Equity savings funds, a category within hybrid mutual funds in India, serve as a tax-efficient investment avenue for investors seeking moderate returns with limited risk exposure. These funds aim to deliver better returns than traditional fixed-income instruments while minimising the impact of equity market volatility.

Funds in this category typically invest about 30–35 per cent each in equities, arbitrage strategies, and debt instruments. By maintaining more than 65 per cent exposure to equity (including arbitrage positions), these funds qualify for favourable equity taxation norms.

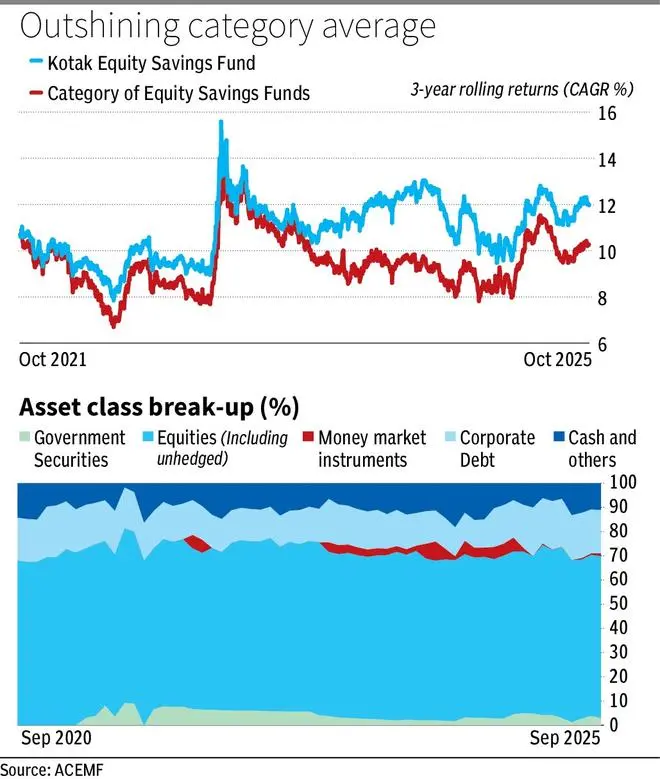

Kotak Equity Savings Fund (KESF) stands out as one of the better performers in this segment. The fund focuses on stability by investing majorly in large-cap equities and high-quality debt securities. Over the past seven years, it has delivered a compounded annual growth rate (CAGR) of 10.4 per cent.

In-house asset allocation model

KESF’s equity exposure can range from 10 per cent on the net equity side to 50 per cent, while maintaining an overall minimum of 65 per cent in equity and equity arbitrage as per SEBI regulations. The extent of directional equity exposure is determined through an internally developed model, similar to the one used for the Kotak Balanced Advantage Fund. This model dynamically adjusts the net equity level based on various market indicators. Historically, the average net equity exposure in the portfolio has been around 30–32 per cent, though it has increased to 46–47 per cent during periods such as the Covid-19 market correction.

The model considers multiple parameters such as Nifty earnings, market momentum, valuation indicators (including price-to-earnings and price-to-book ratios), earnings yield, and interest rate factors like government securities (G-Sec) and treasury bill yields. The objective is to optimise risk-adjusted returns while remaining responsive to both macroeconomic trends and technical momentum signals.

Equity strategy

The arbitrage portion of the portfolio carries no stock-specific risk, as it involves buying in the cash market and selling simultaneously in the futures market to lock in spreads. Stock selection in this segment is purely driven by available arbitrage opportunities, not by company fundamentals or governance considerations.

In contrast, the equity portion follows a disciplined stock-selection process guided by Kotak mutual fund’s proprietary BMV (Business Management Valuation) framework. The in-house research team tracks around 500 companies, covering nearly 90 per cent of India’s market capitalisation. The fund combines both top-down and bottom-up approaches, taking sectoral views based on macroeconomic outlooks and identifying stock-specific opportunities within those sectors.

The equity portfolio is managed in a flexi-cap manner with a strong large-cap bias — typically over 70 per cent of net equity allocation to large-cap companies — along with selective exposure to mid- and small-caps. The fund currently maintains sectoral overweights in consumer services, auto and auto ancillary, telecom, power, and FMCG.

Accrual debt strategy

On the debt side, the fund avoids duration calls, keeping the portfolio’s Macaulay duration low — typically between less than a month and 2.4 years over the past three years — to minimise interest-rate risk.

Over this period, the allocation to government securities has ranged from 1 to 6 per cent, mainly for liquidity purposes. Allocation to corporate bonds has increased to around 12 per cent in recent months, with major exposure to issuers such as Kotak Mahindra Investments, Mankind Pharma, and Mahindra & Mahindra Financial Services.

Credit quality remains high, restricted to sovereign and AAA-rated instruments. However, in recent months, a 1.5 per cent allocation has been made to AA+ rated Mankind Pharma. The fund also holds close to 1 per cent in Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

Performance

Performance, as measured by three-year rolling returns over the past seven years, shows that the fund delivered an average annual return of 10.9 per cent, outperforming the category average of 9.5 per cent. During this period, its three-year returns have ranged between 7.8 per cent and 15.6 per cent.

The regular plan has an expense ratio of 1.76 per cent, slightly higher than the category average of 1.71 per cent, while the direct plan is at 0.66 per cent, marginally lower than the category average of 0.69 per cent.

This fund is suitable for cautious investors seeking lower drawdowns, and those looking to park surplus funds for two to four years while benefiting from equity taxation.

Published on October 25, 2025