Perceptions are shifting regarding the US fixed-income market. In September 2019, interest rates on overnight repos unexpectedly spiked, leading the Federal Reserve Bank of New York to inject $75 billion in liquidity. In March 2020, the Covid-19 pandemic triggered a wave of securities selling, prompting the Fed to purchase over $1 trillion in securities. These events have raised concerns about market stability.

In response, regulators have mandated that Treasury and repo transactions be cleared through clearinghouses. However, many participants, such as hedge funds, lack direct access to central counterparties (CCPs) and rely on dealing banks to connect them. Dealers, citing potential costs, have begun to ditch such clients. An intentional yet indirect consequence of these regulatory policies is the reduced participation of hedge funds in this market.

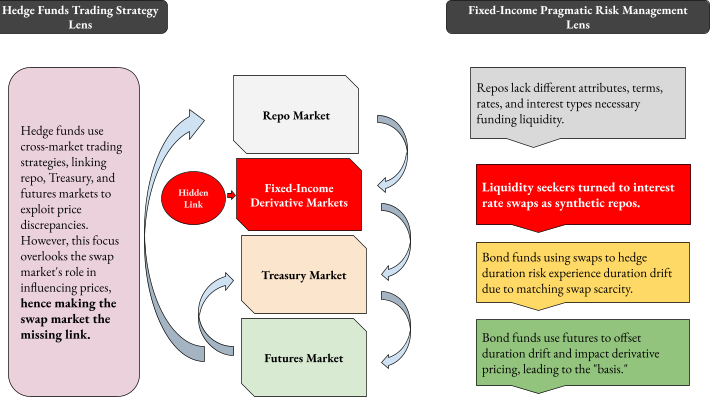

The issue, however, stems from a misdiagnosis of the underlying problem. The prevailing understanding attributes this instability to the behavior of alternative investment funds like hedge funds engaging in “basis trades,” framing liquidity as the key issue in the Treasury market. However, drawing on insights from my interview with seasoned fixed-income portfolio manager Mohsen Fahmi, this piece argues that the market suffers from a different problem altogether: specifically, a chronic inefficiency in the hedging market that could potentially lead to a systemic failure of fixed-income risk management strategies.

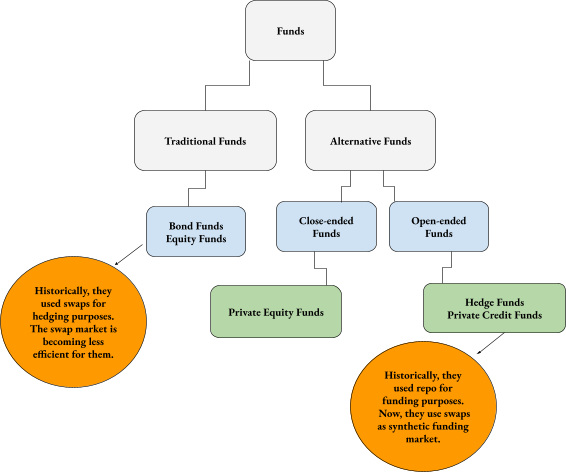

Locating risks hidden in plain sight within pragmatic risk management practices involves broadening our perspective. We need to view investment funds’ business models, including traditional ones like bond funds and alternative ones like hedge funds, as responses to changes in market structures rather than in isolation. This perspective allows us to see these business models as vehicles that transfer inefficiencies and opportunities from one market, such as the derivatives market, to other markets, such as the Treasuries cash market.

Bond mutual funds are some of the largest players in the US Treasury market. For fixed-income fund managers with long-term investments, the Treasury options and interest rate swap markets used to offer contracts with durations matching their portfolios. However, the market for Treasury options is disappearing. Additionally, as an earlier interview with Ralph Axel (the rate strategist at BofA, one of the largest swap dealers) demonstrated, the swap market is also shifting toward catering to different types of clients, particularly those with shorter-term investments.

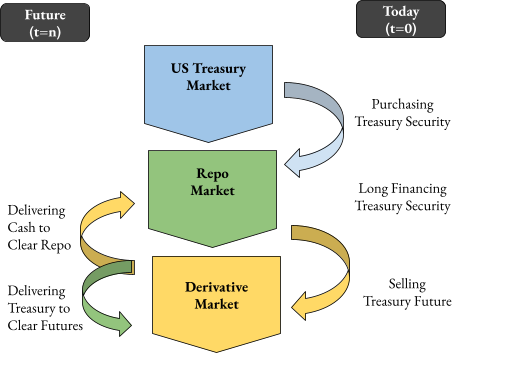

Today, the old demands are rerouted to the Treasury futures market in both cases. Shorter contracts in interest rate swaps and the disappearance of options force fixed-income asset managers to construct their hedging strategies based on futures. This shift generates extra demand for such contracts and increases basis points that hedge funds exploit. However, this behavior of hedge fund managers is just the tip of the iceberg. The larger hazard is shaped by the distortions in the fixed-income derivatives market. Consequently, the solution to stabilize the market lies not in the US Treasury cash market but in its hedging markets.

Instead of focusing on restricting the actions of hedge funds, regulators should learn from risk managers of mutual funds to develop a tool that measures the extent of hedging inefficiencies system-wide. Such a tool can become a new indicator of systemic risks in the fixed-income market. By developing and implementing tools to measure hidden hedging inefficiencies, regulators can gain better insights into creating a more stable and resilient financial system.

How regulators see hedge funds in the Treasury market

The shift in fixed-income fund managers’ portfolios toward US Treasury futures has caused prices to diverge from the related underlying asset, a Treasury security, leading to what is known as “basis.” Normally, policymakers and academics treat such deviations as short-lived phenomena, or sunspots, rather than structural issues. These deviations are expected to be resolved through arbitrage activities, which help the market correct itself, and the prices revert to their baseline and fundamental levels.

However, regulators’ problem with hedge fund arbitrage strategies is that they are orchestrated in a way that siphons liquidity from the market. The key to understanding this hostility towards hedge funds compared to a theoretical arbitrager is “leverage.” Regulators’ adverse view of hedge funds as arbitrageurs stems from their reliance on leveraged funding. Alternative investment funds conduct the arbitrage through “basis trades”—borrowing from the repo market to buy US Treasury securities at a lower price and simultaneously selling US Treasury futures at a higher price.

Regulators at the SEC and the Fed are worried that basis trade strategies are often made possible by low or zero haircuts on repo financing, which could result in liquidity crises. The high leverage utilized by hedge funds implies that if market conditions change suddenly, these funds might be compelled to quickly liquidate their positions, triggering “fire sales” that could destabilize the market. This withdrawal of liquidity by hedge fund arbitrage destabilizes the market rather than helping it return to equilibrium and market-clearing conditions.

Moreover, regulators also point fingers at traditional funds, such as fixed-income asset managers. They argue that these managers have shifted to the futures market due to their increased appetite and leverage, disregarding these funds’ pragmatic risk management considerations. In summary, the behavior of both traditional and alternative fund managers is seen as a key factor in heightened volatility in the US Treasury and repo markets.

However, the problem with this view is that regulators are focusing too much on funds as a self-contained problem rather than as a symptom of a much deeper issue in other segments of the fixed-income market structure. This perspective overlooks underlying structural issues in fixed-income markets, such as changes in the availability and terms of hedging instruments like swaps and options. These changes force fund managers to adopt different strategies, including the increased use of futures, which can inadvertently contribute to market volatility. By not addressing these root causes, regulatory efforts may fail to achieve true financial stability.

Duration drift: a hidden risk in fixed-income risk management

Examining how fund business models interact with market structure, rather than solely focusing on fund behavior, allows us to uncover how these funds’ practical management solutions risk becoming key drivers of instability in the Treasury market. Although Treasury securities are widely regarded as the world’s safest assets, they pose a risk to fixed-income fund managers: their prices move inversely to interest rates.

This risk originates from the evolution of the term structure or yield curve. The term structure represents the relationship between a bond’s term to maturity (when the final and largest payment is made) and its yield to maturity (mostly capturing the bond’s interim, yet smaller, payments). The value of these two sets of cash flows, determining the value of securities, moves inversely to interest rates. This inverse relationship impacts the portfolio’s overall return and necessitates sophisticated hedging solutions to mitigate risks.

For held-to-maturity securities, these risks impact the book value. However, the price risk becomes evident when securities are available-for-sale and fund managers liquidate them before maturity. In such cases, the fixed-income portfolio is exposed to market price and interest rate fluctuations. Interest rate hedging tools like swaps can help mitigate this risk. When the hedging is efficient, the fund’s return can stabilize and become comparable to a fixed benchmark. In fixed-income portfolios, derivatives effectively make the funds risk-free by synthetically aligning the bonds’ duration with the fund manager’s holding period.

The key to effective fixed-income risk management and creating a de facto risk-free asset is identifying derivatives that can synthetically align the fund’s fixed durations with increasingly varying investment periods. Ideally, these derivatives should have the same duration as the fixed-income assets. In the past, the interest rate swaps and options markets were liquid at every maturity, providing fixed-income managers with valuable tools for managing duration risks. As a result, these derivatives were widely popular for this purpose.

Incorporating such derivatives, especially those that match the bonds’ duration, helps establish adjacent points on the yield curve. These points form a vector of differences between portfolio and benchmark exposures that are highly correlated and typically move in opposite directions. This relationship allows fund managers to offset risk positions effectively, ensuring the portfolio’s return remains stable and comparable to a fixed benchmark, thus creating a near-risk-free investment environment.

For instance, if interest rates rise, the difference between the bond portfolio and benchmark returns becomes negative. Simultaneously, the difference between the swaps and benchmark returns turns positive. In an ideal hedge scenario, these opposing movements are equal in magnitude and cancel each other out. Therefore, combining swaps with bonds can help mitigate exposure to term structure risks, stabilizing the portfolio’s overall performance.

When the durations do not align—when the maturity of an underlying asset does not match the hedging instrument—the small period of time left out of the contract generates a hedge risk. For instance, a mismatch occurs when an interest rate swap that hedges a 10-year Treasury security matures in 8 years. This mismatch especially exposes bonds with longer terms to maturity.

Traditionally, the swap and option markets could offer near-perfect matches for most points on the yield curve, ensuring effective risk management. Recently, however, the size of the Treasury options market has been shrinking. It has also become more challenging for risk managers to find swaps that precisely match the maturity dates of their funds’ underlying assets. This phenomenon, known as “duration drift,” poses a significant challenge to effective risk management.

The unhedged portion of the funds’ duration can lead to a loss of value as interest rates fluctuate, and to the failure of the overall hedging process. When hedging methods like swaps or options result in duration drift, risk managers assess the extent of these drifts to devise additional strategies rather than leaving them unaddressed. Treasury futures, in particular, offer a cost-effective alternative to swaps for duration hedging.

Understanding and managing duration drifts is crucial for comprehending why fixed-income risk managers have increased their demand for Treasury futures. However, this nuanced aspect of pragmatic risk management often becomes a mere footnote in financial statements and hedge accounting conventions. This oversight is concerning because small losses from hedging inefficiencies in individual funds can become systematic if duration drift is widespread in the fixed-income market.

Effective regulation should prioritize the systemic implications of duration drift. Recognizing and addressing the causes and effects of duration drift can lead to more robust financial regulations. In such a market structure, focusing on less structural issues, such as hedge funds’ basis trading strategies, would only distract regulators from achieving the financial stability goals.

Hedge accounting: the art of hiding inefficient risk management

Just as the derivatives crises of the mid-1990s emerged as a result of inadequate reporting rules, duration drifts characteristic of contemporary swap markets can pose systemic risks given bookkeeping standards. The most critical flaw at the heart of swap accounting is precisely concerned with short-term, “ineffective” hedges like those constituting duration drift. In the past, these small hedges were generally ignored by accountants. While some recent reforms do aim at making hedge ineffectiveness more apparent in the financial statements, these measures have not been fully successful.

Hedge ineffectiveness due to underhedging the floating-loan cash flow can go unreported as it is not a realized loss yet. Hedge accounting means that gains and losses on exposures and effective hedges of those exposures are recognized in net income in the same periods. As the swap cash flow will not affect or change the cash flow of the underlying asset, and the liquidity issues arising from the inefficient hedge have not materialized yet, the accounting of the swap can conform to the accounting for the hedged item. The swap does not need to do so if the hedged item is not marked to market daily for accounting purposes.

Similarly, for overhedging, a swap’s fair value is reported on the balance sheet and income statement. Thus, the very notion that the fair value of the swap implies hedge ineffectiveness need not be reported as a separate line in either statement.

Accountants may hide the risks, but the risk managers must face them. The challenge lies in finding practical risk management solutions to address the unresolved risks. This is because certain areas of exposure may still need further hedging while others are already over-hedged.

Policy implications

Pragmatic risk management considerations provide a different perspective on Treasury market vulnerabilities than basis trading. In November, our interview with Bank of America strategist Ralph Axel revealed a significant shift in the swap market structure. Rather than being used as a hedge, swaps are now largely used to provide synthetic short-term funding. Whereas portfolio managers used to constitute the biggest clients of swap dealers, a new wave of clients, especially alternative investment funds such as open-ended funds, is turning to swap markets for access to funding.

The shift in swaps from hedging to funding has already started to show cracks in the system. Historically, traditional bond funds used swaps for hedging purposes, while alternative investment funds relied on the repo market for funding. As the efficiency of the repo market declined, alternative asset managers began turning to synthetic and indirect funding instruments such as swaps. This shift has disrupted the market structure for more traditional funds, introducing inefficiencies and distortions in their hedging strategies.

This shift in the function of the swap has impacted swap durations. A swap for funding involves applying the interest rate swap to a portion of the debt rather than the entire amount. This is known as a partial hedge and involves very short-term durations. As a result, swap markets for longer-term maturity, popular amongst fixed-income risk managers, are no longer liquid, and portfolio managers cannot enter the exact contract they seek. Instead, the contracts offered in the swap market are either just below or just above the desired length—in line with the needs of closed- and open-ended alternative funds.

Bond fund managers are adapting to changes in the swap market structure by turning to other derivatives, such as futures. This recent shift has caused price pressure on these derivatives. Additionally, since these strategies are classified as partial hedges, they remain unreported under hedge accounting conventions. This allows managers to avoid showing unnecessary volatilities in profit or loss due to changes in the hedging instrument’s fair value. However, from a financial stability perspective, this accounting convention creates an information gap and hides risks in financial markets, such as those caused by duration drift.

Measuring the extent of duration drift can effectively estimate hidden vulnerabilities in the Treasury market. It can also explain the additional price pressure on futures contracts and the motivation behind basis trading. Without capable valuation models and accounting conventions to capture these risks, regulators should introduce new tools that can display and estimate duration drift. Such tools would be more effective in stabilizing the Treasury market than imposing restrictions on private investment funds.

This is especially critical given the new wave of regulatory pressure. For instance, the Securities and Exchange Commission (SEC) has recently implemented new rules requiring most US Treasury transactions to be cleared by the end of 2025, even though the Fixed Income Clearing Corporation (FICC) is currently the sole clearinghouse for US Treasury securities and repos.

Restructuring the Treasuries market to rely on one central counterparty for handling the entire market could lead to significant systemic risks beyond the usual concentration risks associated with CCPs. While concentration risk may be manageable if the underlying risks are well understood, unresolved fixed-income risk management issues and duration drift could create a blind spot, exacerbating potential concentration risk in CCPs. This presents concerns about not only the concentration of known risks but also hidden risks like duration drift in CCPs that may not be apparent to regulators.

Risk managers of large fixed-income funds, such as bond and pension funds, closely monitor duration drift and its potential impact. Regulators should learn from these practices to develop a tool that measures the extent of duration drift system-wide as a new indicator of systemic risks in the fixed-income market. By developing and implementing tools to measure duration drift, regulators can gain better insights into the market’s underlying risks and proactively address them. This approach will help ensure a more stable and resilient financial system capable of effectively managing known and hidden risks.