The great Peter Lynch once said, “The real key to making money in stocks is not to get scared out of them.” Hedge fund traders can be frightening as they move rapidly and often in tandem but most importantly, they are fickle. The sell-off in software stocks is the most recent example. But I have been saying for years that these companies are the new defensives, observes Nancy Tengler, CIO at Laffer Tengler Investments.

Goldman Sachs reported that institutional investors sold technology stocks at the highest level over the last 11 weeks. Some 60% of that selling was in software stocks.

My experience has shown, and the hedge funds’ collective performance has confirmed, that it often makes sense to take advantage of the volatility they create. Look no further than Nvidia Corp.’s (NVDA) stock powering ever higher after the recent earnings report. Why? Because the hedge funds are piling in. Chips, chips, chips, and more chips!

Salesforce Inc. (CRM) spooked the market with weak guidance. I think that is more about CRM’s model and limited use cases for AI in their software offering than a verdict on all software companies – particularly the cloud hyperscale’s. Cloud computing accelerated last quarter at Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), and Alphabet Inc. (GOOGL).

They continue to turn in double digit earnings growth, they outearn the SPX, dividends and dividend growth are increasingly in the mix, and they are actually benefiting from higher interest rates.

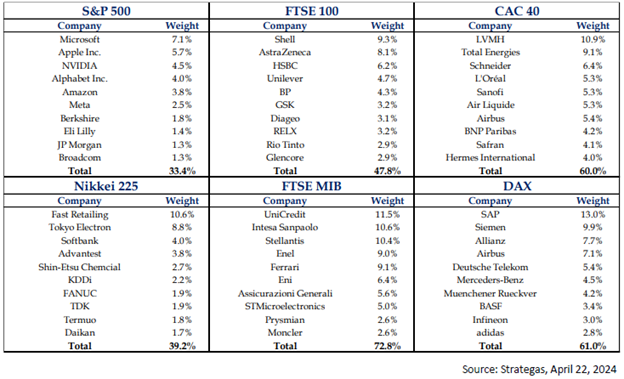

Finally, I want to share a few words about S&P 500 concentration. We hear it repeated almost daily that the market is being driven and dominated by the Mag Seven, the Fab Five, or simply NVDA. But it is important to note that the SPX is the least concentrated index of the major developed global indices.

See the chart above from our friends at Strategas.