Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One scoop to start: Segantii Capital Management has told investors it will hand back their money, weeks after Hong Kong authorities announced a criminal insider dealing case against the hedge fund and its founder Simon Sadler.

And one big interview: A Donald Trump victory in the US presidential election would be “more bearish” and “disruptive” for the bond markets than the re-election of Joe Biden, according to Bill Gross, the longtime fixed-income investor.

In today’s newsletter:

-

New leadership at beleaguered Abrdn

-

The commodities comeback kid

-

Hedge funds hit by lack of private equity exits

Stephen Bird steps down as Abrdn chief executive

It’s been a turbulent flight for Abrdn’s chief executive Stephen Bird, who is fleeing the nest after less than four years at the troubled FTSE 250 asset manager.

Bird inherited a problematic business when he landed in 2020, writes Emma Dunkley in London. It had not long been created from a merger between the pensions-focused business Standard Life and the more gung-ho asset manager Aberdeen, itself the result of years of patchwork acquisitions by deal junkie Martin Gilbert.

Bird has taken some big decisions, notably the acquisition of the UK’s second-largest consumer investment platform, Interactive Investor, for £1.5bn. But his legacy will be both tainted by and synonymous with the 2021 decision to remove the vowels from the company’s name.

The corporate rebrand led to much ridicule and a backlash that the company’s chief investment officer recently described as “corporate bullying”.

All of this distracted from Abrdn’s downward trajectory. In an attempt to curtail this, Bird took a knife to the business, merging or closing funds, culling jobs and slashing employee benefits.

Granted, this period has coincided with broader industry pressures. Abrdn is not alone among its UK-listed rivals grappling with successive quarters of outflows from actively managed funds, poor performance and mounting costs. (Here’s looking at you, Jupiter, Liontrust).

Analysts at Citi said they believe Bird’s departure “may be due to differences in strategic vision” between him and Abrdn’s board, led by chair Douglas Flint.

Speculation was rife last year that Bird sought to sell off its asset management business — the lion’s share of the company’s assets — although both he and Abrdn have denied this. Now the asset manager, whose shares are down by almost a third during Bird’s tenure, could be an acquisition target or even broken up.

The firm’s relatively new chief financial officer Jason Windsor — a former M&A banker — will temporarily take the helm.

Top of the new chief executive’s agenda might be hiring former Countdown presenter Carol Vorderman as a consultant. “Another vowel please, Carol.”

Meanwhile don’t miss this definitive deep dive from March into Abrdn’s decline by Emma and Sally Hickey.

Copper price to rocket to $40,000 a tonne, says top trader Andurand

When mining company BHP made a bid for rival Anglo American last month, it was seen as a play on the future of copper. The shiny red metal is a crucial component in electric vehicles, solar panels and wind farms, and a deal would give BHP control over Anglo’s lucrative copper mines in Chile and Peru.

Now, one of the world’s best known commodities hedge fund managers tells my colleague Costas Mourselas that the price of copper could almost quadruple to $40,000 a tonne in the next four years.

“We are moving towards a doubling of demand growth for copper due to the electrification of the world,” says Pierre Andurand, chief investment officer of Andurand Capital Management, arguing that supply will struggle to keep up with the voracious demand that comes with a global transition away from fossil fuels.

“I think we could end up to $40,000 per tonne over the next four years or so. I’m not saying it will stay there then; eventually we will get a supply response, but that supply response will take more than five years.”

The mining industry estimates that it typically takes around 15 years to develop a new mine, and Andurand doesn’t think that digging deeper and faster in existing mines will be enough.

Andurand climbed the ranks at Goldman Sachs and then at oil trader Vitol before launching his own fund at the age of 30. His volatile performance has earned him a reputation as something of a comeback kid. And indeed he hasn’t been right on all of his big calls. Last year, his Commodities Discretionary Enhanced fund suffered a 55 per cent loss as bullish oil wagers backfired.

“I think we all lost a lot of money, expecting supply disruption that did not happen,” he said. “You remember that pain.”

But he has since recovered most of those losses. His best-known fund, which runs $1.3bn, is up 83 per cent this year, according to investors. One of the bullish bets that got him there was on soaring copper prices, which are up more than 20 per cent.

Chart of the week

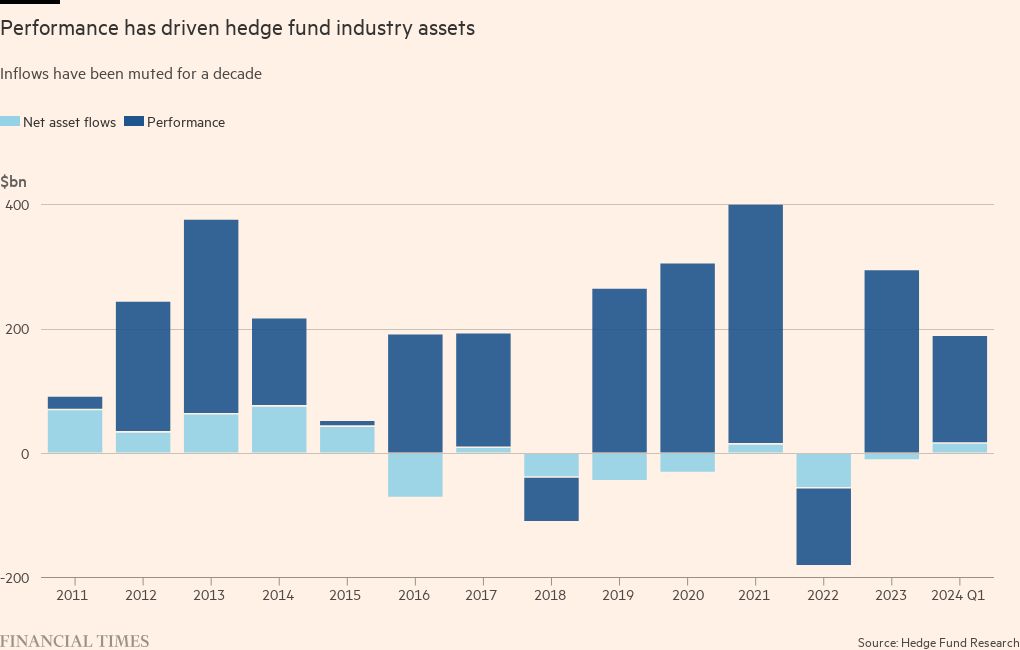

Inflows to hedge funds have been muted for the past decade, with investors pulling cash on a net basis in five years out of the last 10, according to Hedge Fund Research. Performance, rather than inflows, has driven most of the industry’s growth.

One phenomenon that’s driving this? Private equity’s struggle to return money to clients is hitting hedge funds, which rely on the same pension plans, foundations and endowments for fundraising, as Will Louch, Costas Mourselas and I explore in this article.

Hedge funds seeking to raise money from institutional investors are being rebuffed on the grounds that the institutions lack the cash to give them. The difficulty is at least in part due to a slowdown in distributions that investors have received from private equity funds.

“The lower rate of distributions from private equity, [private] debt and venture funds is having a knock-on effect, leading some allocators to pause on new investments into illiquid funds and reduce new investments in more liquid hedge funds,” said Michael Monforth, global head of capital advisory at JPMorgan Chase.

Buyout-backed exits fell to $345bn last year — their lowest level in a decade — leaving the private equity industry sitting on a record backlog of 28,000 companies worth more than $3tn, according to Bain & Co.

“Private equity distributions have gone down, the IPO market has been very thin and M&A has been held back,” said Nick Moakes, chief investment officer of the £36.8bn Wellcome Trust. “If you’re not going to get bought and can’t get listed, PE is scratching its head on how to do distributions.”

Hedge funds and private equity managers are often in direct competition for capital. “For the vast majority of institutions, private equity and hedge funds come out of the alternatives bucket,” said Sunaina Sinha Haldea, head of private capital advisory at wealth manager Raymond James.

“The lack of distributions out of private markets portfolio is going to impact the ability to make new commitments in other parts of the alternatives portfolio . . . that includes hedge funds.”

Five unmissable stories this week

Gabrielle Rubenstein, whose billionaire father David Rubenstein co-founded private equity group Carlyle, is at the centre of a governance dispute at the $80bn Alaska Permanent Fund Corporation, prompting a staff revolt, a political backlash and accusations of undue influence.

UK investment site Hargreaves Lansdown rejected a £4.67bn takeover approach from a group of private equity firms, including CVC Capital Partners and a subsidiary of Abu Dhabi’s sovereign wealth fund. Wealth managers are now firmly in private equity’s sights.

Capital Group, the world’s largest active asset manager, is combining forces with private equity giant KKR to offer hybrid public-private investment funds to wealthy individuals, in a move that seeks to open up the fast growing alternative sector to a wider range of investors.

Bridgewater Associates founder Ray Dalio’s family office has bought two multimillion-dollar “shophouses” in Singapore, as billionaires snap up the heritage properties in the city-state. The Dalio Family Office is also expanding in Abu Dhabi.

Oaktree Capital has moved to seize control of Inter Milan after the football club’s Chinese owners Suning failed to repay a €400mn loan in time. The move thrusts the $192bn investing powerhouse into owning one of the world’s most famous clubs.

And finally

At the V&A in South Kensington, a new exhibition of photographs from the collection of Sir Elton John and David Furnish is a race through well-known images from some of the most important names in modern and contemporary photography, among them Diane Arbus, Robert Mapplethorpe, Juergen Teller.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com