Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Trafigura is not having a great year so far. The commodities trader said this week that first-half ebitda through March was down by nearly half.

More interesting than the numbers, however, were Trafigura’s comments. It noted the odd disconnect between the increasing attention that institutional investors are paying to commodities compared with dubious underlying fundamentals for industrial metals. Asset managers, however, may care more about the resilience of their portfolios than the supply and demand outlook for copper or nickel.

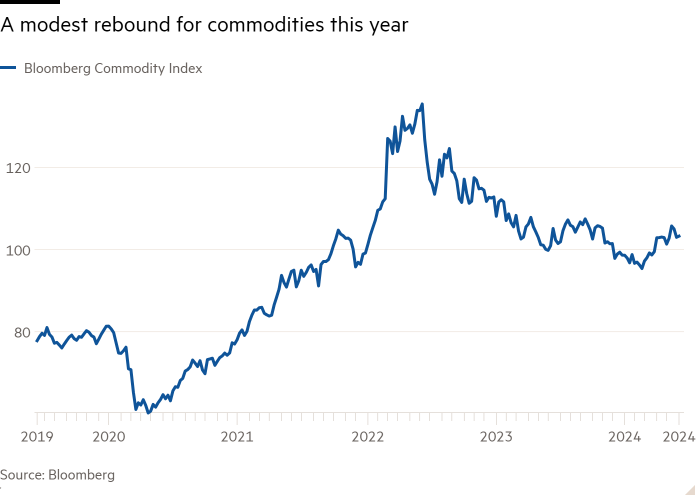

A glance at commodity prices certainly gives a mixed picture. The Bloomberg Commodity Index (BCOM), most popular with passive index funds, has only risen about 4 per cent this year so far, which pales against equities.

Prices don’t tell the whole story, though. Flows into passive tracker funds for the BCOM and S&P GSCI indices have picked up markedly in the past six months. Assets under management in both stand at around $135bn after the sharpest rise (perhaps up a quarter) since the early 2022 invasion of Ukraine.

Back then, supply fears for everything from natural gas to nickel rattled investors, who scrambled to up their exposure to energy. This time it seems that portfolio managers see the hangover of that period’s inflation push as the greater worry. Bond yields in most countries have climbed this year, most prominently in the US where much of the world’s $100tn of AUM resides. Macro and multi-asset portfolio managers are increasingly feeling the need to hedge inflation risk with actual commodities.

Royal London, say, uses commodities to diversify its multi-asset portfolio risk for the pensions it manages. Its roughly £4bn ($5bn) of commodity exposure is one of the largest among UK institutions. With a 5 per cent weighting — half of its maximum — it has a preference for the BCOM funds as they move in the opposite direction of falling bond prices.

The UK asset manager seems overweight compared with peers. Currently about 2 per cent of global AUM has been allocated to commodities, thinks Goldman Sachs. Back in 2010, after a decade of voracious Chinese demand, this figure was closer to 8 per cent.

China’s ailing economy means it is unlikely to produce a powerful growth burst. In fact, in the last year there have been persistent exports of steel and even copper from the country — uncommon over the past decade.

The tipping point for commodity investment is more likely to be perceived structural inflation, especially in the US. If that does not dissipate in the year ahead, long-term investors will then feel forced to add to their commodity positions.