After growing from 15 to 70 employees over the past 18 months and receiving a $12m (£9m) investment, B2B fintech Yaspa’s next move is breaking into the US.

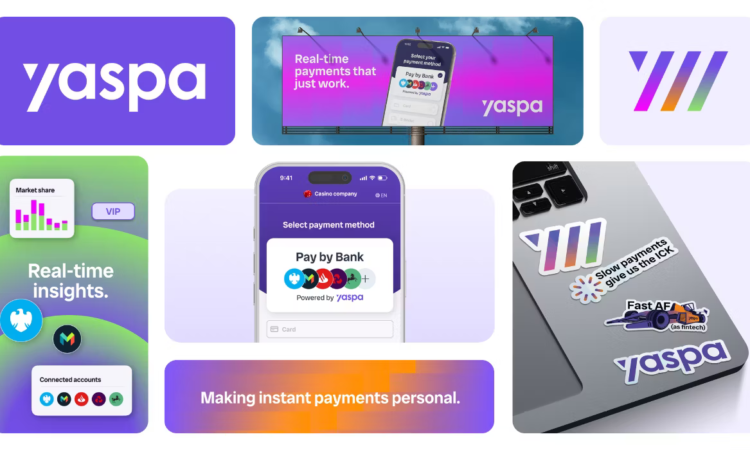

The B2B open banking payments provider, which works primarily within the iGaming (online gambling) sector, is launching into the US with a refreshed brand and visual identity.

Founded in 2017 and formerly known as Citizen, the business rebranded to Yaspa in 2023. From the company’s outset, CEO James Neville sought to link identity and money to help companies understand more about their customers via their financial footprints.

For CMO Kate Marsden, what stands out about Yaspa’s story is how the company has grown its brand as a “very small B2B fintech with basically zero budget”.

After growing from 15 to 70 employees over the past 18 months and receiving a $12m (£9m) investment, B2B fintech Yaspa’s next move is breaking into the US.

The B2B open banking payments provider, which works primarily within the iGaming (online gambling) sector, is launching into the US with a refreshed brand and visual identity.

Founded in 2017 and formerly known as Citizen, the business rebranded to Yaspa in 2023. From the company’s outset, CEO James Neville sought to link identity and money to help companies understand more about their customers via their financial footprints.

For CMO Kate Marsden, what stands out about Yaspa’s story is how the company has grown its brand as a “very small B2B fintech with basically zero budget”.

Marsden explains the name Citizen was an “absolute nightmare” from a commercial and marketing perspective. The team are now using the current brand refresh as an opportunity to scale and show what Yaspa is “developing into”.

“It’s been really lovely working in a company where the power of the brand, and the power of the marketing more generally, is appreciated,” says Marsden.

“Particularly when you’re bringing a new brand to market, you really need to cut through in one way or another. Without a budget, the best way we were able to do that in the very early days was to submit ourselves for award entries, so you could start building up some credibility and building up our name.”

The benefit of this approach is that it positions the company as award winning “right from the start”. However, once Yaspa tarted to build revenue and “had a marketing budget that was meaningful”, the decision was taken to invest in the most recent rebrand.

It’s been really lovely working in a company where the power of the brand, and the power of the marketing more generally, is appreciated.

Kate Marsden, Yaspa

Marsden describes the work as an “organic, homegrown rebrand”, with Yaspa’s in-house designer proving instrumental in bringing the new design to life. The team also worked with London-based agency Huddle at the end of last year to establish the brand’s values and mission, which is to make instant payments personal and effortless.

Yaspa looked at its visual identity to how it could build “something that was stronger and more impactful”, distinct from its competitors and had the longevity to run “over the next few years”. Though it isn’t wildly different, the rebrand is seen as an “organic evolution”, which helps Yaspa seem even more “credible and worthy”.

Marsden says rebranding was a challenge when a lot of concepts had previously been used by other businesses. Yet she urges marketers “not to get too hung up on what the identity is”, acknowledging that founders have their own personal preferences for what a brand should look like.

“My job really has to get that balance right between personal preferences about colours or visual techniques or designs, and making sure that we’re developing a series of visual guidelines and assets that absolutely have strength and applicability across different mediums,” she says.

‘Front door message’: Monzo on why loyalty is the ‘crux’ of its brand strategy

Marsden is taking the approach of finding a design that works and “sticking with it”, to avoid having a strategy which needs to be overhauled every couple of years.

The rebrand won’t alter Yaspa’s marketing mix going forward. Instead, Marsden hopes the “more distinctive and more memorable visualisation” will ensure people remember the brand in the areas where it’s already showing up.

Success and effectiveness of the rebrand will be assessed through the company’s “data-driven” lens, looking at familiarity within the target market and being top of mind.

Doubling down on “face-to-face engagements” is also a priority for Yaspa, as online gambling is “very relationship-based”, and focused on networks and referrals, which the company will be tracking.

Breaking into the US

Coinciding with the rebrand, Yaspa has launched into the North America market at what Marsden describes as an “opportune time” in the online gambling space when different states are increasingly opening up to regulated gambling activity.

From a marketing perspective, she explains the timing gives Yaspa a chance to launch in the country “without the Citizen legacy”. Although a marketing team is yet to be hired in the US, the approach will be “adaptable” given the different regulations towards gambling in different regions.

“My aim really is exactly as it is across the UK, to establish ourselves as a payment provider of choice in the iGaming sector,” says Marsden.

Yaspa also wants to be seen as an “interesting, innovative” provider of payment solutions for ecommerce, cryptocurrency and trading.

While the rebrand process took longer than the team expected, the results have provided a platform for Yaspa to reflect, says Marsden.

“What it gives us is a really strong platform and identity to be able to go out and celebrate all the work the wider company is doing, and the benefits that we can bring to our customers,” she adds.

For the Yaspa CMO, “brand and product are absolutely entwined” and you “can’t have one without the other”. Going forward, she plans to work closely with the product team as the brand looks to “dip” into the B2C world in future.