Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One philatelic memo to start: Investor Bill Gross, once known as the “bond king”, is aiming to set a different investment record this week when the highlights of his rare stamp collection go on sale at the Robert A Siegel auction house in New York. Pre-sale estimates suggest the sale could bring $15mn to $20mn and set a record for a US stamp collection.

And one eccentric proposal: Julia Hoggett, chief executive of the London Stock Exchange, wants to erect a screen outside its Square Mile headquarters to showcase the market’s success stories and combat pessimism over its future.

In today’s newsletter:

-

Hedge fund short sellers burnt by flurry of UK takeover bids

-

Investors pull cash from ESG funds as performance lags

-

Bets against European government bonds surge to two-year high

Flurry of UK takeover bids hits hedge funds

Takeover bids are something of an occupational hazard if you’re a short seller. But this year they’ve had to contend with more than most.

Knockdown share prices in UK companies are piquing the interest of these groups’ foreign rivals or private equity buyers, making it a risky business to bet on share price declines.

Millennium Management, GLG Partners and Gladstone Capital Management are among funds to have been caught out in recent weeks as stocks such as fund supermarket Hargreaves Lansdown, cyber security provider Darktrace and video game services company Keywords Studios soared after attracting offers.

“Shorting any UK mid-cap is insane, literally insane,” said one hedge fund executive who specialises in shorting stocks.

M&A involving a UK target is 84 per cent higher this year than it was during the same period in 2023, according to data from London Stock Exchange Group, based on value of deals. “The UK public-to-private market is especially busy right now,” said Stefan Arnold-Soulby, partner at law firm Paul Weiss.

Millennium, Kintbury Capital and the Canada Pension Plan Investment Board were among the funds shorting Hargreaves Lansdown — behind only BT Group and Abrdn in the dubious honour of being the most shorted UK stocks — when it announced on May 23 it had rejected a £4.67bn bid by a group of private equity firms. Curiously, Hargreaves’s share price had risen 20 per cent in the two weeks before the rejection.

Some managers said they were spreading their short positions across a wider range of UK stocks in order to reduce the damage if one of their short targets received a takeover offer. “Either you cut the short or make it smaller,” said a long-short hedge fund manager who is taking smaller bets with new positions. “It’s all about sizing and controlling [the risk].”

ESG hype passes

Investors have flocked to environmental, social and governance (ESG) equity funds in recent years, lured by the claim that they could do well by doing good.

But enthusiasm is waning for the much-hyped sector that has pulled in trillions of dollars of assets, write Patrick Temple-West and Will Schmitt in New York.

BlackRock’s Larry Fink last year said he did not use the term ESG any more “because it’s been entirely weaponised”.

And now clients have withdrawn a net $40bn from ESG equity funds this year, according to Barclays, the first year that flows have trended negative. Redemptions, which include a record monthly net outflow of about $14bn in April, have been widespread across all main regions — including Europe, the strategy’s traditional stronghold.

The change in sentiment towards sustainability-focused stock funds reflects poor performance, scandals (like the greenwashing probe at Germany’s DWS) and attacks from US Republicans, who have dubbed ESG “radical partisan activism masquerading as responsible corporate governance”.

Pierre-Yves Gauthier, head of strategy and co-founder at AlphaValue, a Paris-based independent research company, compared the sector to the tech bubble that burst in 2000. “ESG was a dotcom sort of hype 20 years later and now it has passed,” he said.

Although the ESG label might increasingly fall out of use, underlying social and environmental challenges will remain, says Todd Cort, a professor at the Yale School of Management, who specialises in sustainable investing.

“Behind the curtain, there will be substantially more effort by investors to understand environmental and social risks,” he said. “That will continue to grow, and I actually don’t care too much if we continue to call it ESG.”

Chart of the week

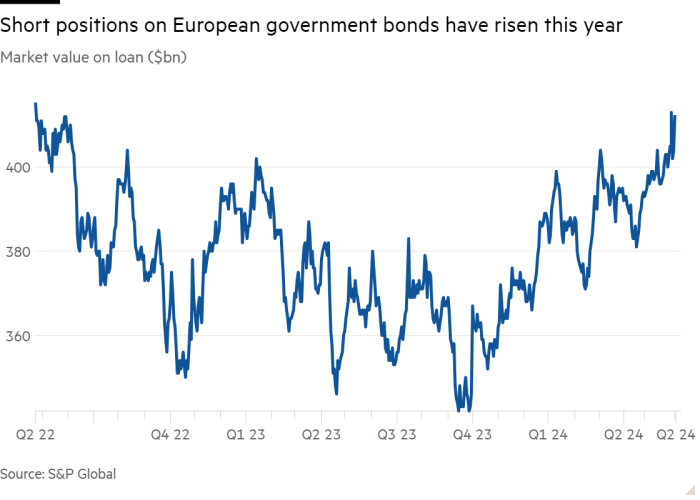

Hedge funds have amassed their biggest bets against Eurozone government bonds in more than two years, in expectation that the European Central Bank will have limited room to cut interest rates further this year, writes Mary McDougall in London.

The total value of bets against European government bonds hit $413bn this week, according to data from S&P Global Market Intelligence, as measured by bonds out on loan. That was up 8 per cent since January and the highest level since April 2022.

The rise in bets came ahead of the ECB delivering a well signalled 0.25 percentage point interest rate cut from a historic high of 4 per cent on Thursday.

But it also raised its inflation and growth forecasts for the rest of the year and removed an explicit easing bias from its monetary policy statement.

“The big picture here is that inflation numbers had been coming down but had a nasty uptick,” said Robert Tipp, head of global bonds at PGIM Fixed Income. “In my opinion they made the mistake of signalling and boxing themselves into a cut even though the data was suggesting they should have held up.”

Five unmissable stories this week

US-based activist Elliott Management has rebuilt a substantial stake worth more than $2bn in SoftBank and is pushing the Japanese tech conglomerate founded by Masayoshi Son to launch a $15bn share buyback.

Bill Ackman has sold a 10 per cent stake in Pershing Square to investors including San Francisco-based Iconiq Capital and Israeli insurance company Menora Mivtachim, in a deal that values the hedge fund at just over $10bn ahead of a possible initial public offering.

Shein is seeking to list on the London Stock Exchange in a possible boost for the City. But UK fund managers have warned that investors will “struggle to support” the flotation over concerns about the online fashion company’s alleged treatment of workers.

A US appeals court has thrown out far-reaching new rules from the US Securities and Exchange Commission that would have forced private equity and hedge funds to be more transparent and change the way they treat their customers.

The artificial intelligence arms race in asset management is shifting from paperwork-intensive compliance and marketing tasks towards guiding investment decisions, tracking the habits of portfolio managers and identifying money-making opportunities.

And finally

The annual showhouse exhibit, WOW!house, at London’s Design Centre, Chelsea Harbour, assigns a series of rooms to interior designers who are given free rein to let their imaginations run wild. My favourite is the Watts 1874 Legend Room by Alidad, a collaboration inspired by Eastnor Castle, the Gothic revival pile in Herefordshire. Behind the sofa is the Trastamara cork wallpaper, inspired by a Japonaiserie screen in the Great Hall, a sneak peek at the Watts X Eastnor collaboration of fabrics and wallpapers, launching soon.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com