Thinkhubstudio/iStock via Getty Images

The market is fixated on when Big Tech will generate economic value from the $400 billion-plus being poured into AI data center expansion annually. The market is missing the point.Monetization has never been Big Tech’s weakness, as explosive revenue growth and high margins have defined their businesses for decades. While execution risk always exists, these companies remain the world’s most reliable operators at scale.

Instead, the real risk to the AI economy lies in the physical constraints of scaling these AI ambitions — not in compute availability from companies like Nvidia (NVDA) or Broadcom (AVGO), and certainly not in Big Tech’s software capabilities, but in power, cooling, and infrastructure that were never designed for this magnitude of demand.

Nvidia’s GPU roadmap is bringing about an immediate need to overhaul data centers, as most data centers today are incapable of powering the kilowatts required for rack-scale systems. Blackwell power requirements of 120 kW for the GB200s and 140 kW for the GB300s represent a 2X increase from the H200s 70kWs. As we look out over the next 1-2 years, it’s expected Nvidia will ship rack-scale systems requiring 300-600 kW – or a 5X increase from what was needed per system in the first half of 2025.

Therefore, it’s not enough to say the AI economy needs more power, but rather it needs power urgently. These are two entirely different matters; for example, the first could be supported by the expansion of nuclear power and the electrical grid, but the latter cannot. In fact, combining these two is something very few companies can do.

This leads me to my Top Pick for 2026 – Bloom Energy.

Bloom Energy offers onsite power generation through solid oxide fuel cells that are behind the meter to reduce dependency on the grid. By providing behind-the-meter generation, Bloom reduces reliance on utility infrastructure and accelerates time-to-power for customers. An added benefit is the United States is the largest producer of natural gas, therefore, Bloom does not struggle to secure supply given the United States has large, well-developed gas supplies and pipeline infrastructure.

Bloom Energy saw incredibly strong price action last year, with my firm securing our first entry at $16.64. Therefore, it requires strong conviction in not only Bloom Energy’s positioning but also the sheer pressure from AI’s primary bottleneck to believe the stock could see another year of strong performance. Below, I lay out why I believe Bloom Energy is setting up for a repeat.

Power is the No. 1 Constraint for AI Data Centers

Before we drill deeper into Bloom Energy’s unique positioning, it’s well worth the time to discuss the mounting pressure in the AI energy bottleneck. Consider that companies like Microsoft (MSFT) and Meta (META) are spending hundreds of billions annually on AI, with tens of billions allocated to Nvidia’s Blackwell GPUs.

Any delay in powering these systems deepens both risk and market perception as it not only pushes out revenue and profits but also extends the period in which Big Tech remains underwater on capex returns. A long timeline for power availability increases both timing risk and financial leverage.

Competitively speaking, power availability is also an advantage, as providers that can energize and deploy GPUs faster will have a meaningful head start over competitors stalled by power constraints. While the concept is straightforward, the stakes are immense, as it’s not only the scale of these AI investments to consider but also the fierce competition to secure power that can amplify the consequences of a delay.

These concerns are being echoed across the industry. Commentary from executives at hyperscalers, neoclouds, Bitcoin miners, colocation providers, and commercial real estate firms all point to power as a key constraint (and consideration) facing the market this year and next.

CBRE said in its H1 2025 North America Data Center Trends Report that “power availability and infrastructure delivery timelines remained the most decisive factors shaping site selection, leasing activity, and pricing across all major U.S. markets.”

Equinix executives stated that “the amount of power we need isn’t sitting around on the grid. And so we are planning, and I think most people in the room that are doing data center development are ensuring you have a clear line of sight to that power before you take down any land or plan any data center capacity.”

A survey by Bloom Energy of 44 hyperscaler and colocation developers found that availability of power was the number one consideration for new site selection, with 84% of respondents placing that in the top 3 with an average rating of 7.8 out of 10.

Amazon CEO Andy Jassy said that:

You see some of the constraints and they kind of exist in multiple places, (but) the single biggest constraint is power.” Microsoft CEO Satya Nadella said Microsoft needs “power in specific places so that we can either lease or build at the pace at which we want.”

Google Cloud’s Thomas Kurian explained that:

More powerful chips… take a lot more power. And power is, in many cases, a short resource.” Arm’s CEO Rene Haas has said that without improvements in efficiency, “by the end of the decade, AI data centers could consume… 20% to 25% of U.S. power requirements. Today that’s probably 4% or less.”

AI Data Center Power Demand: Projected to Surge 8,050% by 2030

Data center power demand is expected to grow at an accelerated clip through the end of the decade and beyond, driven by the two main drivers of more powerful GPUs and surging growth in inference.

In 2024, we had revealed that:

Wells Fargo is projecting AI power demand to surge 550% by 2026, from 8 TWh in 2024 to 52 TWh, before rising another 1,150% to 652 TWh by 2030. This is a remarkable 8,050% growth from their 2024 projected level. AI training is expected to drive the bulk of this demand, at 40 TWh in 2026 and 402 TWh by 2030, with inference’s power demand accelerating at the end of the decade.”

However, we have more data from the IEA that projects global data center power demand to more than double from ~415 TWh in 2024 to ~945 TWh by 2030 under its base-case scenario, or growth of roughly 530 TWh. The agency’s AI “lift-off” scenario projects demand reaching 1,250 TWh, or growth of ~835 TWh, more closely aligning with Wells Fargo’s projection.

Regardless of where AI demand falls relative to these projections, the trend and takeaway are rather clear – AI is set to drive data center power demand much higher by 2030. We can also look at this from a GW perspective, with numerous projections all pointing to substantial growth in data center capacity.

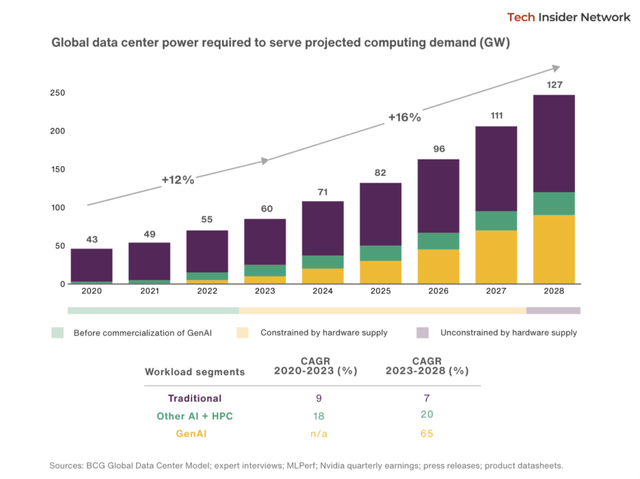

Boston Consulting Group forecasts 45 GW of growth in global data center power demand in just three years, from 82 GW in 2025 to 127 GW by 2028, with this more than doubling from 2023’s 60 GW.

Overall, BCG expects generative AI power demand to rise at a 65% CAGR from 2023 through 2028, with AI training increasing at a 30% CAGR and inference rising at a rapid 122% CAGR. Under BCG’s scenario, gen AI will account for more than one-third of global data center power demand by 2028.

Global AI data center power demand set to surge from 82 GW in 2025 to 127 GW by 2028- a 55% increase. (BCG)

On the other hand, McKinsey projects data center capacity will rise ~2.5x to 219 GW by 2030, up from a similar ~82 GW baseline in 2025. McKinsey projects AI training and inference demand to rise at a nearly 29% CAGR by 2030, driven by inference, rising at a 35% CAGR from ~21GW to ~91GW. In total, AI would be contributing ~112 GW of the projected total 137 GW demand growth.

This is quite a substantial amount of projected capacity growth over the next three to five years. But, more importantly, what level of capex does this require?

Given our prior calculations for each GW to cost between $30 to $38 billion from the ground up (and now towards >$40 billion with Nvidia’s Blackwell Ultra), building out 112 GW of AI training and inference capacity by 2030 could necessitate as much as $4.3 trillion in capex.

Looking more directly at the power side, and more specifically what Bloom’s TAM could be in the realm of on-site generators, Bernstein analysts estimate that generators and turbines could account for ~6% of capex per GW. This would equate to roughly $1.8 to $2.4 billion per GW, or in the long-term scenarios noted above with 112 GW of growth tied to AI, as much as $258 billion. BofA takes a more conservative approach at roughly ~2% of capex per GW, or ~$800 million, placing this 112GW forecast opportunity at nearly $90 billion.

Why Bloom Energy Stands Out in a Crowded Energy Industry

Our primary message has been “time to power” for Bloom, and the company continues to stand out for this very reason as it’s finding strong product-market fit in AI data center power needs. This is a key advantage, as on-site power is becoming more of a necessity as grid constraints and connection timelines rise.

As we had noted above, the industry is expecting to see significant demand growth over the next few years, yet the primary hurdle is that the grid is not able to keep up with such rapid demand in a short timeframe. For example, PJM (home to Data Center Alley in Northern Virginia as well as fast-growing data center markets in Pennsylvania and Ohio) fell short of its reliability requirements in the last two capacity auctions, with the most recent 2027/28 planning year, falling ~6.6GW short.

A similar dynamic is unfolding in Texas, where ERCOT’s interconnection queue has reached roughly 226 GW as of mid November, nearly quadrupling the 63 GW recorded at the end of 2024. Of that total, approximately 165 GW comes from data center projects targeting approval by 2030, whereas ERCOT added only 23 GW of new capacity in 2024–25 — about 10% of the queued demand.

This further validates Bloom’s positioning by enabling new data center projects to come online sooner with on-site, behind the meter power without sitting in interconnection queues for years at a time. Bloom has already proven that it can quickly establish data center power solutions in a rapid manner, completing shipments to Oracle Cloud Infrastructure in just 55 days of its 90-day delivery request.

Its fuel cells are also fuel-flexible and can run on natural gas, biogas, or hydrogen and provide continuous power with 99.9-99.999% reliability metrics. They are also modular in nature and can scale from 20 MW to 500 MW+, allowing flexibility in deployments and ease of scaling. Bloom is also continuously improving on price-performance, stating that its fuel cells have seen double-digit YoY cost reductions each year for the past ten years and a 10X increase in power production in the same footprint vs. 10 years ago.

Bloom also has an advantage over gas turbines when it comes to on-site power demand, as GE Vernova (GEV) had stated in December that its gas turbines are sold out through 2028 with less than 10% remaining in 2029, meaning any new orders would not be delivered for another three-plus years. Nuclear has been floated as a solution to meet GWs of demand, though restarting facilities take years, and SMRs are not expected to be commercially viable at scale until the 2030s.

From Oracle to Quanta: Bloom’s Rapid AI Power Deployment

Doubling capacity this year to 2GW gives Bloom an outlet to meet immediate-term demand from data centers throughout this year into 2027.

A subsidiary of American Electric Power (AEP) had entered into a deal with Bloom in November 2024 for the purchase of 100MW of solid oxide fuel cells with the option to purchase 900MW more, for a total of 1GW.

On Jan. 4, AEP disclosed that its subsidiary had exercised a “substantial” portion of this option for $2.65 billion as part of its plan to develop and build a fuel cell power generation facility in Wyoming. This is rumored to be for Crusoe and Tallgrass Energy’s 2.7GW “Project Jade” campus currently under development, said to be scalable to 10GW in the future.

Bloom also quietly secured a major purchase order from AI server manufacturer Quanta Computer’s subsidiary QMN at the very end of 2025, with it buying three fuel cell microgrid systems for ~$502 million to provide reliable backup power to its B16, B18, and B19 plants in California to ensure that high-value AI server manufacturing is not interrupted in times of inclement weather or wildfires.

As a quick recap of some of Bloom’s prior deals, it announced a partnership with Brookfield in October, which will see the asset management firm invest up to $5 billion in Bloom’s fuel cell tech and potentially finance deals for Bloom to be the preferred on-site power provider for Brookfield’s AI data center portfolio. This spans Brookfield’s $100 billion global AI Infrastructure program announced in November, in partnership with Nvidia and the Kuwait Investment Authority, which is aiming to build “AI factories” on Nvidia’s Vera Rubin stack under Brookfield’s new cloud company Radiant.

Bloom also struck a deal with Oracle back in July to deploy its fuel cells for onsite power at select Oracle Cloud Infrastructure (OCI) data centers, with Bloom serving as the first and second source of power for a single data center, with management hinting that this partnership is likely to expand over time.

Financials

During the Q3 earnings, Bloom Energy beat on the top and bottom-line estimates, with strong margin expansion, including GAAP operating margin moving into positive territory.

Revenue Growth Acceleration

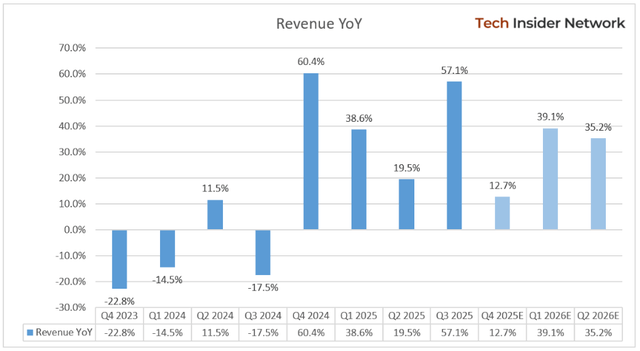

The company reported record revenue of $519.05 million, vs. estimates of $428.07 million. Revenue grew by a solid 57.1% YoY and 29.4% sequential growth, accelerating 37.6 percentage points from the previous quarter’s YoY growth of 19.5%. The company’s fourth consecutive record revenue was driven by the strong demand for its fuel cell technology, driving AI data centers.

Revenue growth is expected to decelerate in Q4 to 12.7% YoY growth to $644.9 million due to tough comps, as last year’s Q4 revenue grew by 60.4%. Revenue will then accelerate to 39.1% YoY growth to $453.6 million in Q1 2026. These forecasts represent a meaningful upward revision following constructive management commentary on the Q3 earnings call, compared with prior expectations in October of just 6.4% growth for Q4 and 20% growth for Q1.

Bloom Energy Q3 2025: Revenue growth surged to 57.1%, marking a 37.6 percentage point acceleration from Q2. (Company IR/Seeking Alpha)

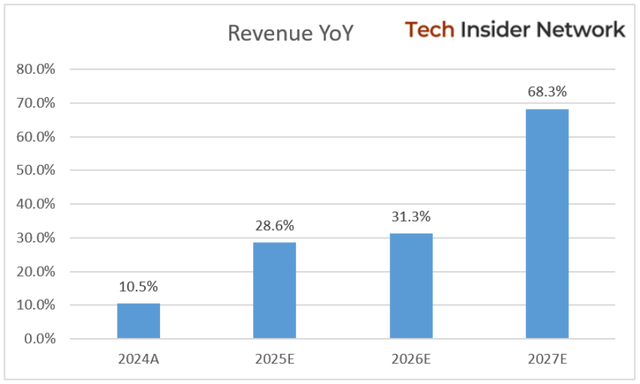

Analysts expect 2025 revenue growth to accelerate to 28.6% YoY to $1.90 billion and to 31.3% YoY growth to $2.49 billion in 2026, up from 24% expected growth during October. Looking further ahead, revenue growth is projected to accelerate sharply again in 2027, surging 68.3% YoY to $4.19 billion, compared with the 62% growth rate expected in October.

Management sounded optimistic about the future growth, as the company’s co-founder and CEO, K. Sridhar, said in the Q3 earnings call, “This seminal year for Bloom positions us for an even stronger 2026 and beyond with higher growth and more profitability.”

Bloom Energy Revenue Growth Acceleration: Forecasted to hit 28.6% in 2025 before surging to 31.3% in 2026 and 68.3% in 2027. (Company IR/Seeking Alpha)

Product Revenue Growth Surges 64% in Q3 2025

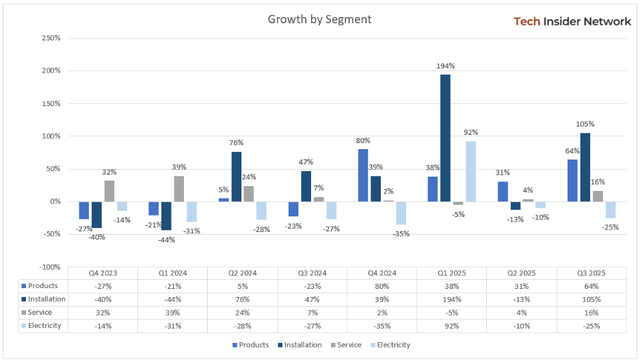

Product, installation, and service revenue growth showed acceleration from the previous quarter. The electricity segment declined sequentially.

-

Installation revenue growth spiked 105% YoY to $65.78 million, accelerating from a (13%) decline in Q2. The strong growth was primarily driven by the timing of key project milestones, particularly to meet the time to power milestones on certain key sites related to installation services and better pricing.

-

Service revenue increased 16% YoY to $58.6 million, a notable acceleration from the 4% growth recorded in the prior quarter. The improvement was primarily driven by stronger contributions from maintenance and service contracts tied to Bloom Energy’s expanding installed base of Energy Server systems.

-

Electricity revenue was down (25%) YoY to $10.35 million, decelerating from a decline of (10%) in Q2. The decline in electricity revenue was driven by lower straight-line revenue recognition following the repowering of certain Managed Services sites, an accounting-related impact.

Bloom Energy Q3 2025 Segment Growth: Installation revenue surged 105% YoY, while Product and Service revenue accelerated to 64% and 16%, respectively. (Company IR)

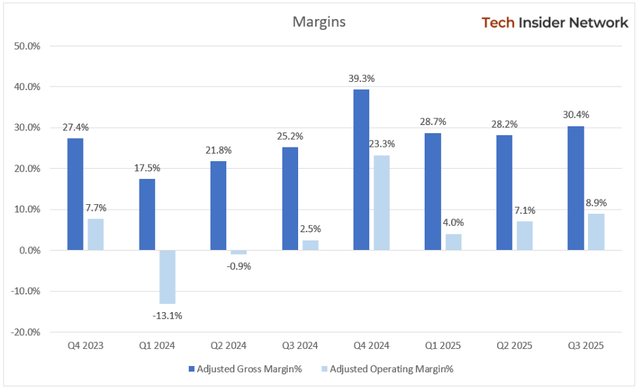

Bloom Energy Q3 2025: Margins Continue to Expand

Bloom Energy’s margins are improving, primarily driven by operational efficiency, product cost improvements, and operating leverage. Bloom is fundamentally transforming into a stronger company as its GAAP operating margins were previously deep in the red, in double digits. AI is driving an important margin inflection for this energy stock.

-

Q3 gross profits grew by 92.7% YoY to $151.68 million, or a gross margin of 29.2%, up 5.4 percentage points YoY and 2.5 percentage points sequentially. Similarly, adjusted gross margins showed strong YoY and sequential improvement, primarily driven by product cost improvements and manufacturing efficiencies.

-

Operating margins improved 4.4 percentage points YoY and 2.4 percentage points sequentially to 1.5%, primarily driven by strong operational efficiencies. Adjusted operating profits grew by 470% YoY to $46.2 million, or an adjusted operating margin of 8.9%, compared to 2.5% in the same period last year.

Bloom Energy’s Q3 2025 adjusted gross margin improved 520 basis points YoY to 30.4%. (Company IR)

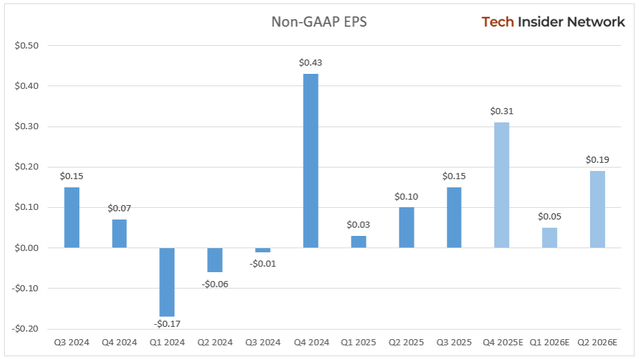

Bloom Energy Set for 96% Adjusted EPS Growth in 2026

GAAP EPS came in at ($0.10) in Q3 compared to ($0.06) in the same period last year. GAAP EPS was negatively impacted by a one-time loss related to unconsolidated affiliates of ($19.6 million) or a ($0.08) per share. The company reported adjusted EPS of $0.15, beating estimates by 47%, and was up from ($0.01) in the same period last year and $0.10 in the previous quarter. Bloom reported strong profit growth driven by operational efficiency, product cost improvements, and operating leverage.

Analysts expect adjusted EPS of $0.31 in Q4 and $0.05 in Q1. Looking forward, adjusted EPS is expected to grow strongly in 2026 by 95.9% YoY to $1.08, up from estimates of 84.7% during October, and 147.4% growth in 2027 to $2.67, up from the estimated 122.4% growth during October.

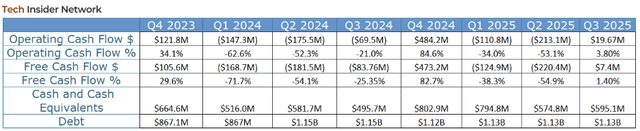

Cash Flow and Balance Sheet

The company reported positive operating cash flows and free cash flows in Q3 2025 after negative cash flows in the first two quarters of the year.

-

Based on earlier commentary and current year-to-date figures, it implies a sharp sequential rebound in Q4, with operating cash flow and free cash flow potentially exceeding $396 million and $371 million, respectively.

Valuation

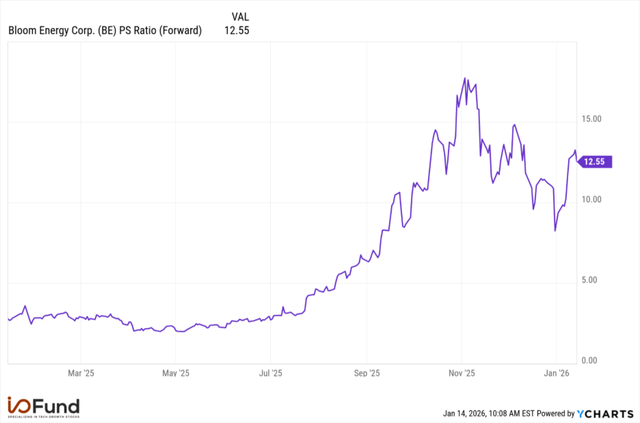

Bloom Energy is trading at a P/S ratio of 18.2 and a forward P/S ratio of 12.6. The strong AI-demand led the company’s stock outperformance of 291.2% in 2025, and YTD return of 56%. As a result, Bloom Energy is trading at a premium to its average forward P/S ratio of 3.6. The company’s forward P/S ratio peaked at 17.7 in November and is now 29% below that level. On the bottom line, the company is trading at a forward P/E ratio of 123.5.

Conclusion

We’re in the era of “what you see is what you get” – meaning, those offering strong earnings reports right now are setting up for a strong runway as future generations of AI accelerators will only be more power hungry.

Bloom Energy has a compelling story, and after two decades, it appears like the stars are aligning for this alternative energy company. There’s far less speculation today than there was at the start of 2025, when my team first covered Bloom with an entry at $16.64. The customer base has expanded to four major accounts, margins are improving, and utilization of Bloom’s SOFCs has increased due to ongoing product enhancements, helping to support the stock’s 390% return in our portfolio last year.

Whether with Bloom Energy or the many other lesser-known AI stocks that my company has successfully identified, the test for investors will be figuring out how to hold on while this market unfolds in the coming quarters (and years).

We hope to help with all of the above, from being early to the products and solutions driving forward this massive market to carefully examining the financials for confirmation the company is delivering, and providing the technicals in our weekly webinars to help stay the course while also not getting too emotional during the highs and lows.