Amid macroeconomic uncertainties and heightened market volatility, institutional investors are looking for ways to diversify a traditional 60/40 portfolio and generate higher returns. In this context, hedge fund allocation has emerged as a timely investment option.

J.P. Morgan Asset Management (JPMAM) and Singaporean wealth fund GIC have teamed up to produce a white paper seeking to equip institutional investors with a comprehensive framework for constructing and managing hedge fund allocations.

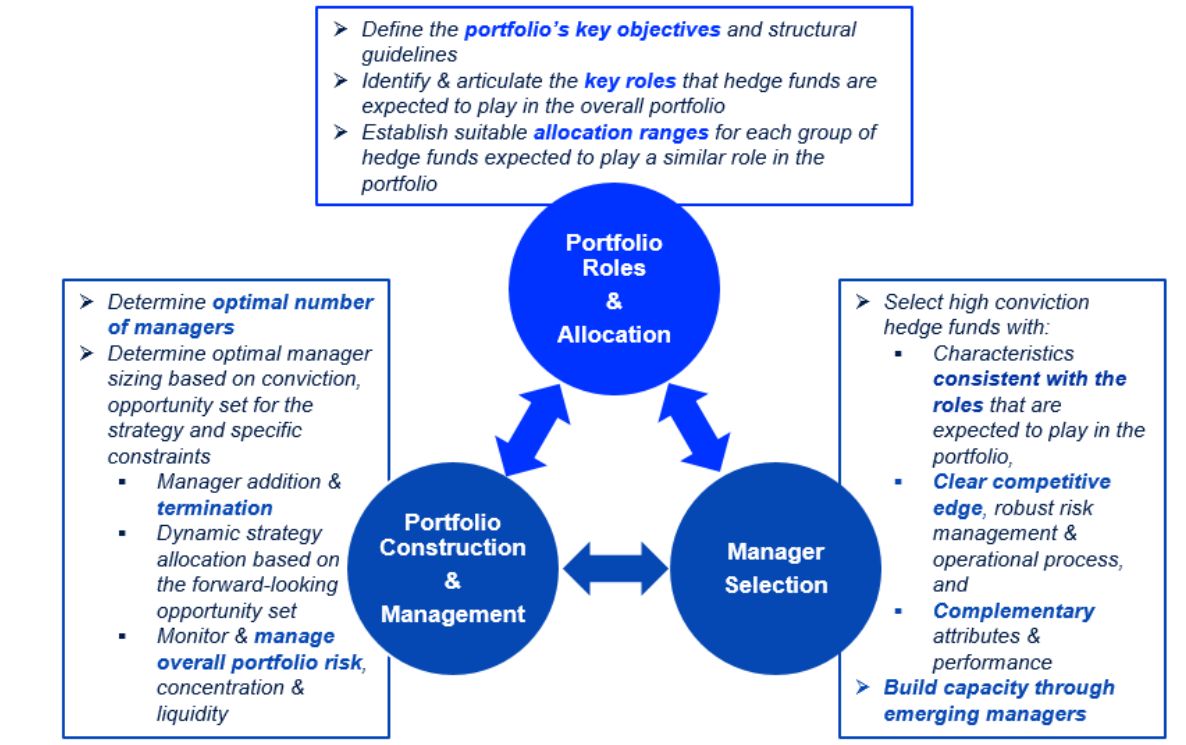

Compared to traditional strategic asset allocation (SAA) models which separate top-down and bottom-up considerations, the two firms believe that an integrated framework is more effective.

The framework combines top-down asset allocation considerations with bottom-up manager selection, along with robust and proactive portfolio construction and management.

The first component adopts a top-down total portfolio perspective, defining the roles that hedge fund allocation is expected to fulfil and determining the desired allocation ranges for different types of hedge funds.

The next two components take a bottom-up perspective, highlighting crucial areas that are often neglected when selecting managers and managing the hedge fund portfolio on a day-to-day basis.

Together, they comprise a comprehensive process and generate insights essential for building a successful hedge fund allocation, according to the paper.

“Given hedge funds’ unique value proposition in deriving returns from both long and short positions and dynamic investment strategies, a well-designed and actively managed hedge fund portfolio can provide resilience and potential alpha across various market conditions,” says Lyn Ngooi, investment specialist, hedge fund and alternative credit solutions, at JPMAM.

“We expect hedge funds to play an increasingly important role in institutional portfolios as a tool to help mitigate losses, enhance macro resilience, and improve risk-adjusted performance.”

Source: J.P. Morgan Asset Management

“In the above hedge fund allocation framework, the ‘Portfolio Roles & Allocation’ component is a top-down consideration. Equally crucial, however, are the selection of hedge fund managers (‘Manager Selection’) and the day-to-day portfolio management process (‘Portfolio Construction & Management’). The aim for the bottom-up approach is not to be exhaustive but to highlight practical considerations that are often neglected by new hedge fund investors,” Ngooi explains.

This hedge fund framework serves as a concrete example of the total portfolio approach that many institutional investors have been implementing. It allows bottom-up observations and insights to continually feed back into top-down portfolio considerations, helping to refine the determination of roles and structural guidelines for hedge fund allocation and creating a continuous cycle of improvement for investors’ processes, according to the paper.