Orion Portfolio Solutions LLC lessened its stake in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC – Free Report) by 27.4% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 89,832 shares of the exchange traded fund’s stock after selling 33,918 shares during the quarter. Orion Portfolio Solutions LLC’s holdings in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF were worth $1,182,000 at the end of the most recent quarter.

Orion Portfolio Solutions LLC lessened its stake in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC – Free Report) by 27.4% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 89,832 shares of the exchange traded fund’s stock after selling 33,918 shares during the quarter. Orion Portfolio Solutions LLC’s holdings in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF were worth $1,182,000 at the end of the most recent quarter.

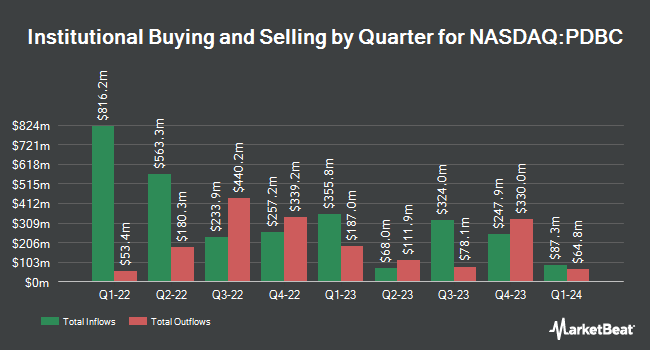

Several other hedge funds and other institutional investors have also recently made changes to their positions in PDBC. Barclays PLC acquired a new stake in shares of Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF during the 3rd quarter valued at approximately $7,740,000. Kingsview Wealth Management LLC grew its holdings in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF by 706.6% in the third quarter. Kingsview Wealth Management LLC now owns 93,311 shares of the exchange traded fund’s stock valued at $1,395,000 after purchasing an additional 81,743 shares during the last quarter. Avantax Advisory Services Inc. increased its position in shares of Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF by 49.6% in the third quarter. Avantax Advisory Services Inc. now owns 60,131 shares of the exchange traded fund’s stock valued at $899,000 after buying an additional 19,931 shares in the last quarter. Western Wealth Management LLC raised its position in Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF by 42.2% during the third quarter. Western Wealth Management LLC now owns 34,575 shares of the exchange traded fund’s stock worth $517,000 after acquiring an additional 10,260 shares during the last quarter. Finally, Atria Wealth Solutions Inc. raised its position in shares of Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF by 112.6% during the 3rd quarter. Atria Wealth Solutions Inc. now owns 126,799 shares of the exchange traded fund’s stock worth $1,896,000 after purchasing an additional 67,153 shares during the last quarter.

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF Stock Down 0.6 %

PDBC stock opened at $14.05 on Monday. The stock’s 50 day moving average price is $14.16 and its 200 day moving average price is $13.78. Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF has a 1 year low of $13.05 and a 1 year high of $15.35.

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF Profile

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) is an exchange-traded fund that mostly invests in broad market commodities. The fund holds a diverse basket of commodity futures and aims to mitigate negative roll yield in its contract selection. The fund is structured as an ETF and is actively managed.

Read More

Receive News & Ratings for Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF and related companies with MarketBeat.com’s FREE daily email newsletter.