Each time the Freeport natural gas export terminal breaks down, traders at the hedge fund Skylar Capital Management LP look for any available insights to predict when production will restart.

Article content

(Bloomberg) — Each time the Freeport natural gas export terminal breaks down, traders at the hedge fund Skylar Capital Management LP look for any available insights to predict when production will restart.

They’ve scoured satellite photos of the site in Texas, hired pilots for flyovers, consulted with experts in the construction of liquefied natural gas facilities, leveraged machine learning and studied thermal images and power-meter data.

Advertisement 2

Article content

Article content

The Freeport LNG plant may not be well known outside of energy and trading circles, but it’s vital to one of the world’s most important commodities markets.

When running at maximum capacity, Freeport can liquefy up to 2% of the US’ daily gas production, or enough to power 11 million homes. So when the facility breaks down — which it does more than any other export plant in the country — it can move prices around the globe. And because it’s privately held, Freeport doesn’t need to disclose its maintenance schedule or production flows. That’s forcing commodity traders who have long gathered market intelligence to predict where supply and demand are headed to take their research to a whole new level.

“Freeport defies all patterns of expectations,” Skylar Capital Founder and Managing Partner Bill Perkins said in an interview.

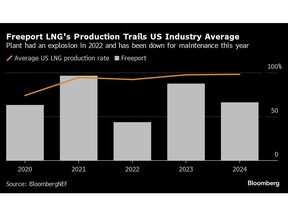

Freeport LNG is a sprawling complex of pipes and tanks overlooking the Gulf of Mexico, about an hour’s drive south of Houston. Since its first full year operating in 2020, the facility’s utilization rate, or percentage of operating capacity, has been the lowest compared with other US LNG projects in operation, according to an analysis of BloombergNEF data. The plant just fully restarted after initially shutting down in January for maintenance. It was offline for eight months in 2022 following an explosion.

Article content

Advertisement 3

Article content

Freeport, which began having outages as early as 2021, hasn’t offered an in-depth explanation for them. In an email, the company said all three trains at the facility were back in service on Tuesday. Through a spokesperson, the company declined to comment on the potential impact it would have on the gas market.

Alex Bennitt, a product manager for YES Energy’s power-grid monitoring data, helps traders estimate how much gas is flowing through Freeport by tracking the plant’s electricity usage.

He’s installed a briefcase-sized device close to the plant with what’s essentially a big magnet inside. The device, which is patented, is near a transmission line and can track how much power is flowing to Freeport. The more electricity the plant uses, the more gas it’s apt to be processing.

The data that the device collects is crucial to traders like Doug Young, head of gas strategy for hedge fund Roscommon Analytics. Gas futures, he said, have repeatedly moved 5 to 7 cents per million British thermal units on changes he’s spotted in the amount of power flowing to Freeport.

“It’s become a 24-7 tracking operation,” Young said.

Advertisement 4

Article content

LNG has become an increasingly crucial source of energy around the globe, especially since Russia invaded Ukraine in 2022 and prompted much of Europe to find new sources of gas. Facilities like Freeport process it by cooling gas to -256F (-160C), which liquefies the fuel so it can be piped onto specialized tankers and shipped around the globe. The US was the world’s largest LNG supplier in 2023, exporting just under 12 billion cubic feet of gas per day, or about one-fifth of global supply.

Read More: A $290 Billion Investment Cements Gas’s Relevance for Decades

Dinesh Kumar, vice president of LNG trading at GAIL Global Singapore Pte, said his team keeps a constant eye on the gas flows to Freeport. Kumar notes that the US market is open, relatively speaking, compared with LNG production sites in other countries.

“The market is in a tight balance, and any small disruption has a considerable impact on the prices,” Kumar said.

Perkins of Skylar Capital said that while Freeport’s unpredictability is frustrating, it has offered a good lesson for commodity traders, forcing them to sharpen their market-research skills.

“We’re in the job of knowing,” he said. “But when you don’t know, we’re forced to estimate.”

—With assistance from Naureen S. Malik.

Article content