Does Billionaire Philippe Laffont Know Something Wall Street Doesn’t? His Hedge Fund Is Backing a Stock That Jumped 211% in Just 5 Days.

Philippe Laffont’s hedge fund, Coatue Management, owns shares of Beyond Meat.

Hedge funds are some of the most fascinating institutions on Wall Street. One firm that I analyze closely is Coatue Management, founded by billionaire investor Philippe Laffont. Coatue is primarily known to invest in growth stocks, particularly in the technology and healthcare sectors.

According to its latest 13F filing, some of Coatue’s largest positions include CoreWeave, Meta Platforms, Amazon, GE Vernova, and Microsoft. If the names above are any indication, I think it’s safe to say that Laffont is bullish on artificial intelligence (AI). Beyond AI, Coatue also holds positions in companies such as Intuitive Surgical, Caris Life Sciences, and Hinge Health.

It would appear that Coatue is invested in top-notch businesses — deliberately avoiding abnormal levels of risk. This begs the question: Why in the world does Coatue hold Beyond Meat (BYND +9.12%) stock?

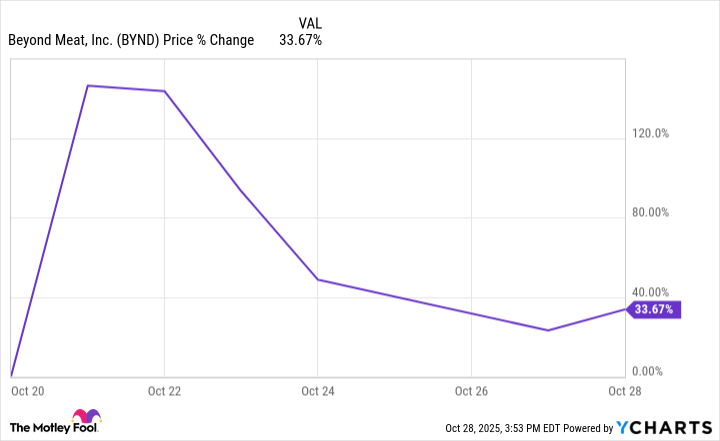

Over the last few trading sessions, shares of Beyond Meat skyrocketed by more than 200% seemingly out of nowhere, before collapsing again.

Does Laffont know something the rest of us don’t? Let’s dig into what’s fueled the rally in Beyond Meat stock.

Why did Beyond Meat stock move higher?

The volatility in Beyond Meat stock was kicked off following an 8-K filing in mid-October. In the filing, the company disclosed the completion of a convertible note offering — effectively swapping the securities to augment liquidity needs. Per the structure of the deal, a total of 316,150,176 new shares were added to Beyond Meat’s outstanding share count.

Initially, the news was not met with much fanfare. After all, the company basically telegraphed that it is not generating enough cash flow organically to bolster the cash position on its balance sheet. Nevertheless, retail traders swiftly changed the negative sentiment surrounding Beyond Meat.

Thanks to buzz on social media platforms, a choreographed short squeeze was orchestrated — sending shares of Beyond Meat parabolic. These types of events happen from time to time. Remember GameStop and AMC Entertainment?

Broadly speaking, though, short squeezes tend to be fleeting — maybe lasting a couple of days at most. Seldom are they prolonged events that go on for no real reason. This isn’t exactly what’s going on with Beyond Meat, though.

Shortly following the convertible debt transaction, the company announced a major distribution deal with Walmart. Admittedly, this could be perceived as a positive tailwind. In theory, selling into Walmart could lead to new customer acquisition and represent part of a turnaround that Beyond Meat so desperately needs (more on that below).

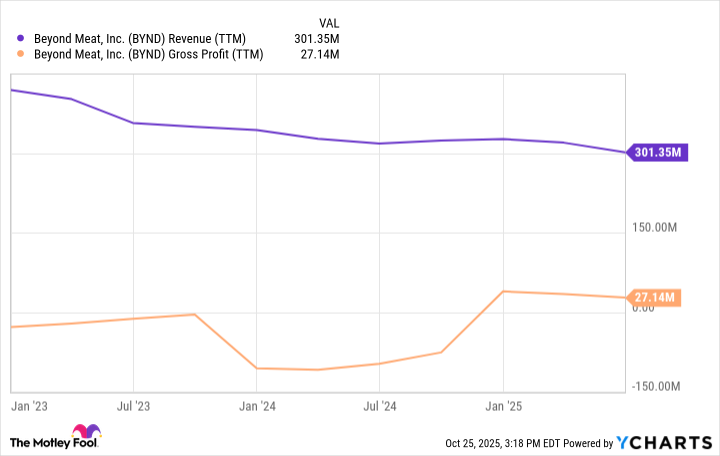

Beyond Meat is a business in decline

The snapshot below illustrates Beyond Meat’s revenue and gross profit over the last 12 months. Not only are sales in decline, but the company’s gross margin profile is razor thin — hovering around 9%. With this type of trajectory, it’s no wonder the company is desperate for cash and resorted to the debt offering.

BYND Revenue (TTM) data by YCharts

To me, Beyond Meat’s business is in trouble and there aren’t many — if any — prudent reasons to buy the stock.

Against that backdrop, I’m confident that the outsized volatility and abnormal gains investors have witnessed over the last week can be summed up by the following idea: day traders found their newest meme stock.

Why might Laffont like Beyond Meat stock?

Given Beyond Meat’s poor operational performance, it’s curious why Coatue would hold a position in the company at all. I have a few theories.

First, Coatue has been an investor in another plant-based meat company, Impossible Foods, for several years. It’s possible that the firm saw Beyond Meat as an opportunity to gain more exposure at the intersection of health, wellness, and the trillion-dollar food market. Simply put, owning Beyond Meat stock could be a form of hedging the investment in Impossible Foods.

Another idea is that Coatue might be willing to roll the dice on an unusually high beta stock. Given its core positions are diversified blue-chip companies disrupting multiple industries poised for long-term growth, perhaps Coatue is allocating a portion of its portfolio to a more speculative asset.

My last theory — and the one that seems most plausible — is that Beyond Meat represents an incredibly small position within Coatue’s broader portfolio. The fund only owns 343,393 Beyond Meat shares, accounting for less than 0.1% of its total holdings — suggesting it may be a peripheral investment rather than a core focus area.

It’s important to note that the short squeeze may see a crash landing. Shares of Beyond Meat fell sharply from their peak, although they still show a gain of more than 30%. Chasing momentum now is risky. It’s best to sit this one out and avoid being a bag holder.

All told, I do not think that Laffont knows something the rest of Wall Street doesn’t.