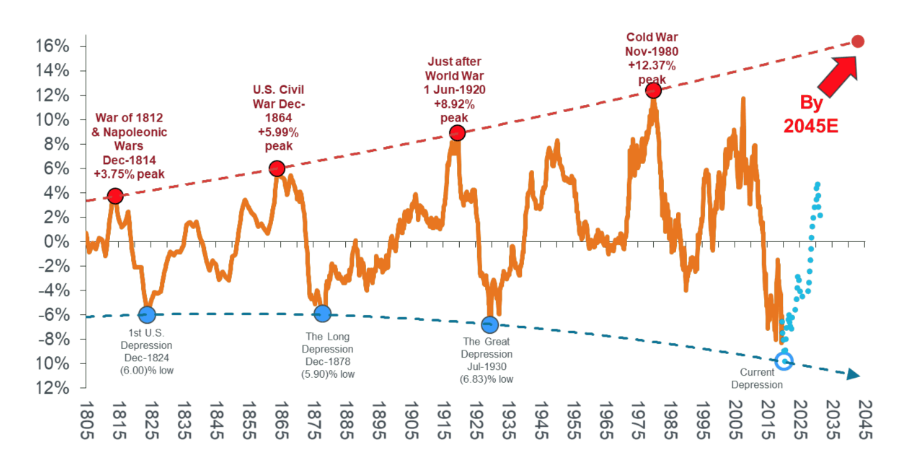

Every decade or so, like clockwork, we enter into a commodities supercycle that sees prices surge across almost every industry.

The last was in the late 2000s in the run-up to the financial crisis.

Uranium prices hit a record high of $148 per lb in 2007. Crude oil followed suit, climbing to a record high of $145 per barrel in 2008.

Gold hit a record high around that time as well, topping out at more than $1,800 an ounce in 2011. However, that peak was eclipsed in May when gold prices soared to $2,454 per ounce.

Prices regressed over the next decade, culminating with the pandemic in 2020, which caused an outright collapse in commodities. But that only set the stage for the current commodities supercycle.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Thus, a bull run for commodities was primed to occur as soon as things got back on track and economies started growing again. The rebound in the United States has been especially robust, which has helped drive commodities prices to their current levels.

However, it’s also become apparent that global energy supplies are totally inadequate. The proliferation of massive data centers and energy-intensive technologies like AI and Bitcoin mining have caused a massive spike in energy consumption.

The demand for technology is also pushing up prices for metals of all kinds — copper, silver, vanadium, lithium, etc.

Gold, meanwhile, has benefited from lower grades, production setbacks, inflation, and geopolitical turmoil. Speaking of which, ongoing wars in Ukraine and the Middle East have thrown the energy markets into disarray.

As always, OPEC has its thumb on the scale of the oil market, but sanctions and embargoes against Russia have created even more volatility.

And finally, uranium has catapulted to its highest level in a decade due to a resurgence in nuclear energy, which had previously fallen out of favor following the Fukushima meltdown in 2011. That black swan event resulted in a lost decade for uranium that wiped out 85% of the industry.

This is the perfect storm of events that’s led to a brand-new commodities supercycle — and it’s a tremendous opportunity for investors, because it’s just getting started.

That’s why my colleague and co-editor of The Wealth Advisory, Jason Williams, has released a new report detailing three distinct ways to profit from the commodities supercycle.

One details a way for investors to lock in huge payouts from gold miners. Another exploits the copper bull. And the third details the best way to play uranium.

Add up all three and you have the perfect playbook for profit. And I’m not just talking about massive capital gains, either. I’m talking about fat streams of income that will keep you flush with cash into your own golden years.

All the details you need are right here.

Fight on,

Jason Simpkins

Simpkins is the founder and editor of Secret Stock Files, an investment service that focuses on companies with assets — tangible resources and products that can hold and appreciate in value. He covers mining companies, energy companies, defense contractors, dividend payers, commodities, staples, legacies and more…

In 2023 he joined The Wealth Advisory team as a defense market analyst where he reviews and recommends new military and government opportunities that come across his radar, especially those that spin-off healthy, growing income streams. For more on Jason, check out his editor’s page.

Be sure to visit our Angel Investment Research channel on YouTube and tune into Jason’s podcasts.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.