Soybean contracts fared better than corn, closing 0.09% down on the day after a volatile session

-

Agricultural commodity volatility surged after the USDA’s acreage and stocks reports.

-

Corn futures plunged after acreage beat the top range of estimates.

-

Soybeans avoided violent selling pressure, with estimates coming within range.

-

Wheat prices may look for more upside following yesterday’s big move higher.

Traders digest U.S. crop reports

The United States Department of Agriculture (USDA) today issued its annual acreage report and its quarterly stocks report for grains. The agricultural commodities market, particularly corn, reacted to the new data, as traders digested the updated estimates.

Corn prices suffer biggest daily percentage drop since July 2023

Corn contracts for September (/ZCU4) plunged after the reports crossed the wires, dropping more than 3%—the biggest daily percentage decline since July 2023.

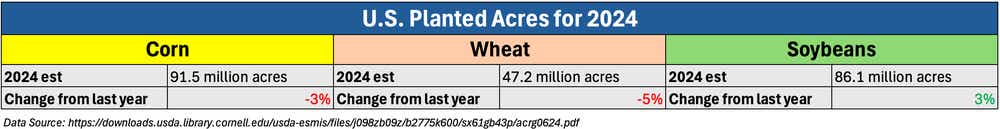

The USDA’s acreage report showed a 3% drop in planted acreage from 2023, coming in at 91.5 million acres, which was above the top range of estimates at 91.3 million acres, according to Reuters.

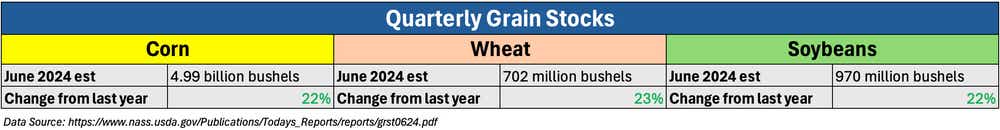

Grain stocks also weighed on corn prices, with that report showing 4.99 billion bushels of corn stocks in all positions. That is up 22% from a year ago despite a disappearance (i.e., what has been consumed) of 3.36 billion bushels from March to May compared to 3.29 billion bushels last year.

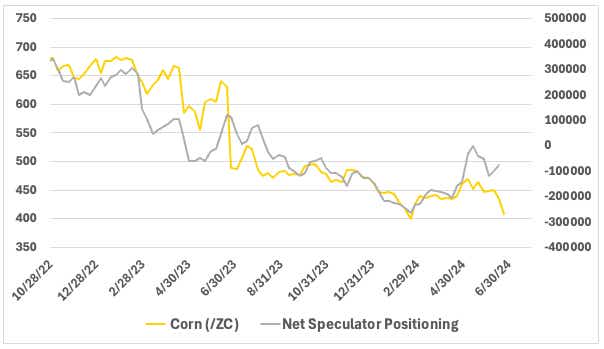

The reaction comes amid a market that is already short the commodity, with speculators in Chicago Board of Trade (CBOT) corn short 76,711 contracts on net among speculators, or non-commercial traders, according to the Commodity Futures Trading Commission (CFTC).

Looking at the technicals, corn prices fell below the value area low (VAL) on the report, putting prices in an area of low liquidity—helping to explain the violent price action.

The relative strength index (RSI) on the continuous contract is on track to break below 30, which would put prices in oversold territory. That doesn’t mean we would get an immediate rebound. In fact, it could invite more selling. That, combined with little support until the February lows, puts corn at risk of falling further.

Soybeans hold as numbers match analysts’ expectations

Soybean contracts fared better following the report, closing 0.09% down on the day after a volatile session. Still, prices are near multi-year lows and are looking at a monthly loss of over 8%, the largest since May 2023.

The USDA pegged soybean acres at 86.1 million, a 3% increase from the year before. Soybean stocks were put at 970 million bushels, up 22% from this time last year. The top range of estimates called for 87.5 million acres.

Soybean traders were also short going into this report, with speculators in CBOT soybeans net short 74,302 contracts.

Soybean prices also exhibit a weak technical posture, with prices lingering near lows not traded since 2020. The RSI is also nearing a break below the 30 level. The 1,100 level has held up to several intraday tests, which could indicate some buying appetite there. That level coincides with the VAL, supporting a view that buyers may be ready to step in at 1,110.

Wheat falls despite drop in acres

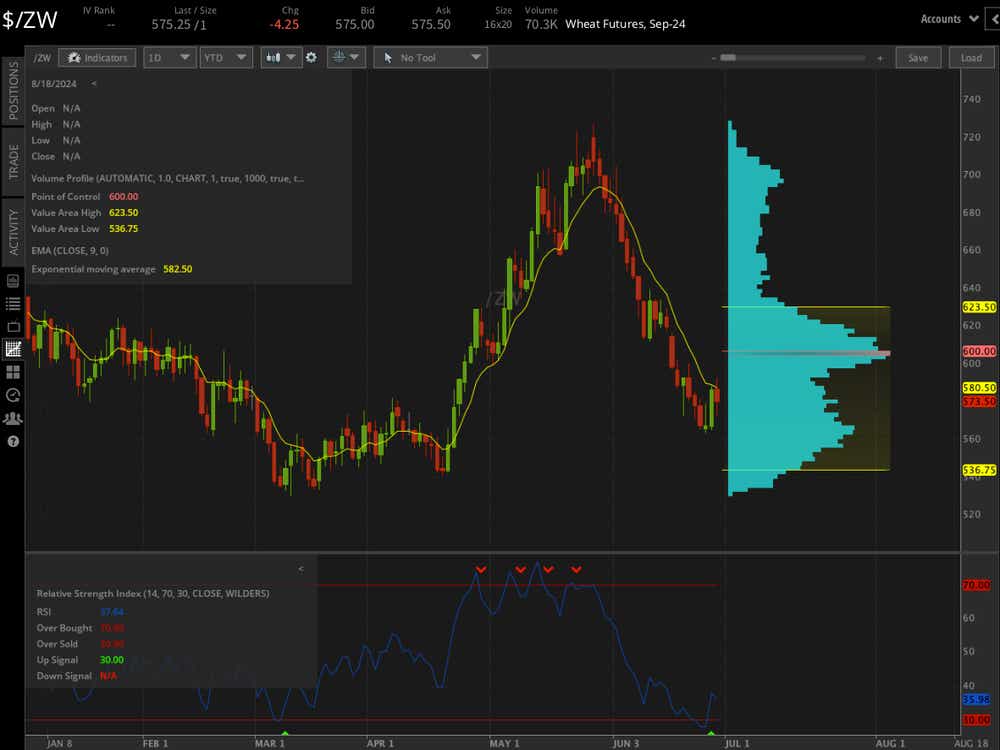

Wheat contracts (/ZWU4) closed 0.73% lower, or down 4.25 per bushel, after the report. The selling comes after a 3.39% gain yesterday, which was the biggest daily percentage gain since May 20, 2024, and came a day after I made a bullish call on the commodity during Wednesday’s Options Trading Concepts Live show.

The USDA put wheat planted acres at 47.2 million, down 5% from this time a year ago. Wheat stocks were at 702 million bushels, up 23% from last year. That put wheat acres near the low range of analysts’ expectations at 47.1 million acres, but near the higher side of estimates for stocks, which called for 705 million bushels.

Wheat prices may recover next week if seasonality and historical price performance patterns play out—something I outlined on the show linked above. Wheat speculators remain net short per the latest CFTC data, which could help pressure prices higher if we don’t break last week’s lows over the next week.

The commodity may offer the best case for the lows already being in. Yesterday’s strong move remains only partially retraced, and the RSI moved out of oversold territory. Prices must clear the nine-day exponential moving average (EMA), a level that has defended two intraday attempts so far. A close above it could inspire some confidence in bulls to attempt to establish a trend reversal from May and June price action.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.