(Bloomberg) — Wall Street’s half-trillion-dollar business cloning quant trades has some surprising new customers: the very firms whose strategies it mimics.

Most Read from Bloomberg

Once hostile to the copycat products being churned out by big banks, hedge funds are becoming a major driver of the boom in what are known as quantitative investment strategies, or QIS.

These tools take popular systematic trades and typically turn them into swaps or structured notes, creating a quick and cheap way to gain exposure. They’ve long drawn fire from hedge funds for being pale imitations of the sophisticated strategies they replicate, which were often developed in academia and pioneered over decades by the likes of AQR Capital Management and Dimensional Fund Advisors.

Yet money managers are increasingly giving in to the sheer convenience of QIS.

Pierre de Saab, who trades options at Geneva-based Dominice & Co., is among them. He’s written research arguing the rigidity of QIS means they do worse in market selloffs and can’t replace hedge-fund managers like him. Yet last year he began using the vehicles himself as a handy way to put on new positions.

“It can be challenging to hire a trader every time you want to do something new,” said de Saab, a partner at Dominice, which runs $1.5 billion. “You can use QIS as a starting point, and also as a way to outsource execution so that your staff can work on higher added-value tasks.”

While he declined to provide details of the specific strategies he uses, de Saab said the trades now make up about 5% of his portfolio.

‘Validation’

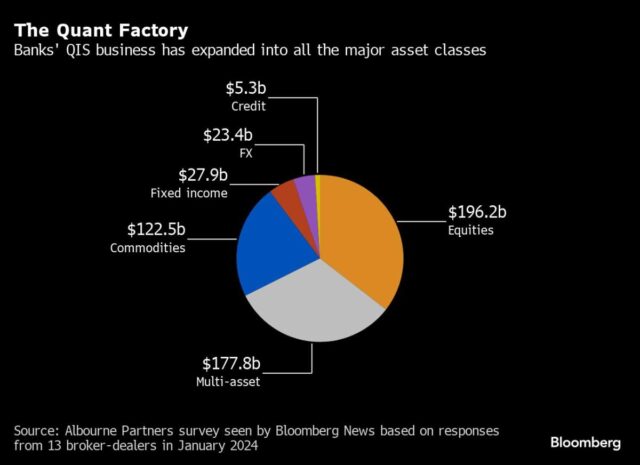

QIS adoption is accelerating across the board as higher interest rates boost many of the strategies on which the tools are based. Their total notional exposures climbed to a record $552 billion in December, according to an Albourne Partners survey of 13 broker-dealers seen by Bloomberg News.

While the tools were originally aimed at institutional investors like pensions, banks say all manner of hedge funds are now turning to them. Giulio Alfinito, global head of QIS structuring at UBS Investment Bank, estimates hedge funds now account for a high single-digit or even double-digit percentage of notional QIS assets at some banks, up from zero a few years ago.

“If we can live within that ecosystem, it is a good source of validation for our algorithms,” he said.

Uses vary, but in a typical case a fixed-income team at a multi-strategy hedge fund might trade stock options with QIS. Or a firm that’s never done commodities might utilize them to quickly add some exposure to raw materials.

“To multi-pod type of hedge funds, QIS is a cheap way for them to get access to an asset class” where a team doesn’t have trading capabilities, said Arnaud Jobert, the co-head of global strategic indices at JPMorgan Chase & Co., which runs a notional $85 billion in the business. “Five or 10 years ago, there was very little hedge fund adoption. If anything, hedge funds could see QIS as a competitor.”

Throwing Spaghetti

Wary hedge funds can still find plenty of reasons to hesitate. Banks selling QIS aren’t asset managers, so have no fiduciary duty to the client. The strategies are also executed entirely based on a predetermined rulebook, meaning they can’t be easily adjusted and may pay more to trade, undermining the argument that they’re inexpensive.

Deniz Cicek at Axonic Capital, a New York-based firm running $4.8 billion, knows there are banks peddling similar trades to his fixed-income options strategy. He’s also heard pitches for equity QIS that banks say can diversify his portfolio.

“My investors can do it themselves, so what’s my value?” he said. “As a hedge fund manager, I think the edge is knowing when to get in and how much money to put in these exposures rather than just getting a static exposure.”

QIS are also often marketed based on backtests, or a simulation of how a trade would have performed in the past. But even if market conditions remain conducive, the very act of creating a new strategy can funnel money into the trade, changing the calculus.

“A big consideration is the live return versus the backtest,” said John Downing, who runs a QIS-based ETF at Simplify Asset Management. “It might be a victim of its own success where you have so many folks chasing the same premium.”

De Saab at Dominice said his analysis of more than 1,000 strategies showed about 76% delivered a lower risk-adjusted return, or Sharpe ratio, after going live, and 32% even went negative.

Critics argue the high failure rate of QIS is evidence banks are simply throwing spaghetti at the wall to see what sticks. Data provider LumRisk says a total of about 7,000 indexes have been launched overall (QIS are each structured around an index), but nearly 1,900 are no longer available, with a record 392 retiring in the Covid volatility of 2020.

New Domains

In the view of the banks, it’s all part of the natural churn as markets, clients and even the products themselves evolve. Nowadays a buyer can customize their QIS, turn them on and off, and sometimes buy options on a strategy.

Banks are also increasing the breadth and depth of QIS offerings, pushing into more complex domains with trades like equity dispersion, which buys an array of single-stock options and sells index derivatives, and intraday momentum, which chases trends in stock-index futures over a day.

Strategies are getting more creative, too. Deutsche Bank AG has a QIS that buys and sells shares with a machine-learning algorithm. JPMorgan has strategies for niche commodities like British gas and a trademarked offering using GPT-4.

Still, even as this array of trades lures in more hedge-fund users, an element of competition remains.

Jobert says JPMorgan would be careful about giving the fast money access to more “sensitive” strategies with limited capacity. And de Saab at Dominice reckons the copycats are raising the bar for many of his kind, because gone are the days when one could charge high fees just for offering simple strategies like constantly selling options.

“You’re not going to be rewarded for providing access,” de Saab said. “QIS has that market.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.