It’s a big day for markets, with stock futures climbing after inflation data came in better-than-expected. A Fed meeting is still to come.

Most Read from MarketWatch

At the near halfway mark to 2024, those putting money in the S&P 500 SPX and Nasdaq COMP have been rewarded with double digit gains, while some commodity investors haven’t done too shabbily either.

In our call of the day, a team of Citi analysts predict a “last $80 hurrah” for oil prices and suggest a better place to park money.

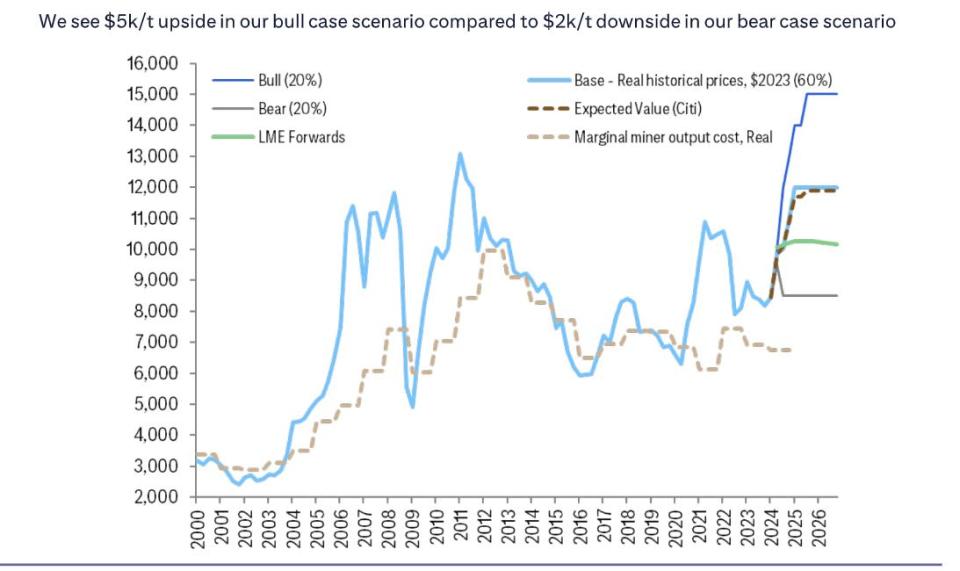

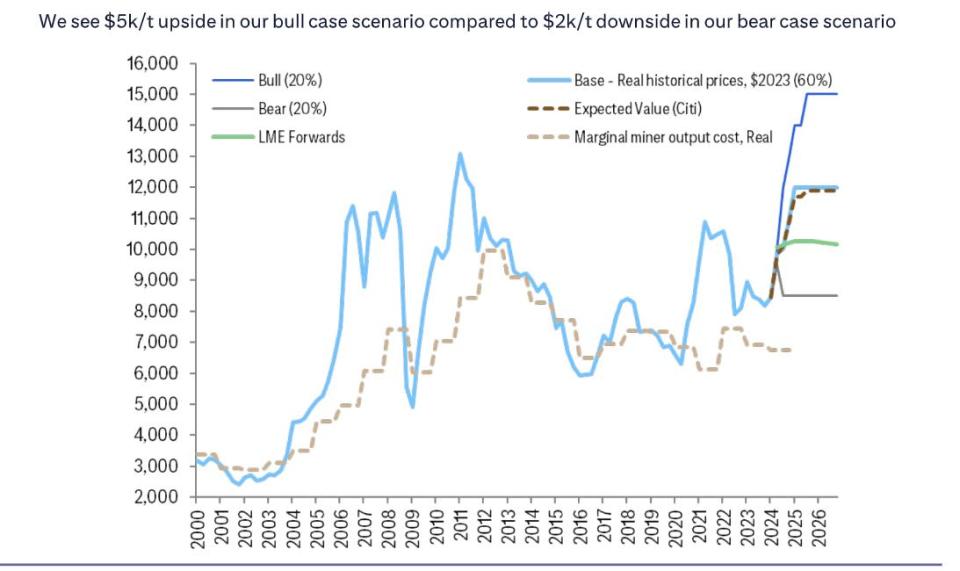

“Our highest conviction call is that copper should continue to outperform crude oil over the coming year,” says a team led by Maximilian Layton, global head of commodities, in Citi’s third-quarter outlook for the asset class that published on Wednesday.

They note the “spectacular year for some commodities, with copper HG00, gold GC00 and cocoa CC00 all reaching fresh all-time highs, not to mention benchmark gas prices NG00 rallying 25-60% over the past three months.”

Read: Gas prices see ‘ultra-rare’ drop to start summer

But they expect range bound action for oil seen this year will continue through the third quarter, albeit with some near-term risks skewed slightly to the upside. Global benchmark Brent BRN00 will likely hit $82/barrel in the next three months, then head south into the fourth quarter and next year, when prices should settle at around $60/barrel, they predict.

Citi sees global oil balances moving into a “meaningful surplus,” even if OPEC and its allies extend production cuts through to the end of next year. They say that bearish view means producers should hedge and investors should “use any strength over the coming months as an opportunity to take downside exposures.”

Oil prices CL00 are rising after data showed falling inventories, though in line with Citi’s bearish view, the International Energy Agency has lowered its demand-growth forecast.

In their cheerier copper forecast, they see the metal rallying to an average $12,000 per metric ton by early 2025 — benchmark copper on the London Metal Exchange was trading at around $9,831 per metric ton on Wednesday. Layton and his team said that weak physical data will likely keep a lid on bullish sentiment from fund buying, but that prices won’t dip below $9,000.

Copper should climb as “improving expectations for global growth and rate cuts drive the next leg higher,” along with a tighter physical market, they said.

And copper is “THE energy transition and AI trade within commodities,” with demand to be driven by electric vehicles and solar and wind power, and as for AI, set to be used for power distribution within U.S. and global data centers, adds Layton and co.

Citi repeated a bullish call for gold and silver, saying those assets will test $3,000/oz and $40/oz over the next 12-18 months. “Strong physical demand drivers, a Fed easing cycle, and EM consumption recovery could allow the 2024 bull cycle to continue, they say.

The markets

Stocks DJIA SPX COMP are flying out of the gate, as trading kicks off post data and ahead of the Fed decision. Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y are tumbling, gold GC00 and silver SI00 are climbing, and the dollar DXY under pressure. Follow along in MarketWatch’s live markets blog for more.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5375.32 |

1.59% |

2.45% |

12.69% |

23.03% |

|

Nasdaq Composite |

17,343.55 |

2.89% |

5.04% |

15.54% |

27.78% |

|

10-year Treasury |

4.4 |

12.00 |

5.60 |

51.91 |

60.80 |

|

Gold |

2330.5 |

-1.89% |

-2.56% |

12.49% |

19.16% |

|

Oil |

78.91 |

6.22% |

0.05% |

10.63% |

14.90% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

Consumer prices were unchanged in May, against expectations for a 0.1% rise. Annual CPI rose 3.3%, down from 3.4% in April. Core prices, which strip out energy and food, rose 0.2% in May, also below forecast and dropped to 3.4% from 3.6% on an annual basis. Read about the data in MarketWatch’s live blog.

That inflation ease may still not be enough for a Fed cut when the central bank announces its decision at 2 p.m. Economists are largely focusing on clues for the timing of the first cut. A news conference with Chairman Jerome Powell is expected at 2:30 p.m.

Data from China earlier on Wednesday indicated continued tepid demand, with consumer prices up slightly in May, but factory-gate prices down again.

GameStop shares GME are lower. The meme stock said it raised around $2.14 billion in a share sale, as another cryptic tweet by influential trader Keith Gill, aka Roaring Kitty, emerged.

Oracle shares ORCL are climbing after an earnings miss, but upbeat guidance from the software maker. Investors also cheered AI-fueled cloud deals with rivals Microsoft MSFT and Google Cloud GOOGL, but some question the long-term potential of such deals.

FedEx FDX is laying off 2,000 workers at a cost of up to $375 million.

Retailer Target TGT has raised its quarterly dividend.

AI chip maker Broadcom AVGO will report after the close.

The U.S. is reportedly mulling a further clampdown on China’s access to AI chip technology.

Best of the web

This widespread inflation myth is a big problem for Biden

I spent a day down TikTok’s disinformation rabbit hole

Women have the edge on soft skills to succeed in the age of AI

Nathan’s hot-dog eating champ Joey Chestnut is now promoting plant-based franks

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

|

Ticker |

Security name |

|

GME |

GameStop |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

AMC |

AMC Entertainment |

|

AAPL |

Apple |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

NIO |

NIO |

|

AMD |

Advanced Micro Device |

|

MSFT |

Microsoft |

|

PLTR |

Palantir Technologies |

Random reads

World’s oldest book fetches nearly $4 million.

The insect migration superhighway.

Bulgari thieves escape through ancient sewers.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.