LendingClub is lending better than its fintech rivals, but isn’t getting the credit.

Fintech stocks are an intriguing play right now. Over the past five years, they’ve endured the pandemic and pandemic-related inflation, the fastest-ever increases in the federal funds rate, the regional banking crisis of 2023, and then the “Liberation Day” global turmoil.

Yet with interest rates now on their way down and the economy seemingly getting back to a “normal” environment, surviving fintech stocks could be big winners.

LendingClub (LC +3.27%) is the oldest and most seasoned of these new-aged lenders, and has in many ways executed better than newer peers through the recent downturns. Nevertheless, its valuation has badly lagged peers such as SoFi Technologies and Upstart Holdings.

On its recent earnings call, in which the company handily beat estimates, CEO Scott Sanborn noted LendingClub will undergo a rebranding soon.

A new brand typically isn’t that important for a stock; but in this case, it could go a long way.

Today’s Change

(3.27%) $0.55

Current Price

$17.39

Key Data Points

Market Cap

$2B

Day’s Range

$16.80 – $17.55

52wk Range

$7.90 – $19.88

Volume

2.1M

Avg Vol

1.7M

Gross Margin

70.89%

Dividend Yield

N/A

Ditching the old name and the old model

On the recent third-quarter conference call with analysts, Sanborn noted that the company is being very deliberate with the rebranding, which should take place in the “middle-ish” of next year:

We built up equity in this brand after almost 20 years. We think a new brand will give us a broader permission set with our customer base, and kind of create new opportunities for us. But we’ve got to make sure we don’t lose the tens of thousands of positive reviews and awards and our conversion rate that we finally honed across all these channels … so lots of work to do.

Why is LendingClub rebranding? A massive discount.

It’s somewhat surprising LendingClub is rebranding, given its high customer satisfaction metrics. Customers rate the company 4.83 stars out of five, according to reviews collected by BazaarVoice, and LendingClub has a very high net promoter score of 81, indicating high customer loyalty.

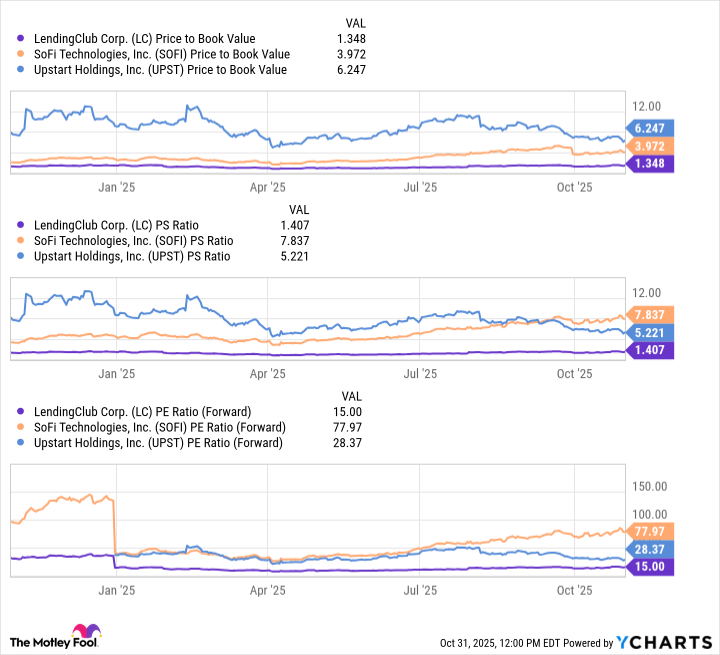

However, LendingClub’s valuation has lagged its main public market peers Sofi and Upstart by a significant amount on price-to-book, forward price-to-earnings, and price-to-sales ratios:

LC Price to Book Value data by YCharts

One might attribute LendingClub’s lower valuation to two things. First, the company’s original model was facilitating loans between personal loan borrowers and retail investors looking for a high-yield investment.

That retail model proved successful but was somewhat risky for a number of reasons. But really since 2016, LendingClub has long since abandoned its retail model and has become highly institutional. Now, LendingClub primarily sells its loans to banks, large asset managers, and starting this year, even directly to insurance companies. On the last earnings call, LendingClub announced BlackRock, the largest asset manager in the world, agreed to purchase up to $1 billion in LendingClub loans through 2026.

The second potential reason for the discount is LendingClub’s lower originations growth versus these peers.

To be sure, LendingClub still posted an impressive 37% originations growth last quarter, primarily in the unsecured personal loan category. Still, that compares with 53% personal loan originations growth for SoFi in the third quarter and 154% personal loan originations growth for Upstart in the most recently reported second quarter.

Yet the valuation gap still seems large, despite the difference in originations growth. Moreover, as anyone aware of banking history knows, not all originations are created equal.

LendingClub’s loans appear of higher quality

While both Sofi’s and Upstart’s personal loan originations growth are higher, LendingClub is seemingly much more efficient at turning each loan into revenue and profits:

|

Company |

Originations Growth (YOY) |

Revenue Growth (YOY) |

Earnings/Contribution Profit Growth (YOY) |

|---|---|---|---|

|

LendingClub |

37% |

32% |

185% |

|

SoFi (lending segment only) |

53% |

25% |

9% |

|

Upstart |

154% |

102% |

110% |

To be fair to SoFi, the above figures are just its lending division. SoFi is more diversified than these other two fintechs, and its financial services segment, mainly in credit cards and brokerage, enabled stronger performance than the personal lending comparisons above.

Still, as one can see, in terms of like-for-like personal loan performance, LendingClub’s originations are yielding better revenue-per-loan and bottom-line performance.

Image source: Getty Images.

Conservatism pays off

The main reason LendingClub has been more efficient at turning originations into revenue and profits is the focus on quality over quantity. According to the company, LendingClub’s underwriting has produced between 37% and 47% lower 30-day delinquencies by month nine of a loan’s duration, compared with its competitive set.

How was that accomplished? As the oldest fintech, LendingClub had the biggest trove of borrower data heading into the trouble of the past five years, and the largest pool of existing customers. Repeat borrowers are much more efficient for fintechs as they are easily reached with an email, as opposed to finding new customers via more expensive direct mail, and they also tend to have better credit. LendingClub’s new LevelUp Savings account also gives borrowers 2% cash back on timely payments, further incentivizing good behavior while growing deposits. During the downturn, LendingClub also chose to largely eschew the lower-income, higher-risk part of the market, and focus on these higher-quality borrowers at the expense of growth.

I had the pleasure of speaking with CFO Drew LaBenne after earnings, who elaborated that LendingClub’s loan performance through the downturn is now leading to better pricing on its loan sales. As one can see, LendingClub’s revenue growth is closer to its originations growth than either SoFi or Upstart, which both appear to be selling more loans at a greater discount.

Furthermore, some other factors may be playing into the superior earnings growth. On the conference call, Sanborn noted LendingClub is selling loans without having to provide “credit enhancements.”

LaBenne elaborated on our call that other competitors in the space are using co-investments or other loss share arrangements. In these types of arrangements, a fintech may guarantee minimum returns and cover the difference if underwriting falls short of a performance threshold. Other competitors may offer discounts on its servicing fees if loan performance falls short. Since LendingClub is selling its loans “cleanly” without these guarantees, that could explain its better bottom-line performance.

Is LendingClub about to start a new chapter?

While SoFi offers more services and technology, and Upstart has emphasized its AI-focused underwriting, LendingClub appears to have exceeded its competitors it terms of borrower selection, underwriting, and understanding borrower and loan buyer incentives.

The company is hosting an Investor Day on Wednesday this week, which the company doesn’t do every year. Expect management to lay out a longer-term vision, and perhaps new business ventures in addition to the core personal loan product.

The longer-term vision may wake the investing public out of its lack of interest in the stock. But if this week’s event doesn’t do it, perhaps the 2026 rebranding will. In any case, LendingClub looks like a much more solid value than its competitive set today.