Stay informed with free updates

Simply sign up to the Hedge funds myFT Digest — delivered directly to your inbox.

Private equity’s struggle to return money to clients is hitting hedge funds, which rely on the same pension plans, foundations and endowments for fundraising.

Hedge funds seeking to raise money from institutional investors are being rebuffed on the grounds that the institutions lack the cash to give them.

The difficulty is at least in part due to a slowdown in distributions that investors have received from private equity funds.

“The lower rate of distributions from private equity, [private] debt and venture funds is having a knock-on effect, leading some allocators to pause on new investments into illiquid funds and reduce new investments in more liquid hedge funds,” said Michael Monforth, global head of capital advisory at JPMorgan Chase.

Buyout-backed exits fell to $345bn last year — their lowest level in a decade, according to Bain & Co’s annual private equity report. This has left the private equity industry sitting on a record backlog of 28,000 companies worth more than $3tn, the Bain & Co report found, as a slowdown in dealmaking made it harder to return money to their backers.

“Private equity distributions have gone down, the IPO market has been very thin and M&A has been held back,” said Nick Moakes, chief investment officer of the £36.8bn Wellcome Trust. “If you’re not going to get bought and can’t get listed, PE is scratching its head on how to do distributions.”

Hedge funds and private equity managers are often competing to raise money from the so-called “alternatives” allocation of institutional investors, which can also include private credit, infrastructure and real estate assets. As investors receive distributions from existing holdings, the money is recycled into new commitments.

“For the vast majority of institutions, private equity and hedge funds come out of the alternatives bucket,” Sunaina Sinha Haldea, head of private capital advisory at wealth manager Raymond James, said.

“The lack of distributions out of private markets portfolios is going to impact the ability to make new commitments in other parts of the alternatives portfolio . . . that includes hedge funds.”

Last year assets in the global private capital industry ballooned to $14.5tn, according to the Bain & Co report, more than treble the $4tn it managed a decade earlier.

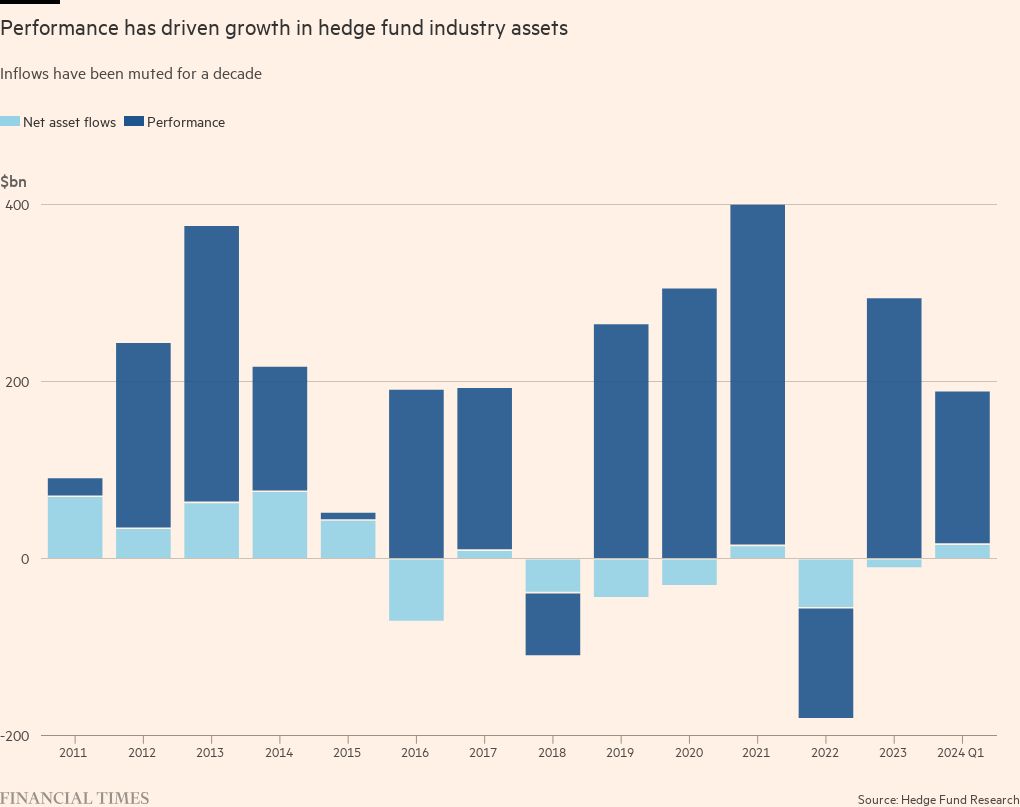

In contrast, inflows to hedge funds have been muted for the past decade, with investors pulling cash on a net basis in five years out of the last 10, according to Hedge Fund Research.

The capital constrained environment is also having an impact on the market for new hedge fund launches.

Former Millennium co-chief investment officer Bobby Jain has been forced to scale down day-one fundraising ambitions for his new hedge fund, Jain Global, ahead of its July launch.

One hedge fund manager currently trying to raise capital said investors often cited the lack of distributions they had received from their private equity investments as a reason why they would not invest. Investors were waiting to receive more money back before reinvesting, they added.

“What you are seeing is a failure to exit on the private equities, and it’s kind of having this follow on effect where its leading to a lower velocity of capital flowing throughout all alternatives,” Sam Diedrich, a managing director at Partners Capital, said. “It’s becoming a real issue.”