- Mounting geopolitical tensions increase the risk of another energy price surge

- How can investors navigate an environment of rising raw material prices?

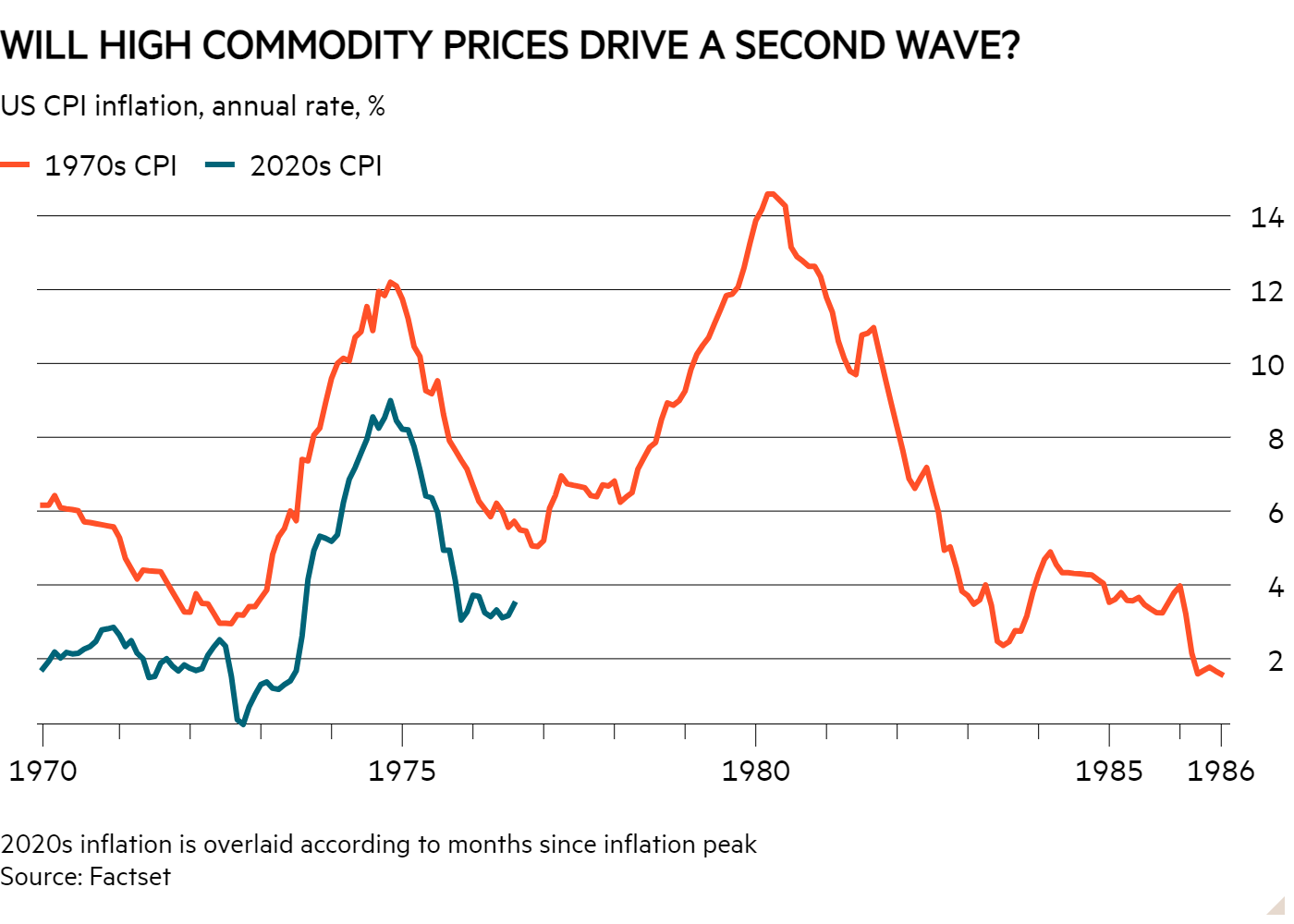

A striking chart, first circulated last year, has started popping up again. Shown below, it plots the path of US inflation in the 1970s and the 2020s – and it fits alarmingly well.

Last year, analysts were quick to dismiss comparisons with the 1970s. Fifty years ago, the second surge was caused by another energy price shock, and analysts were sceptical about the chance of it happening again. TS Lombard economist Dario Perkins said that predictions of a second wave required another energy shock at just the right time to validate them, a problem when “‘shocks’, by definition, are not forecastable”. But following the escalation of conflict in the Middle East, economists are starting to take the threat of a second inflation surge more seriously.

World Bank warnings

Earlier this year, World Bank economists warned that global commodity prices are levelling off after a steep descent, potentially making it harder for central banks to cut interest rates this year.

Their analysis shows that between mid-2022 and mid-2023, global commodity prices plunged by almost 40 per cent, helping to shave almost 2 percentage points off global inflation between 2022 and 2023. Today, these helpful forces have stalled. The body expects global commodity prices to decline by 4 per cent in just 2024. This pace “will do little to subdue inflation”, and will still leave prices about 38 per cent higher than they were before the pandemic.

And this represents a relatively benign scenario. Geopolitical tensions have already propped up the price of oil and many other critical commodities this year, even as economic growth has slowed. The price of Brent crude oil peaked at $91 in April, around $34 above the 2015-19 average. The World Bank warns that if the conflict in the Middle East escalates further, oil supply disruptions could push up global inflation again.

The region is also a crucial gas supplier, with 20 per cent of global liquefied natural gas trade going through the Strait of Hormuz. If gas supply is interrupted, knock-on effects to fertiliser production could see food prices driven upwards in tandem. Indermit Gill, the World Bank Group’s chief economist, said that “the world is at a vulnerable moment”, adding that “a major energy shock could undermine much of the progress in reducing inflation over the past two years”.

How can investors navigate a world of higher commodity prices?

For now, economists are still relatively sanguine about the risks of a second wave. TS Lombard’s Perkins thinks that while a surge in oil prices would add to inflation, “it doesn’t necessarily warrant renewed rate hikes”. He said that although a policy pivot could be postponed, it would probably not be enough to turn officials “uber hawkish”. TS Lombard calculations imply that it would take oil prices of $100 a barrel (they are currently closer to $80) to push US inflation back above 4 per cent.

There are also the unusual supply and demand dynamics of the oil market to contend with. Analysts at Capital Economics think that heightened supply risks might actually provide OPEC+ with an opportunity to start unwinding its output cuts without sparking a collapse in prices. Caroline Bain, chief commodities economist, expects OPEC+ to increase supply this year in an effort to recapture market share, meaning that the price of Brent crude oil could actually drop by the end of the year. This should mean a more limited pass-through to inflation rates.

Torsten Slok, chief economist at Apollo thinks that, although geopolitical uncertainty is pushing commodity prices higher, there are longer-term drivers too. This includes geopolitical fragmentation, and stronger AI-driven demand for energy (which has an over 60 per cent weighting in the S&P GSCI index). For investors tempted by signs of life in the commodities sector, my colleague Dave Baxter sets out funds to help take advantage of rising raw material prices.