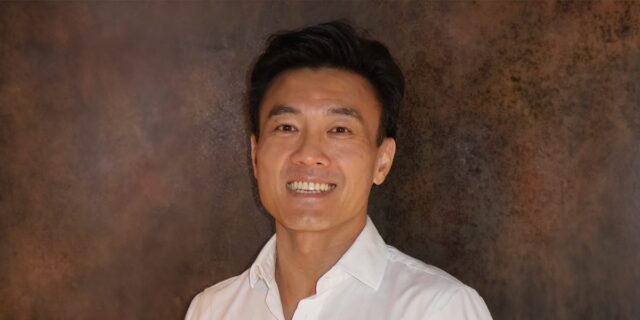

Some of the world’s biggest hedge fund investors are backing former Millennium executive Jonathan Xiong’s new Arrowpoint Investment Partners.

The Asia-based multistrategy fund is launching with $1 billion and has secured big-name allocators, including Blackstone, Canada’s largest pension, and Singapore’s sovereign wealth fund Temasek.

The new fund, which began trading Monday with more than 15 portfolio managers working from offices in Singapore and Hong Kong, is entering a crowded space. Globally, the biggest multistrategy managers like Citadel and Xiong’s old firm Millennium continue to crowd out smaller competitors by poaching talent and hoovering up assets. Locally, the Asian hedge fund market has newcomers entering the fray and longtime players beefing up their rosters.

“This increased demand for talent has led to higher competition amongst funds. There are not that many experienced buy-side investing professionals,” Arun Singhal, a former Millennium portfolio manager in Singapore who now runs a crypto-focused investment firm, told Business Insider earlier this year.

Arrowpoint believes its top-down portfolio construction and thought-out infrastructure will set it apart from competitors, a person close to the manager told BI.

This person said the firm will manage its trading teams — which from the start will run strategies such as fundamental equities, quant, fixed income, and commodities — as components of an overall portfolio, not as individual businesses. The focus for PMs will be making money when their strategy is in favor, and protecting the downside when it’s not, and the firm’s management takes into account how macro factors and market cycles affect different strategies when evaluating their performance.

The firm’s infrastructure, similar to that of Bobby Jain’s new fund, which also launched Monday, was built with every asset class in mind.

Arrowpoint was built as a multistrategy firm from the start, allowing the manager to improve its operating leverage — thanks to the way its technology and systems are structured — as the firm scales, the person close to the firm said. The goal was to have “operations across all asset classes from the start,” the person said.

Older multistrategy funds that have added on different asset classes and systems as they expanded can get bogged down by the cost and maintenance of the additions. As Jain Global COO Jonathan Barton explained to BI, it can work — “it just requires a lot of people,” which increases costs.

With $1 billion in assets to start, Arrowpoint is already a significant player in the Asian hedge fund scene and will continue to grow. The current plan, the person said, is to cap assets around $4 to $5 billion.

There are also two new offices opening soon in the region, the person said, subject to regulators and agreements with personnel additions.