(Bloomberg) — Australia’s sovereign wealth fund has called time on using government bonds to diversify equity exposure and instead favors hedge funds to balance risk in its A$223 billion ($149 billion) portfolio.

The Future Fund will look to equity market-neutral and systematic macro strategies offered by hedge funds after declaring “the era of using government bonds to diversify equity-related risk is over,” in a position paper released Friday.

The shift is the result of the fund’s view that rocky geopolitics will reorder global trade, leading to higher inflation, interest rates and volatility and a stronger correlation between stocks and bonds.

“So in that environment, government bonds or duration is just a less reliable diversifier,” Future Fund Chief Investment Officer Ben Samild said in an interview. “There are different hedge fund strategies that we can own that have historically performed very well, particularly in times of quickly changing inflation.”

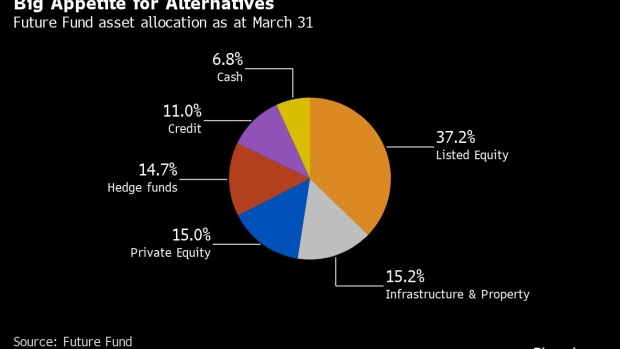

In addition to macro and market-neutral strategies, the fund will consider commodity-focused funds, volatility investing and trend-following portfolios to diversify risk, Samild said. Equities make up 37.2% of its assets, according to first-quarter data.

The fund is a big proponent of alternative assets. Hedge funds have typically accounted for between 10% and 20% of its portfolio, according to Samild. Hedge funds, private equity, venture capital, unlisted infrastructure and property together made up more than 40% as of March.

The fund outsources billions of dollars to some of the world’s largest alternative asset managers including Man Group, Citadel, Blackstone Inc. and Brookfield Corp., data released earlier this year showed.

“We have a very large hedge fund portfolio that is pretty well established,” Samild said. He doesn’t anticipate a significant increase in the hedge funds that help steward the allocation. “We like to be strong partners and don’t churn through. That is one of the reasons we think we have a comparative advantage in getting access to high-quality managers,” he said.

Future Fund anticipates a further shift in global trade dynamics, marked by governments championing “economic resilience” instead of the focus on cost efficiency that has marked the past 30 years. This will bring supply chains closer to home countries and support domestic manufacturing in high-tech areas such as semiconductors, according to the fund.

“We’ve gone from a world where there was an assumption that there were ever-lower barriers and frictions to international trade,” Samild said. “We’ve always thought one needs to be a little cautious about that assumption and now we think you need to be even more cautious.”

The increased risk of conflict, and the potential for sudden sanctions akin to those imposed on Russia following its invasion of Ukraine, have led the fund to rethink its geographic diversification in favor of investments at home.

“There’s always been a bit of a bias to own domestic assets,” he said. “We have a domestic inflation mandate so it is the cleanest thing for us to hold from a portfolio construction perspective.”

The fund also said it aims to own assets that perform well during inflationary periods, as well as those that will benefit from the transition away from fossil fuels.

©2024 Bloomberg L.P.