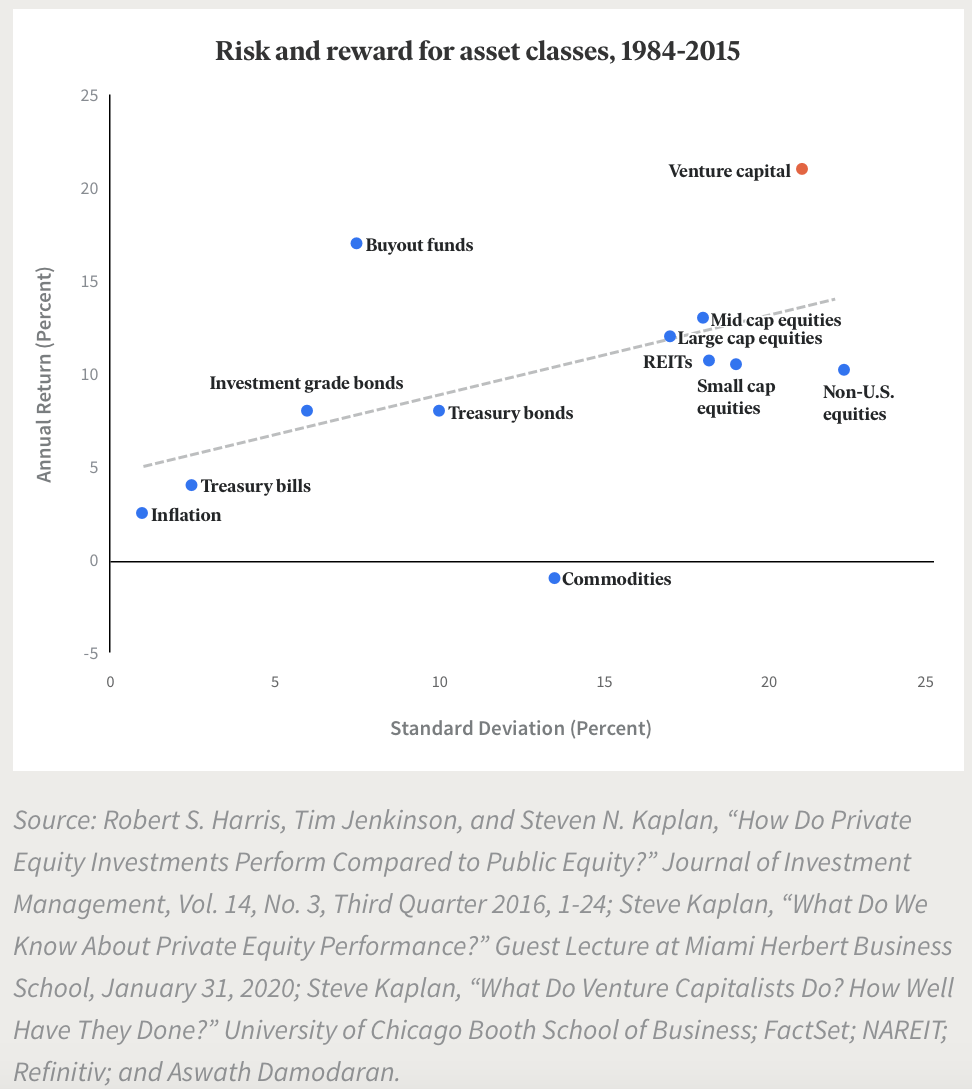

During my 13-year career in investment banking at Goldman Sachs and Credit Suisse, my firms helped take some of these companies public. Nowadays, private companies tend to stay private for longer, allowing more wealth to accrue to private investors instead of public equity investors. This is why investing in private growth companies long before they go public makes strategic sense.

To find the next Google or Tesla before they become public, can be a game changer. I’m a fan of investing 10% – 20% of my investable capital into alternative investments such as venture capital. Meanwhile, large institutions, such as the $30+ billion Yale Endowment Fund invests 50%+ into alternatives.

Why Invest In The Innovation Fund?

Here are the reasons to invest in the Innovation Fund. I have personally invested $143,000 in the Innovation Fund and plan to continue building my position over the years.

Open-Ended Venture Capital Fund

The Innovation Fund is an open-ended venture capital fund specializing in private AI companies and those with AI features. With an investment minimum of just $10, it’s accessible for everyone.

Diverse Investment Sectors

The Innovation Fund invests in various sectors, including:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Low Minimum Investment

Unlike closed-end venture capital funds, which often require a $100,000 – $250,000 minimum and an invitation to invest, the Innovation Fund is open to all with a low minimum of $10. This allows you to easily dollar-cost average into private growth companies.

Transparency and Flexibility

Before you invest, you can see exactly what the fund is invested in, providing transparency and helping you make informed decisions.

Here’s my latest conversation with Ben Miller, CEO of Fundrise, about the latest initiatives of the Innovation Fund. I have interviewed Ben Miller three times before on the Financial Samurai podcast and have also met with him for a drink while he was in San Francisco.

Top Holdings of the Innovation Fund

The Innovation Fund invests in some of the best private growth companies in the world, including:

- OpenAI

- Anthropic

- Databricks

- Anduril

- Anyscale

- dbt Labs

- Canva

- Jetty

- ServiceTitan

- Inspectify

- Immuta

- Vanta

- Theory Ventures (co-investing for greater deal access)

To provide liquidity for investors, the fund also invests in corporate bonds from companies like Uber, Match, Splunk, Elastic, Zoominfo, and Twilio. Investors in private growth companies should invest for the long term, at least five plus years.

Great Timing and Investments At Lower Valuations

The Innovation Fund launched in the second half of 2022, an optimal time as valuations had come down from their 2020 and 2021 highs.

Now, with a booming market for private AI companies, the fund has invested in great companies at attractive valuations. These valuations are have a likelihood of increasing with new rounds of fundraising, acquisitions, or IPOs. Of course, no investments returns are guaranteed.

Competitive Fees

The Innovation Fund charges a low 1.85% management fee with no carry (percentage of profits), compared to traditional venture capital funds that charge 2% – 3.5% management fees and 20% – 35% carry.

Why pay higher fees when you can invest in the same high-quality private AI companies through the Innovation Fund? You don’t given the Innovation Fund is accessible to all.

Proven Expertise and Vision In AI

Fundrise, the management company behind the Innovation Fund, boasts over 1 million registered users interested in its real private real estate funds. As a result, Fundrise is a robust platform that can easily promote and utilize many of these private companies’ products. This gives the Innovation Fund an edge over traditional venture capitalists, who primarily offer capital, connections, and expertise.

Fundrise offers connections, expertise, capital, and the ability to help promote and use the companies it invests in. As a result, the Innovation Fund should be able to gain access to other future quality investments.

Invest In Artificial Intelligence Today

Investing in the Innovation Fund enables you to diversify and potentially gain more from the AI revolution without the risks associated with individual investments. With the ability to dollar-cost average, you can align your investments with your financial goals and risk tolerance.

Check out the Innovation Fund today and take a step toward participating in the AI-driven world.

Fundrise is a sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise. Financial Samurai has invested six-figures in the Innovation Fund so far. Ultimately, Financial Samurai plans to invest $500,000 in private AI companies by 2027.