Pakistan State Oil (PSO), the country’s largest oil marketing company, is undergoing one of the boldest strategic pivots in its history. After quietly dissolving its venture capital arm, an experiment that never got off the ground, PSO is doubling down on fintech.

Through its subsidiary Cerisma (Private) Limited, which operates the Payvay virtual wallet, the company is working to transform its vast retail footprint into a digital financial platform.

PSO Pulls the Plug on Its VC Ambitions

In late September, PSO’s Board approved the winding up of PSO Venture Capital (Private) Limited (PSOVC), a wholly owned subsidiary that never executed a single deal despite being capitalized for investments.

The decision was disclosed in a filing to the Pakistan Stock Exchange, with management citing a strategic review and aligning the move with SECP guidelines and the Companies Act 2017.

At its peak, PSOVC held reserves valued at around PKR 2.14 billion, yet failed to deploy funds into Pakistan’s struggling startup ecosystem. The closure marks the end of a chapter that once promised PSO would emerge as a major institutional investor, but instead highlights the difficulty of marrying bureaucratic structures with startup agility.

Payvay: The Digital Pivot

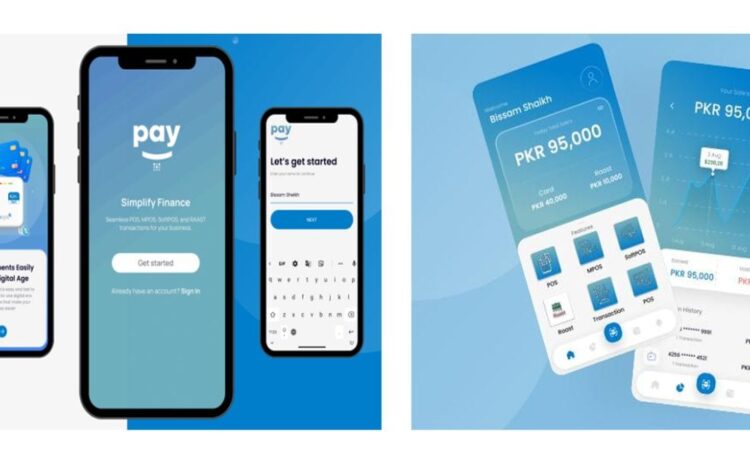

While the VC dream has ended, fintech has become central to PSO’s diversification strategy. Operated under Cerisma (Private) Limited, Payvay is positioned as PSO’s flagship digital wallet.

PSO’s advantage lies in scale. With more than 3,500 fuel stations nationwide, every outlet is a potential point of sale and customer engagement hub. The goal is to leverage these physical touchpoints to drive digital payments adoption.

Payvay has already joined the 1LINK network, enabling bill payments, interbank transfers, and ATM routing. Its settlement bank is the Bank of Punjab, giving it the regulatory and operational backbone required to scale.

Meanwhile, PSO continues to run its earlier wallet, Digicash, which had amassed over 335,000 users by 2024 and reportedly processes billions in monthly volumes. Over time, analysts expect Digicash to be absorbed into Payvay, consolidating PSO’s fintech operations under a single brand.

Strategic Partnerships Strengthen the Fintech Ecosystem

PSO is not building Payvay in isolation. It has entered partnerships that expand its fintech reach.

Faysal Bank Collaboration: In 2025, PSO partnered with Faysal Bank to roll out Shariah-compliant POS systems at fuel stations. This enables secure digital transactions for both fuel and non-fuel purchases, improving convenience for customers.

Haball’s PSP and PSO Approval: Fintech startup Haball secured in-principle approval from the State Bank of Pakistan to operate as a Payment Service Provider and Payment System Operator. While not owned by PSO, the development underscores how regulatory support is broadening for digital payments, a tailwind for Payvay.

GoPayFast and Google Pay Tie-ins: GoPayFast, another SBP-licensed fintech, announced integration with Google Pay. Though separate, this signals momentum in Pakistan’s payments infrastructure, an ecosystem within which Payvay must compete and collaborate.

Together, these moves suggest PSO’s fintech push is part of a larger industry shift, embedding state-owned and private players alike into Pakistan’s fast-growing digital payments landscape.

PSO’s Financial Backdrop

Despite diversification efforts, PSO’s core business remains strong. In FY25, the company reported PKR 20.9 billion in profit, up 32 percent from FY24, even as sales volumes slipped 12 percent. In Q4 alone, profits surged to PKR 5.9 billion, more than doubling year-on-year thanks to improved margins and lower finance costs.

Still, PSO faces structural challenges. Its balance sheet is heavily burdened by circular debt, with large receivables tied up in the power and gas sectors. In 2024, PSO even floated a proposal to convert government dues into equity stakes in public-sector energy assets, highlighting the pressure to manage liquidity.

Risks, Challenges and What to Watch

- Regulatory Scrutiny: Fintech is tightly overseen by the State Bank. Any misstep in compliance or consumer data protection could trigger penalties and reputational fallout.

- Competition: With JazzCash, Easypaisa, Nayapay, banks, and new fintech startups dominating the space (like barq from Saudi Arabia), Payvay faces an uphill battle for users and merchants.

- Behavior Change: Convincing customers to shift from entrenched wallets to Payvay will require strong incentives, user trust, and seamless functionality.

- Execution vs Capital: The VC failure proved that money alone does not guarantee success. Payvay’s fate depends on execution, retention, and monetization.

- Merchant Adoption: Expanding beyond PSO’s own stations will be critical. Smaller merchants need clear benefits and easy onboarding to embrace Payvay.

- Revenue Assumptions: Projections of savings via transaction fees or float income remain hypothetical. Adoption rates will determine real impact.

Pakistan’s “Evolving” Fintech Landscape

PSO’s pivot underscores the growing ambition of legacy corporates to tap into digital finance. With unmatched distribution and brand recognition, PSO has a built-in edge that most fintech startups cannot replicate.

Yet the collapse of PSOVC is a reminder that institutional inertia can undermine bold ideas. For Payvay to succeed, PSO will need to act less like a sprawling state-owned giant and more like a nimble tech player.

If executed well, Payvay could become a powerful bridge between fuel stations, everyday merchants, and digital consumers, expanding access to payments in underserved regions. If not, it risks joining a growing list of costly experiments in Pakistan’s turbulent fintech sector.