Flexicap vs. Multicap: After 10 years, the winner is clear. (It’s Not What You Think) – Money News

In Indian mutual funds, flexibility and structure have long fought for dominance. Flexi-cap funds were given the freedom to move across market caps, while multi-cap funds were built to stay disciplined with fixed allocations. A decade later, the numbers tell a story not of rivalry, but of two distinct approaches to wealth creation.

Based on data from the Financial Express Mutual Fund Screener (financialexpress.com) as of November 10, 2025, Flexi-cap funds as a category have compounded at a CAGR of 13.89% over ten years, 18.27% over five years, and 16.15% over three years. Multi-cap funds, which do not yet have a complete 10-year dataset, show CAGRs of 18.84% over three years and 4.57% over five years.

To put it simply, Flexi-caps have shown stronger long-term consistency, while Multi-caps have delivered superior shorter-term momentum. And with both categories benchmarked against the Nifty 500 TRI’s 10-year CAGR of 14.97%, the past decade has effectively been a contest between agility and enforced diversification.

What are flexicap and multicap funds?

A Flexi-cap fund can invest across large, mid, and small caps in any proportion. That flexibility allows fund managers to respond to market valuations, liquidity cycles, or sentiment shifts. It’s an approach built on tactical agility.

A Multi-cap fund, in contrast, must maintain at least 25% each in large, mid, and small caps. The rule enforces balance, it protects investors from overexposure to any single segment, but limits tactical concentration when one market cap is leading.

The SEBI reclassification in 2017–18 made this distinction clearer, and over time, the data have shown that how managers use (or are restrained from using) flexibility defines performance as much as stock selection does.

Top Performing Flexicap Funds Over 10 Years

Parag Parikh Flexi Cap Fund – Direct Plan – Growth

With a 10-year CAGR of 18.46%, this fund outpaced the Nifty 500 TRI’s 14.97% CAGR by a wide 3.49% margin.. Its NAV stands at Rs 93.54, backed by an AUM of Rs 1,19,723 crore. The expense ratio is 0.63%, while the portfolio turnover ratio is 37.19%, indicating low churn and long-term conviction.

The portfolio’s top holdings include HDFC Bank, Power Grid, and Bajaj Holdings, and the fund is rated Very High Risk.

Its Sharpe ratio of 1.70 signals robust risk-adjusted performance. Its lower volatility compared to peers has been key to sustaining alpha through cycles.

The Sharpe ratio, simply put, is the risk-adjusted return of the underlying asset. So, the higher the Sharpe ratio, generally speaking, the better.

Beta, on the other hand, reflects the sensitivity of returns with respect to movement in the Sensex. A Beta of 1 means the fund’s returns move in sync with movements in the benchmark; a Beta of more than 1 means the returns go up/down faster than the benchmark.

HDFC Flexi Cap Fund – Direct Plan – Growth

The HDFC Flexi Cap Fund has compounded at a CAGR of 17.42% over ten years, surpassing the benchmark by 2.45%. The NAV stands at Rs 2,250.20, and the AUM at Rs 85,560 crore. The expense ratio is 0.70%, while the portfolio turnover ratio is 20.60%, indicating a relatively steady buy-and-hold approach.

Core holdings such as ICICI Bank, HDFC Bank, Axis Bank, and State Bank of India dominate its portfolio.

Its Sharpe ratio of 1.47 reflects strong risk-adjusted performance, indicating the fund has efficiently converted volatility into consistent excess returns over time.

Aditya Birla Sun Life Flexi Cap Fund – Direct Plan – Growth

The fund has generated a 10-year CAGR of 15.74%, modestly above the Nifty 500 TRI’s 14.97%. The AUM stands at Rs 23,533 crore, with an expense ratio of 0.86% (Direct Plan). Aditya Birla Sun Life flexi cap fund has a NAV of Rs 1,548.26.

The fund’s portfolio turnover ratio of 33% shows low churn, reinforcing its buy-and-hold character.

With sector allocations tilted toward banks (21.96%), IT (9.36%), and automobiles (6.82%), it has maintained a balance but not excessive conservatism. With a Sharpe ratio of 0.91, the fund’s risk-adjusted returns are moderate, showing that while it trails top Flexi-cap peers, it has maintained stability with measured exposure across sectors.

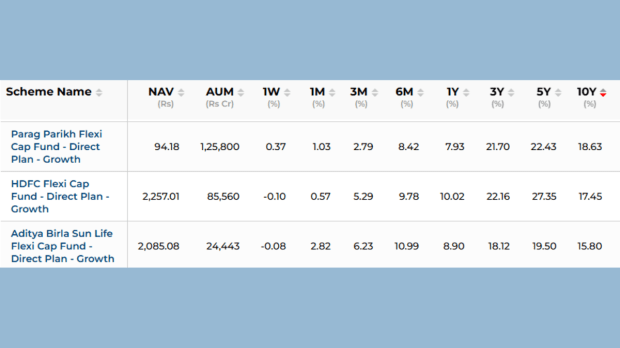

Here’s a snapshot from the Screener:

Top Performing Multicap Funds Over 10 Years

Quant Multi Cap Fund – Direct Plan – Growth

Among Multi-cap schemes, the Quant Multi Cap Fund stands out with a 10-year CAGR of 18.55%, beating the Nifty 500 TRI at 14.97% by 3.58%. Its NAV is Rs 681.68, and AUM is Rs 9,323 crore. The expense ratio stands at 0.62%, while the portfolio turnover ratio is 79%, consistent with Quant’s high-frequency, data-driven rebalancing model.

The portfolio includes Aurobindo Pharma, Reliance Industries, Adani Power, and Britannia Industries as top holdings.

The Sharpe ratio for the Quant Multi Cap Fund – Direct Plan – Growth is −0.44 currently. This high-turnover, high-conviction approach has amplified returns in cyclical upswings.

Sundaram Multi Cap Fund – Direct Plan – Growth

The Sundaram Multi Cap Fund has compounded at a 10-year CAGR of 16.60%, driven by disciplined rebalancing across market caps. Its NAV stands at Rs 435.56, and AUM at Rs 2,829 crore. The expense ratio is 0.94%, and the portfolio turnover ratio is 56.70%, showing active but not excessive rotation.

Top holdings include HDFC Bank, ICICI Bank, and Reliance Industries. Though the Nifty 500 Multicap 50:25:25 TRI benchmark lacks a full 10-year series, shorter-term data support the fund’s consistency.

The Sharpe ratio of 0.80 highlights balanced risk-adjusted performance, consistent with the fund’s disciplined allocation strategy and moderate volatility.

Nippon India Multi Cap Fund – Direct Plan – Growth

The Nippon India Multi Cap Fund has posted a 10-year CAGR of 16.23%. Its NAV stands at Rs 332.12, with an AUM of Rs 47,294 crore. The expense ratio is 0.73%, and the portfolio turnover ratio is 22.00%, among the lowest in its category, indicating stability in holdings.

Key investments include HDFC Bank, Axis Bank, and Infosys.

With a Sharpe ratio of 1.17, the fund demonstrates efficient risk management and steady excess returns relative to its volatility, placing it among the better risk-adjusted performers in the category.

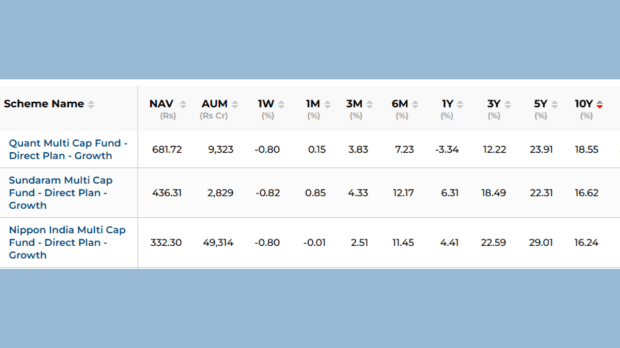

Here’s a snapshot from the Screener:

The decade verdict: Which category won?

If this decade were judged on endurance, Flexi-cap funds win the consistency race. All three Flexi-cap funds beat the Nifty 500 TRI’s 10-year CAGR and maintained lower volatility, with turnover ratios between 20 and 37%, demonstrating control.

If the verdict were based on peak performance, Multi-caps steal the spotlight. The Quant Multi Cap Fund’s 10-year CAGR of 18.55% narrowly edges out Parag Parikh Flexi Cap’s 18.46%, proving that structured diversification can still deliver superior compounding when combined with tactical agility.

Which fund type should you choose in 2025?

Investors comfortable with manager-driven calls and tactical allocation should opt for Flexi-cap funds, which reward long-term patience and allow fund houses to shift weights dynamically.

Those preferring balanced exposure across the market should choose Multi-cap funds ideal for investors who want to stay diversified through all market cycles without monitoring frequent shifts.

With 2025 poised for sectoral churn, a barbell strategy can seem to work: pair one strong Flexi-cap fund for core allocation with a Multi-cap fund for built-in diversification.

The investor’s takeaway

Flexi-caps dominate in stability and discipline, while Multi-caps win in bursts of high growth. Over ten years, however, the scale tilts slightly toward Flexi-caps for their steadier CAGR, controlled turnover, and predictable drawdowns.

Both Flexi-cap and Multi-cap funds have built wealth, but through different philosophies. Flexi-caps relied on judgment and timing; Multi-caps relied on structure and breadth.

For investors, the decision isn’t about picking a “winner.” It’s about recognising temperament. Those seeking smoother compounding and lower churn can lean toward Flexi-caps. Those willing to tolerate volatility for bursts of outperformance can add Multi-caps.

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.