Los Angeles Capital Management LLC acquired a new stake in Diamond Hill Investment Group, Inc. (NASDAQ:DHIL – Free Report) during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 16,041 shares of the asset manager’s stock, valued at approximately $2,473,000. Los Angeles Capital Management LLC owned 0.56% of Diamond Hill Investment Group at the end of the most recent quarter.

Los Angeles Capital Management LLC acquired a new stake in Diamond Hill Investment Group, Inc. (NASDAQ:DHIL – Free Report) during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 16,041 shares of the asset manager’s stock, valued at approximately $2,473,000. Los Angeles Capital Management LLC owned 0.56% of Diamond Hill Investment Group at the end of the most recent quarter.

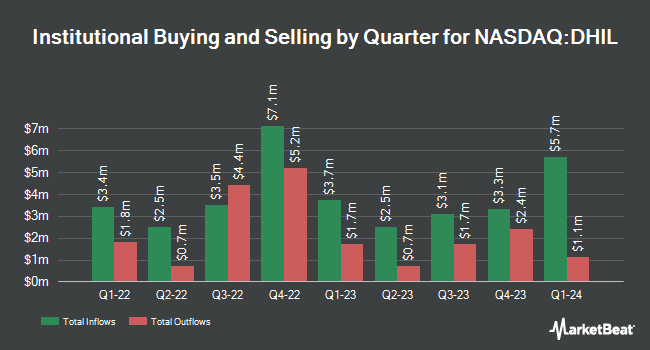

Several other institutional investors and hedge funds have also recently bought and sold shares of DHIL. Assenagon Asset Management S.A. purchased a new stake in Diamond Hill Investment Group in the 4th quarter valued at about $1,239,000. Charles Schwab Investment Management Inc. raised its holdings in Diamond Hill Investment Group by 17.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 37,275 shares of the asset manager’s stock valued at $6,283,000 after buying an additional 5,532 shares during the period. Vanguard Group Inc. raised its holdings in Diamond Hill Investment Group by 1.2% in the 3rd quarter. Vanguard Group Inc. now owns 159,384 shares of the asset manager’s stock valued at $26,867,000 after buying an additional 1,941 shares during the period. Gerber LLC purchased a new stake in Diamond Hill Investment Group in the 4th quarter valued at about $317,000. Finally, Merit Financial Group LLC raised its holdings in Diamond Hill Investment Group by 42.3% in the 4th quarter. Merit Financial Group LLC now owns 6,272 shares of the asset manager’s stock valued at $1,038,000 after buying an additional 1,863 shares during the period. 65.50% of the stock is currently owned by hedge funds and other institutional investors.

Diamond Hill Investment Group Price Performance

NASDAQ DHIL opened at $143.16 on Friday. The company has a market cap of $396.98 million, a P/E ratio of 9.70 and a beta of 0.99. The stock has a 50-day moving average of $151.06 and a two-hundred day moving average of $155.28. Diamond Hill Investment Group, Inc. has a 1-year low of $143.08 and a 1-year high of $188.28.

Diamond Hill Investment Group (NASDAQ:DHIL – Get Free Report) last released its earnings results on Wednesday, May 8th. The asset manager reported $3.00 earnings per share for the quarter. The company had revenue of $36.30 million during the quarter. Diamond Hill Investment Group had a return on equity of 18.75% and a net margin of 30.60%.

Diamond Hill Investment Group Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, June 14th. Shareholders of record on Monday, June 3rd were given a $1.50 dividend. This represents a $6.00 annualized dividend and a yield of 4.19%. The ex-dividend date was Monday, June 3rd. Diamond Hill Investment Group’s dividend payout ratio is currently 40.65%.

Insider Buying and Selling at Diamond Hill Investment Group

In other news, Director James F. Laird, Jr. sold 2,500 shares of the business’s stock in a transaction dated Wednesday, May 15th. The stock was sold at an average price of $158.40, for a total transaction of $396,000.00. Following the completion of the transaction, the director now directly owns 28,000 shares of the company’s stock, valued at $4,435,200. The sale was disclosed in a filing with the SEC, which is accessible through this link. In related news, Director Richard Scott Cooley acquired 500 shares of the stock in a transaction dated Monday, June 3rd. The stock was acquired at an average cost of $150.00 per share, with a total value of $75,000.00. Following the completion of the transaction, the director now owns 8,387 shares in the company, valued at approximately $1,258,050. The purchase was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director James F. Laird, Jr. sold 2,500 shares of the company’s stock in a transaction that occurred on Wednesday, May 15th. The shares were sold at an average price of $158.40, for a total value of $396,000.00. Following the completion of the transaction, the director now directly owns 28,000 shares of the company’s stock, valued at $4,435,200. The disclosure for this sale can be found here. 3.50% of the stock is currently owned by corporate insiders.

Diamond Hill Investment Group Company Profile

Diamond Hill Investment Group, Inc, through its subsidiary, Diamond Hill Capital Management, Inc, provides investment advisory and fund administration services in the United States. It offers investment advisory and related services to clients through pooled vehicles, such as private fund; separately managed accounts; collective investment trusts; and other pooled vehicles, including sub-advised funds and model delivery programs.

Featured Stories

Want to see what other hedge funds are holding DHIL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Diamond Hill Investment Group, Inc. (NASDAQ:DHIL – Free Report).

Receive News & Ratings for Diamond Hill Investment Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Diamond Hill Investment Group and related companies with MarketBeat.com’s FREE daily email newsletter.