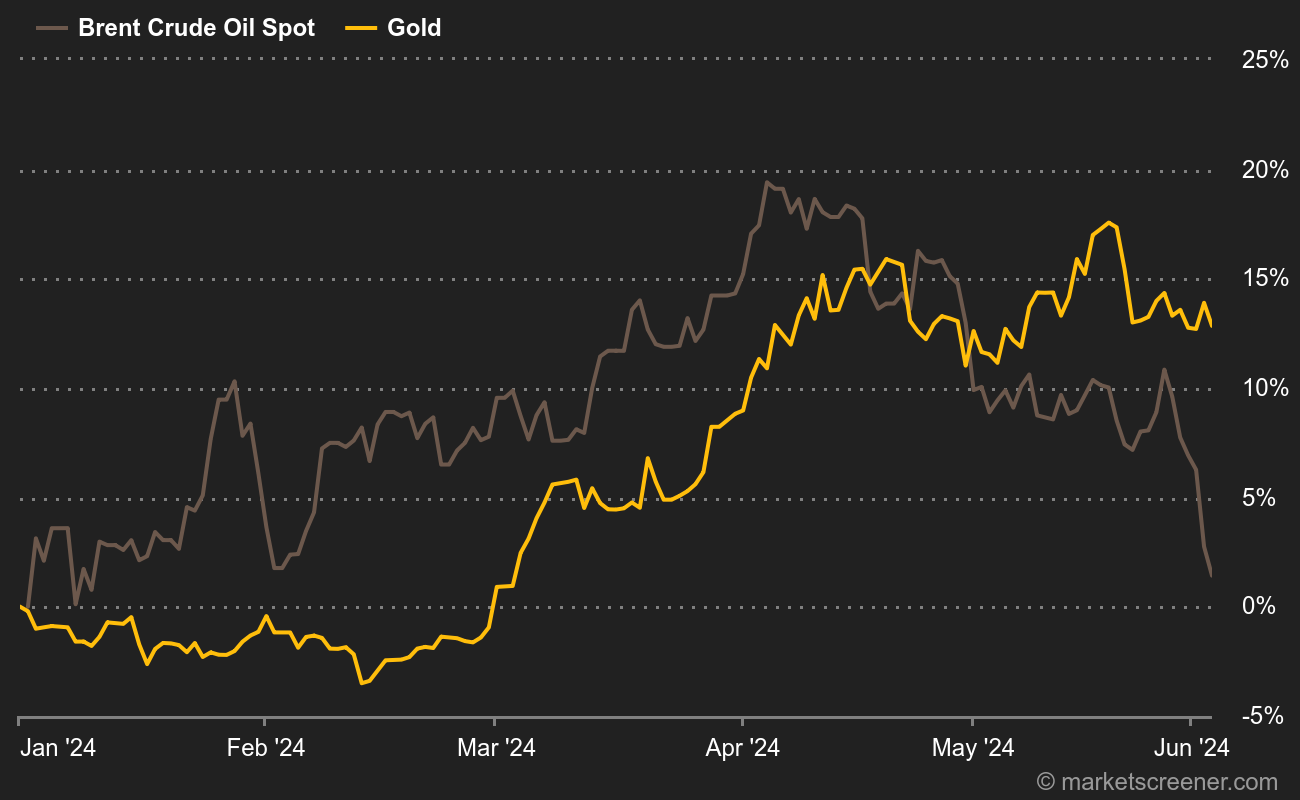

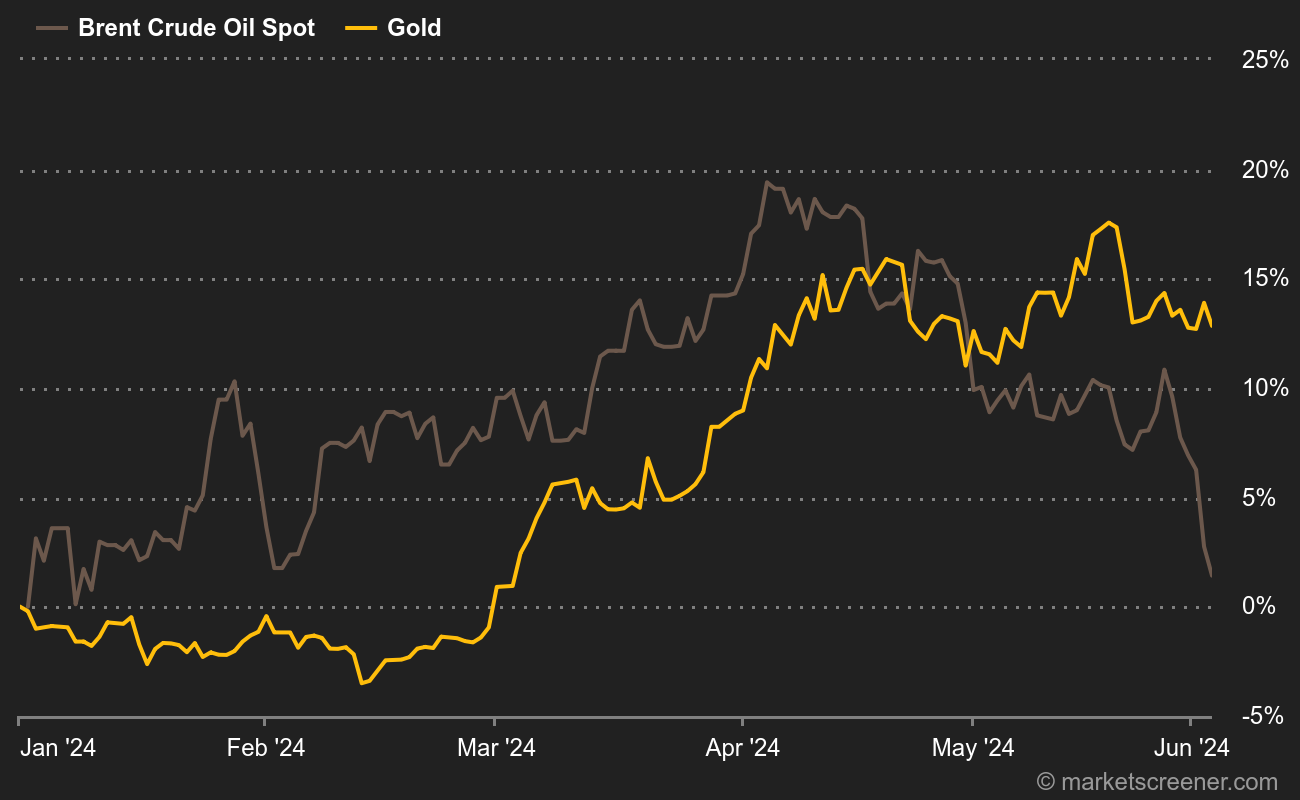

This week’s focus is on black gold prices, which have recently plummeted to their early February level, following some surprising comments from OPEC+. Among other commodities, silver is struggling, while industrial metals are feeling the pinch of economic fears.

Oil gets its feet wet

Oil prices remained close to their lowest levels in four months, following OPEC+’s decision to increase its supply by the end of the year. At the same time, US crude oil and fuel inventories rose, sending a second negative signal.

Brent crude is now trading below USD 78 a barrel, having exceeded USD 90 two months earlier. At the same time, WTI was trading at USD 73. Both contracts lost almost a dollar on Tuesday, reaching their lowest levels since the beginning of February. On Monday, they had plunged by USD 3 each.

The drop follows the announcement by the Organization of the Petroleum Exporting Countries and its allies of plans to increase supply from October, despite recent signs of weakening demand growth. “Brent remains under pressure as part of the market continues to view OPEC’s proposed timetable for voluntary cuts as a binding commitment to increase by 500,000 barrels per day in the fourth quarter of 2024, irrespective of the fundamental outlook for oil or sentiment at the end of the summer,” explained Helima Croft, head of commodities research at RBC Capital, in a market note.

However, Saudi Energy Minister Prince Abdulaziz bin Salman said OPEC+ would pause the rollout of cuts or cancel them if demand wasn’t strong enough to absorb the barrels. “OPEC+ has made it clear that the return of these barrels to the market may be halted if market conditions do not allow for this additional supply. However, it is questionable how long some members will be prepared to retain a substantial share of supply in the market and cede market share to non-OPEC+ producers”, says Warren Patterson, head of commodities at ING.

In the United States, inventories of crude oil, gasoline and distillates rose last week, according to sources citing figures from the American Petroleum Institute. The API figures show that crude inventories rose by more than 4 million barrels in the week ending May 31, compared with a 2.3 million barrel decline forecast by analysts in a Reuters poll. Independent energy analyst Tim Evans wrote that the crude figures in the API report “represent a clear bearish surprise”.

An overview of the commodities

In precious metals, the trend has been clearly downward for the past week, with silver falling sharply.

Industrial metals have also been on a downward trend, clearly affected by the latest mediocre economic data from China and the United States.

As for agricultural markets, the mood continues to differ from one product to another. The explosion in cocoa prices in recent months was followed by consolidation, but prices have recovered significantly since mid-May. Over the recent period, coffee has also shown signs of recovery (note that the scale is different from that of metals).