NEW YORK, Jan. 30, 2026 (GLOBE NEWSWIRE) — Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or the “Company”), a leading critical minerals mining company, is pleased to announce the Austrian Government has again renewed the Wolfsberg license for a further 2 years despite incorrect media reports to the contrary.

Key Highlights

-

The Austrian government renews the Wolfsberg mining license for a further 2 years.

-

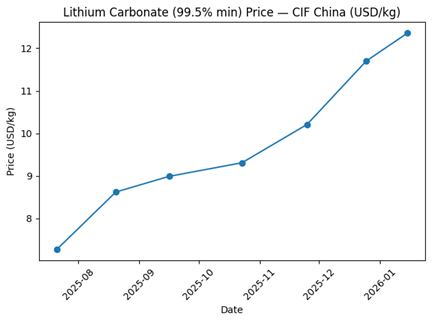

Lithium prices continue their rapid rise.

-

A decision on whether to commence mining will be made by the end of 2026.

Critical Metals Corp., Chairman Tony Sage commented:

“We have recently met with Obeikan (our Saudi hydroxide plant partners) and agreed a framework for a ‘decision to mine’ by the end of 2026 if prices remain robust and financing options are available.”

The lithium sector has over the past 6 months shown a strong rebound, with prices for key lithium compounds surging significantly from early 2025 lows due to tightening supply dynamics and robust demand growth. Battery-grade lithium carbonate prices in China have climbed to around CNY 168,000–170,000 per tonne (approximately US$23,000–24,000 per tonne equivalent, based on recent spot and futures data), marking gains of over 40% in the past month and more than 100% year-over-year in some benchmarks. This follows a peak near CNY 180,000 per tonne in late January. Similarly, spodumene concentrate (6% Li₂O, CIF China) has traded around US$2,000–2,168 per tonne, recovering from prior subdued levels amid supply constraints and speculative momentum. These upward movements reflect a shift from earlier oversupply concerns toward a more balanced or deficit-leaning market.

The outlook for lithium prices remains positive for 2026, driven primarily by accelerating demand from battery energy storage systems (BESS) and the robotics and drone sectors, which is outperforming expectations and emerging as a major growth driver alongside electric vehicles. Analysts anticipate a narrowing surplus or even a small deficit in lithium carbonate equivalent, with forecasts pointing to sustained or higher prices amid capped new supply additions and geopolitical efforts to secure non-Chinese sources. Energy storage investments in major economies, combined with resilient downstream consumption, support optimism for continued price strength, positioning projects like our Wolfsberg lithium project to attract project financing.

About Wolfsberg

The Wolfsberg Lithium Project is a strategically located hard-rock lithium development in Carinthia, Austria, and is considered one of Europe’s most advanced lithium assets. The project is designed to supply high-quality spodumene concentrate to the growing European electric vehicle and battery storage markets. Wolfsberg benefits from strong infrastructure access, a skilled regional workforce, and proximity to major automotive and battery manufacturing hubs. With established permitting progress and development studies completed, Wolfsberg is positioned to play a key role in strengthening Europe’s domestic supply of critical battery materials and supporting the continent’s energy transition.