Hedge funds and algorithmic traders, on the other hand, use sophisticated techniques and strategies to earn profits on nearly every trade.

The reason for the growth of India’s options market is a heady cocktail combining the ‘gamification’ of stock trading, the rise of a young cohort of online traders unaware of the complexities of options trading, easy access to the stock market, and the growing popularity of discount broking apps like Groww and Zerodha.

Add to this the profusion of finfluencers drumming up a follow-the-leader approach that’s pushing young traders to losses more often than profits, and you have what a former chief of India’s markets regulator called a “dangerous mix” that could undo the gains India has seen in its investment culture in the recent past.

Options are financial instruments derived from the value of other underlying financial instruments such as stocks, indices, commodities, and currencies. Because they are derived from other instruments, they form a part of what is called the derivatives market.

Futures are another kind of stock market derivative instrument.

Put simply, traders can purchase the ‘option’ to buy one of these financial instruments at a predetermined price on a set future date. This predetermined price is called the strike price, and the set date is called the expiry. Traders also pay a premium to the seller for the right to that option. Finally, they also pay a brokerage fee to the brokers who process their transactions.

For most full-service brokers — who also provide investment guidance — brokerage fee is a percentage of the value of the trade. So, the larger the options contract being bought, the higher their fees.

Discount brokers such as Groww, Zerodha and Upstox, on the other hand, charge a flat rate per transaction.

Also Read: How do you spot a fake ‘finfluencer’? Red flags include penny stocks, get-rich-quick schemes

India is an options trading behemoth

The Futures Industry Association maintains an updated database of the derivatives market across the world, in every exchange and the data collected by it is eye-opening, to say the least.

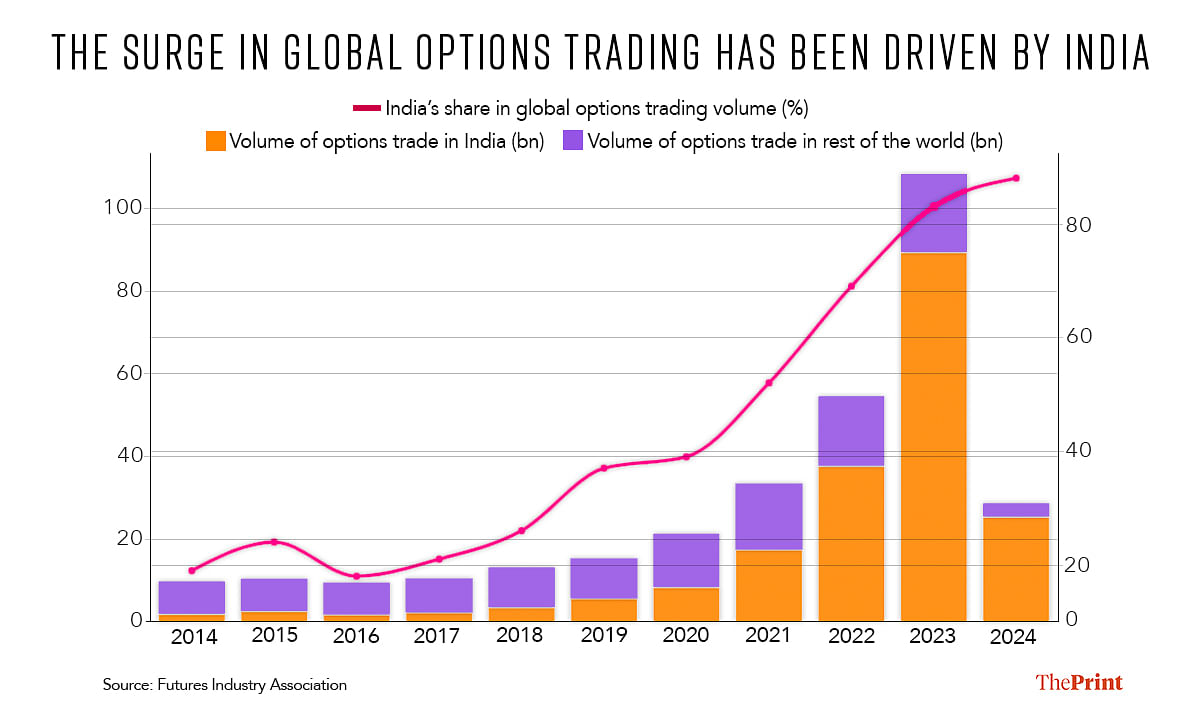

So far in 2024, 28.6 billion options contracts have been traded, of which 25.3 billion or about 88 percent were traded in India. The story was similar in 2023, when India accounted for 83 percent of the total global options trade by volume.

This shows that what happens in India drives the global options market. For example, in the pre-pandemic year 2019, India saw only 5.6 billion options trades, or only about 37 percent of the global total.

But, as the pandemic progressed and stock market interest in India grew, so did India’s options trading volume, which single-handedly boosted global trade volumes to more than seven times what they were before COVID-19.

Brokerages & hedge funds are raking it in

According to ICRA, the fee that brokers can earn when it comes to options trading is closely linked to the number of contracts traded. So, with the gigantic increase in the number of options contracts traded, brokerage income from the segment also saw remarkable growth.

According to research by ICICI Securities, revenue earned from brokerage fees makes up the overwhelming majority of the total revenue earned by brokerages. For Angel One, for example, brokerage fees made up about 68 percent of its revenues. For discount broking apps like Groww and Zerodha, this number is as high as 87 percent and 83 percent, respectively.

What this has meant is that, as the volume of options trading in India has surged, so has the income earned from the brokerage on these transactions, leading to a jump in overall revenues.

“The aggregate net operating income of the brokerage industry is expected to grow by 18-22 percent in FY2024, following the 13 percent increase in FY2023 and the record growth of 37 percent in FY2022,” ICRA said in its report. “Growth in FY2023 was primarily driven by a few leading discount brokers with a dominant presence in the futures & options segment.”

It added that the aggregate net profit of the brokerage industry is expected to register a “new high” in the current fiscal with the increase of 22-25 percent after remaining flat in FY2023.

According to new reports, Groww saw its total revenue jump a whopping 252 percent in 2022-23 to Rs 1,294 crore. Its net profit jumped a staggering 973 percent to Rs 73 crore. Zerodha, meanwhile, reportedly saw a 37 percent increase in its net profit to Rs 2,908.9 crore in 2022-23.

The growth in India’s market has garnered the attention of international brokerages as well, with Reuters reporting last October that hedge funds Dymon Asia Capital and Citadel Securities were increasing their presence in India.

In August last year, Chauwei Yak, CEO and CIO of Gao Capital, a Singapore-headquartered international asset management company, said the company had “built research and trading infrastructure to expand to new markets — Japan and India”.

The profitability of the options market in India has even led to an intense court case in the US.

Hedge fund Jane Street in April 2024 sued its competitor Millennium Management and two of its employees for the alleged theft of a confidential trading strategy relating to India’s options market. During the court proceedings, it came to light that the strategy had earned Jane Street $1 billion in 2023.

“What is happening is that many youngsters are taking to options trading in the same way as gambling, it is nothing else,” Ajay Bodke, an independent market analyst, said. “They go into it with hardly any knowledge of how options trading works. So they get slaughtered in the market by seasoned traders who understand what ratios to look at, and who rely on sophisticated techniques like algorithmic trading and use it to make informed decisions.”

The rise of discount broking

Another factor that has significantly encouraged this gamification of options trading is the rise of discount brokers apps like Zerodha, Groww, and Angel One.

A discount broker charges lower commissions than a full-service broker. Brokerage fees charged by discount brokers is not a percentage of the trading turnover, as is charged by full-service brokers, but a flat brokerage fee per order. Zerodha and Groww, for example, charge a flat Rs 20 on all option trades, according to their respective websites.

“Discount brokers, by virtue of their user-friendly interface and low brokerage cost, have benefitted from the sizable participation of young investors with an inclination towards trading in options,” ICRA said in a report released in January this year.

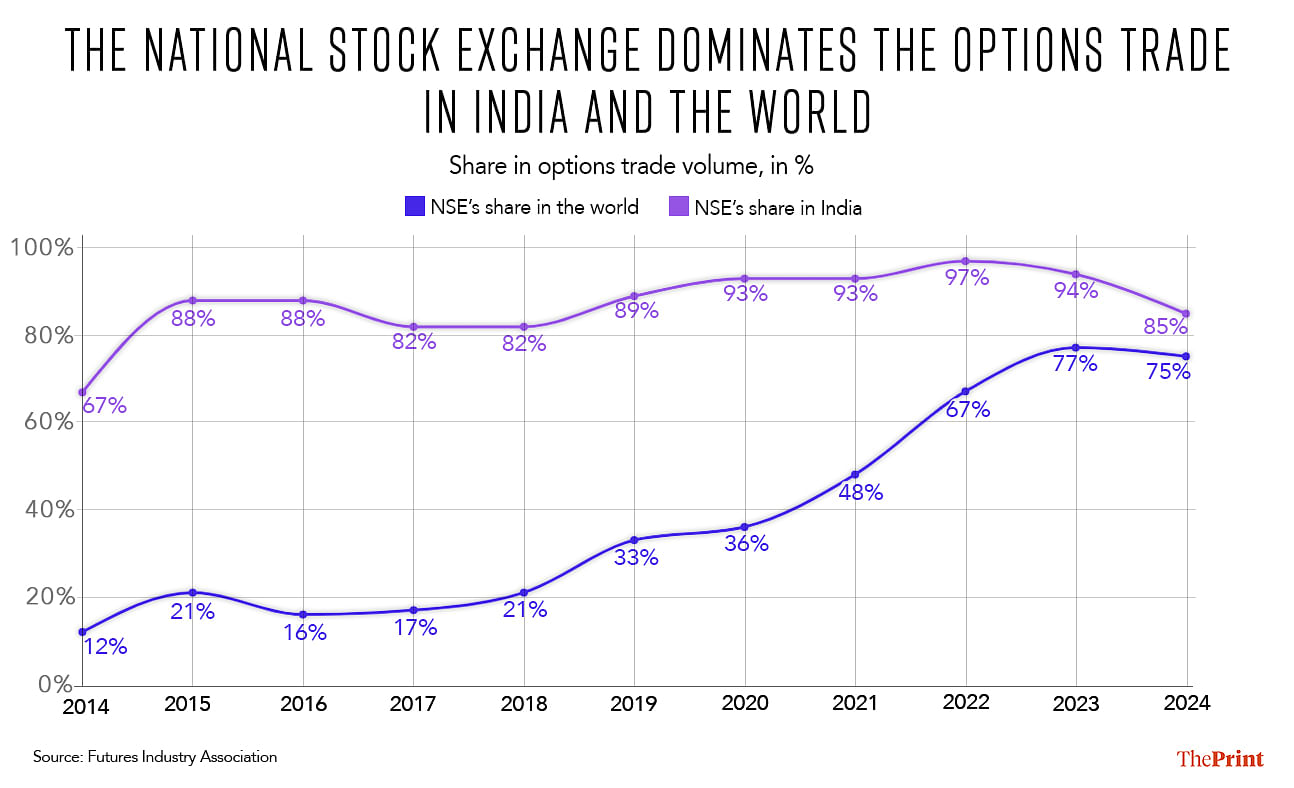

According to data on the NSE, the top five discount brokers account for 63.8 percent of the active clients on the NSE as of March 2024, up from 59.9 percent a year earlier. Their market share was just 18 percent in March 2019.

Within this, discount broker Groww has emerged as the largest broker in India with a market share of 23.4 percent in 2023-24. Zerodha is second, with a market share of 17.9 percent. That is, just these two apps contribute more than 40 percent of the NSE’s active participants.

What this has also meant is that the culture of trading has changed, according to James, who added that this change has diluted some of the safeguards that existed in the past. “Earlier, when you went to a physical brokerage, the broker himself would serve as a second layer of defence, in that they might advise you for or against a particular trade.”

“That was a safeguard. Now, the top three brokerages are discount brokers that don’t have any branches. You can trade yourself at the click of a button,” James explained.

Also Read: SEBI invites public comments in bid to clamp down on finfluencers & their undeclared revenue streams

Most Indians are losing money on options

The act of buying an option is similar to betting, where you bet that a stock market index, for example, will rise to a certain level by a certain date. If it does reach that level, you earn a profit. If it doesn’t, you don’t have to exercise your option. The only money you have lost is the premium amount.

This low-risk, high-potential reward system is particularly attractive to young investors, who plunge headlong into options trading with significant enthusiasm but no prior knowledge. “The youngsters today ‘play’ at trading as if it was any other form of online gaming,” Rupak De, senior technical analyst at LKP Securities explained. “People in the industry now talk of the gamification of stock trading.”

“These new traders don’t have any strategies, and do no technical analysis,” he lamented.

Adding, “They just speculate based on the price movement. And because they don’t have any training, they end up losing money much more often than gaining.”

In January 2023, India’s stock market regulator Securities and Exchange Board of India (SEBI) released a report analysing the profits and losses of individual traders dealing in the derivatives market. Its findings were startling.

“89 percent of the individual traders (i.e. 9 out of 10 individual traders) in equity futures and options segment incurred losses during FY22, up from 87 percent in FY19,” the report said. It added that “the percentage went up to 90 percent for active traders and further to 94 percent on excluding the outliers from active individual traders’ group during FY22”.

In other words, 90 percent of those who actively traded in futures and options actually ended up losing money over the course of 2021-22. If stray outlier events were removed from the calculation, then this number rose to 94 percent.

“For the group of active traders (excluding outliers), the average loss of a loss maker was over 15 times the average profit by a profit maker during FY22,” the report said. This meant that people who lost money lost 15 times the total amount gained by those who won.

Although the SEBI data is for 2021-22, every stock market analyst ThePrint spoke to confirmed that nine out of 10 options traders still lose money on an aggregate basis over the course of a year.

The ‘gamification’ of stock market trading

There are a number of factors that are driving young Indian investors to keep going back to the options market despite losing money time and again. The most important, however, seems to be a deep cultural shift spurred by the confluence of the financial and technological worlds. That is, the rise of entire industries such as online gaming — where players can earn livelihoods from playing games online — has opened up the younger generation to the idea of treating the stock market the same way.

“Availability of work from home policies during lockdown coupled with user-friendly trading platforms, lower brokerage charges, growing popularity of finfluencers and rising digital penetration, the industry has witnessed sizable participation of young investors with inclination towards trading in index options,” said Deep Inder Singh, vice president at ICRA Ltd.

According to the SEBI report, during 2021-22, traders in the age-group 30-40 years formed the largest share (39 percent) in the derivatives market.

However, what was notable was the rise in the share of traders in the age group of 20-30 years. These young traders made up just 11 percent of total derivatives traders in 2018-19, but accounted for 36 percent by 2021-22 — a clear indication of the huge interest this age group has been taking in the stock market.

What’s more, the overwhelming majority of them seem to be males, with the SEBI data saying males formed 80 percent of individual traders in India in the equity F&O segment.

“Nowadays, the traders treat options trading like a game,” Anand James, chief market strategist at Geojit Financial Services said. “Even if they make Rs 15 in a day, they feel satisfied that a game has been played. And even if they lose money, they feel that there is a conclusion to their activity and there is some closure.”

This is unlike conventional stocks where the purchaser can hold the stock in perpetuity.

“That brevity of activity is very attractive to them, and this is in line with how we all operate now,” James added. “Everything is at the click of a button, including something as fundamental as banking. Now even the brokerages are apps, so these young traders can link their bank accounts and do trades instantly.”

Also Read: Who is Ravisutanjani Kumar, ‘finfluencer’ once tagged by Modi, now accused of ‘faking’ degrees

Low risk, high potential reward a huge attraction

The other factor really encouraging the younger generation to enter the options market is the low-risk, high-potential reward nature of the market.

“In options, the premium amount can be very small,” former SEBI chairman Ajay Tyagi explained. “It is more of a speculative instrument as compared to buying equities. Also, it is an option. You don’t have to guarantee that you will exercise that option.”

However, Tyagi added that this perception of low risk can actually blind traders to how much they are actually losing. “The premium amount, however, has to be paid upfront, and even though each individual amount is small, it adds up to a huge amount over the year.”

According to SEBI, the average loss in the F&O segment in 2021-22 stood at Rs 1.1 lakh, and rose to Rs 1.25 lakh when only active traders were factored into the equation.

Might be overstating India’s options market size

Faisal Mohammed, assistant vice president of business analysis at Zerodha, however, said the narrative may be overstating the size of the options market in India. The key reason for this, he explained, was the difference between two metrics: the notional turnover and the premium turnover.

Notional turnover is the strike price plus premium multiplied by the number of options being bought (called lot size). This number is, as the name suggests, only a notional value. A more accurate representation of the actual traded value is the premium turnover, or how much premium changed hands. The premium turnover is simply the premium per option multiplied by the number of options.

“There are certain things being missed in all this talk about the options turnover being very high,” Mohammed said. “A lot of people look at the options notional turnover, which is maybe not the right number to look at. The notional turnover for the Nifty yesterday was Rs 5.32 crore, while the premium turnover was about Rs 70,000 crore.”

However, he did concede that, just going by the number of trades being done, India was the biggest market.

Other barriers to entry have been lowered

In addition to the ease of options trading and the attraction of its risk-rewards system, several other entry barriers to the market have also been lowered over the last few years, further increasing its attractiveness. These include the addition of new index options that can be bought, which has not only increased the choices for prospective buyers, but has also given them more opportunities in a week to buy options.

“With the introduction of new index options such as Nifty Midcap from January 2022, Fin Nifty index from January 2021 and the relaunch of Bankex & Sensex derivatives contracts in May 2023, the share of the new launches in the overall options turnover increased to 26 percent in November 2023 from 17 percent in January 2023,” ICRA said.

Earlier, the expiry date for options was issued only on the last Thursday of each month. This then became every Thursday, and then, with the proliferation of index options, there is now an expiry every working day.

“Separate expiry days for each index, such as Nifty Midcap on Monday, Fin Nifty on Tuesday, weekly Bank Nifty on Wednesday, Nifty 50 on Thursday and Sensex & Bankex on Friday, has driven the increase in volumes,” ICRA added.

The other barrier to entry that has been lowered is to do with the lot sizes. SEBI mandates the lot sizes for each index and stock. That is, it tells you the minimum number of options you can buy at a time. However, over the years, it has been reducing the lot sizes, which means traders can do more with their money.

“The miniaturisation of contracts, with the reduction in the lot size of Bankex to 15 from 20 and Sensex to 10 from 15 in May 2023, Nifty 50 to 50 from 75 in April 2021, Bank Nifty to 15 from 25 in July 2023, has also facilitated investors with low wallet size to trade in the instruments,” ICRA added. “This has led to the expansion of the trader base.”

Rise of finfluencers and need for regulation

Finally, a significant factor driving young people to the options market is the role of finfluencers — social media influencers who talk about financial markets.

“Curbing the rise of these finfluencers would help retail traders,” De explained. “These finfluencers do live videos on options trading, and the people watching just follow them blindly without understanding or learning anything about how to read options data or how to read the charts.”

Former SEBI chairman Tyagi agrees with this assessment, saying these unregistered financial advisors “need to be reined in”.

“Not all of them are regulated, only about 1,200-1,300 are regulated, and the others in the digital media, these finfluencers, also drive this with their opinions,” he said. “It is a deadly mix.”

Though SEBI has taken some actions against finfluencers and has also tried to warn the public about the risks of derivatives trading, this doesn’t seem to be working.

In October 2023, SEBI barred Mohammad Nasiruddin Ansari, a finfluencer, from dealing in the securities market. It also ordered him to pay back Rs 17.2 crore, which it said he had made by fooling clients through “misleading/false information” and “influencing” them to deal in securities.

Before that, in May, another finfluencer P.R. Sundar settled a case with the markets regulator, agreeing to not only stay away from buying or selling securities for a year, but to also pay about Rs 6 crore. That month, SEBI also directed brokerages to prominently display a warning based on its research that nine out of 10 derivatives traders lost large amounts of money.

“SEBI has asked the brokers to display warnings, but that is not dissuading people, which is a cause for concern,” Tyagi said. “Because once they start losing large enough amounts, they will lose interest in the market, and that would be counter-productive to this investment culture that is being cultivated.”

“When people lose more and more money, more blame will come to the regulator and the government,” he said.

Adding, “Everyone should not be allowed to invest in options and futures.”

(Edited by Amrtansh Arora)

Also Read: Millionaire influencer BitBoy’s fall has lessons — ‘perfect example of why crypto needs regulation’