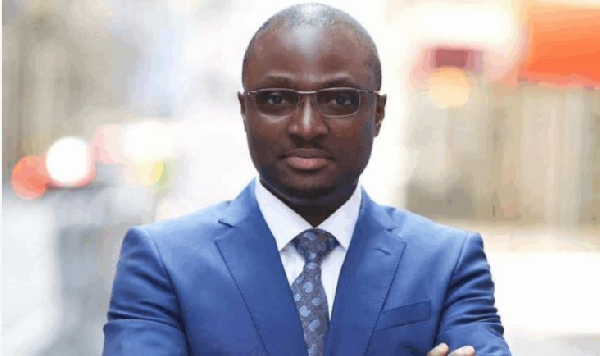

After six transformative years at the Bank of Ghana (BoG), Kwame Oppong, Director of the Fintech and Innovation Office, has stepped down—leaving behind a legacy that will continue to shape Ghana’s digital financial ecosystem.

Pioneering leadership at BoG

Since the creation of the FinTech and Innovation Office in 2020, Oppong has been the driving force behind policies, initiatives and projects that positioned Ghana as a continental leader in digital finance.

His vision, rooted in innovation and inclusion, ensured that regulation kept pace with rapid technological advancements while safeguarding financial stability.

Some notable achievements and initiatives

Under his stewardship, Ghana steadily progressed to the #1 position in the world on GSMA’s global mobile money regulatory index.

The Office also led groundbreaking initiatives that bridged policy, technology, and market needs including:

The eCedi Pilot Project – Tested the feasibility of Ghana’s Central Bank Digital Currency (CBDC) which won the Innovation in Digital Currency Design (Financial Inclusion) award from Currency Research.

Regulatory Sandbox – Created a safe environment for fintech innovators to test solutions which was cited in the UK Labour Party’s manifesto.

Licence Passporting & cross-border mobile money interoperability – An ongoing collaboration with the National Bank of Rwanda to explore mobile money interoperability and license passporting across both jurisdictions as a precursor to a broader Africa-wide implementation.

Supervisory Intelligence Platform – An internally developed Supervisory Technology (SupTech) platform that digitized prudential reporting and enhanced it with geospatial mapping capabilities for monitoring fintech sector activities. This platform won FinTech Policy of the Year (2022) by CentralBanking.com.

Akushika Chatbot – An AI-powered platform to streamline complaints and information management.

OpenDX Ghana & Digital Banking Frameworks that Laid the foundation for open banking and fully digital banks in future.

Guidelines on remittances, dormant accounts, crowdfunding, merchant accounts, and card processing localization and a Corporate Governance Guidelines to address emerging risks and building trust in the digital space.

3i Africa Summit (2024) – Convened nearly 8,000 investors, innovators, policy makers and industry players from 81 countries, positioning Ghana as an African fintech investment hub.

eCedi Hackathon – Fostered innovation in CBDC applications, engaging blockchain experts, fintechs, and developers.

DC FinTech Week 2024 Leaders Dinner- A diplomatic dinner that hosts select leaders from public and private sectors globally during the DC FinTech Week a premier global policy forum held alongside the IMF and World Bank Group annual meetings in Washington, D.C.

The event is supported by institutions such as the Bank for International Settlements, Georgetown University, PayPal, Amazon Web Services, and VISA. Being selected as the 1st emerging market host further positioned Ghana as both a thought leader and an attractive fintech investment destination.

His tenure also saw the zenith of bilateral relations between Ghana and Singapore through collaboration with the Monetary Authority of Singapore (MAS) on several breakthrough initiatives that could enhance the future of cross-border trade for MSMEs in Ghana. These initiatives include:

Universal Trusted Credentials (UTC) which tokenized the local MSME’s legal and financial profiles to engender trust in their participation in international trade.

Ghana Integrated Finance Ecosystem (GIFE) which sought to enhance SMEs’ access to finance utilizing innovative AI solutions to assess “intent-to-pay” as opposed to the traditional “ability-to-pay” credit assessment models.

Project DESFT- a live cross-border trade financing model, using blockchain-based technology to swap a Singapore authorized stablecoin and Ghana’s eCedi without using the US dollar for settlement.

Beyond global engagements, his office also pursued a strong mandate to safeguard the financial ecosystem through investigations into unlicensed entities, money-doubling schemes, and unauthorized financial products.

This work resulted in several public notices and law enforcement actions against unscrupulous operations that abused and defrauded the public.

Through these initiatives, his office not only advanced innovation but also safeguarded trust in Ghana’s digital financial ecosystem, leaving behind a legacy of strong regulation, innovation, and inclusion.

Building blocks for the future

Oppong’s tenure was marked by foresight—balancing opportunity with risk, and innovation with structure. His initiatives have directly contributed to expanding financial inclusion, empowering SMEs and creating an enabling environment for digital trade.

He spearheaded effort to initiate policy changes on virtual assets (cryptocurrencies and stablecoins) and outbound remittances, establishing Ghana as a thought leader in fintech regulation.

Beyond BoG

With a professional background spanning financial services, technology, digital financial services operations, policy and regulation, Mr. Oppong has worked with organizations such as CGAP (World Bank Group), Millicom, and Hewlett-Packard Company. His global perspective and deep expertise continue to influence digital economies worldwide.

Reflecting on his journey, he remarked, “I’ve been fortunate to collaborate with inspiring team members, supportive colleagues, visionary leadership and dynamic fintech founders who challenged and shaped the way I think and lead. Thank you to each of you—it’s been a privilege to work with you.”

A lasting legacy

Kwame Oppong’s leadership has left an indelible mark, not only on the Bank of Ghana but also on Africa’s fintech landscape. His legacy is one of vision, impact, and innovation—a blueprint for how regulators and innovators can work together to transform economies and expand opportunities for all.