In focus: Live cattle’s multi-year long bull market was a foreseeable event – IF you were NOT using “market fundamentals,” that is.

Today I did an AI Google search for “how to predict live cattle prices.” Here’s the generated answer:

Live cattle prices can be unpredictable because they can fluctuate throughout the year due to a number of factors, includingcattle slaughter, meat and poultry supply, demand for cattle for grazing or feeding, consumer demand for beef, cash and futures prices, production technology changes, industry structure changes.

That’s about as helpful as a compass on the moon.

Don’t blame the robot. The AI search engine did what it was designed for: summarize the wide spectrum of information on a certain topic into a neat, informative capsule. And like it or not, the wide spectrum of information on market forecasting says price trends are driven by news events called “fundamentals.”

But like the robot says, those “fundamentals” are frequently in flux, spinning prices all over the place.

And even when the “fundamental” path seems locked, the intended effect on prices often fails.

Take, for example, the live cattle market. Starting in early 2020, the US livestock market was slated to be a foregone casualty of the global pandemic. Live cattle prices circled the drain of a decade low, and an entirely new word was created to describe the widely expected decline of farm-raised beef prices: the “Cowvid” Crisis. (Jan. 15, 2021 HistoryColoroda.org)

These 2020 news items from the time feed the bearish flames:

- “Live Cattle Futures Plunge as Pandemic Roils Markets” (April 6 Reuters)

- “US Cattle Futures Hit 10-Year Lows as Coronavirus Stokes Demand Uncertainty” (March 17 Farming Independent)

- “Coronavirus Sends Crop and Livestock Prices into a Tailspin” (April 7 FB.org)

The “fundamental” path seemed locked, to the downside.

And yet, after bottoming in May 2020, live cattle prices launched into a 3-year long rally to record highs in September 2023.

So, one might question: Is this proof that markets, are random, as so many investors puzzled by similar occurrences believe?

Not at all. It’s proof that the “fundamental” model of market analysis is misdirected. News is not the driving force of price trends. Investor psychology, which unfolds as Elliott wave patterns directly on price charts themselves, is.

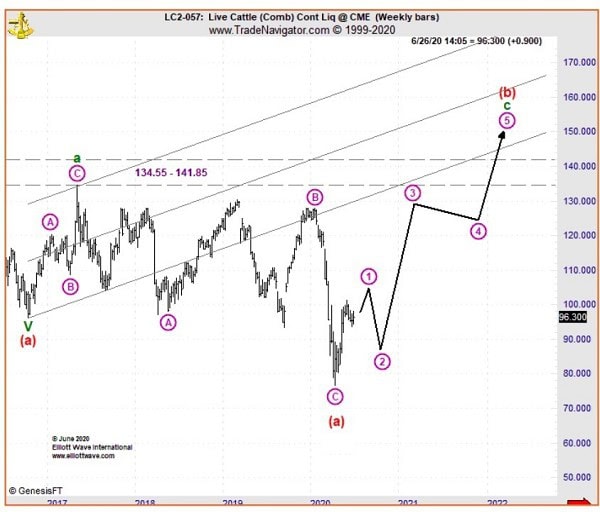

Here, we go back to our June 2020 Monthly Commodity Junctures, where we posted this weekly price chart of live cattle. There, the Elliott wave picture called for prices to embark on a powerful, five-wave rally in not just months but years ahead.

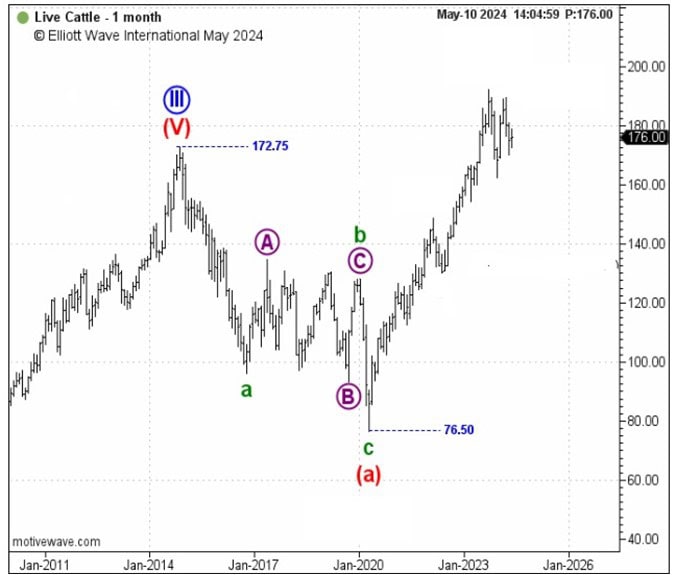

And, this is what followed. Cattle prices reclaimed the upside in a 3-year long bull run to lifetime highs in September 2023 before catching its breath.

Follow-up. On February 22, 2024, one livestock futures report asked, “Is the Bull Market Story Over in Live Cattle?” (Farm Progress) What did they use to determine the answer?

If you guessed “market fundamentals,” you’re right. Namely, whether U.S. cattle supplies stick to their current 52-year lows.

Side note: In late 2020, cattle supplies stood at record highs – “the largest inventory since 2008” revealed the U.S. Department of Agriculture on November 25, 2020. From a “fundamental” perspective, that should’ve kept prices depressed. Of course, it didn’t.

In no world is there a risk-free model for commodity trading or even forecasting. But the odds of ending up where you want significantly increase when you’re following the right navigational path.

Elliott wave analysis is an objective approach to interpreting price trends and enables one to define clear price support/resistance levels to help minimize risk.

Right now, in the May 10 Commodity Junctures (our new, long-term educational service) “Weekly Wrap-Up” video presents an updated price chart and analysis for where live cattle prices may be headed in the coming weeks, and months.

Commodity Prices Are on the MooooVe!

When it comes to knowing the future of commodity prices, there’s no such thing as a silver bullet. Even the most jarring Black Swan events like that of the pandemic can’t accurately determine where prices will go.

The only confident measure of a market’s trend is investor psychology, which unfolds as Elliott wave patterns directly on price charts. Right now, our Commodity Junctures presents high-confident outlooks for the world’s leading names in livestock, grains, softs, foods, and more.

See below to turn a new page in your investment future.