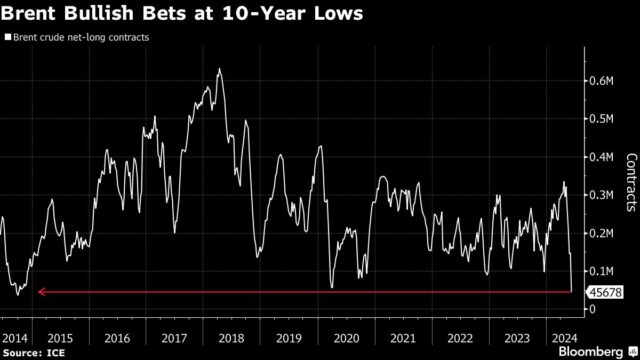

(Bloomberg) — Hedge funds dumped bullish bets on Brent crude and ramped up shorts against the global benchmark — sending their positioning to the least bullish in almost a decade — after OPEC and its allies decided to revive some production this year.

Most Read from Bloomberg

Money managers’ net-long position on Brent crude shrank by 102,075 lots to a total of 45,678 lots in data through Tuesday, weekly ICE Futures Europe data on futures and options show. That’s the lowest level for the net-long position since September 2014.

Brent crude futures dipped below $78 a barrel this week, the lowest in four months, after OPEC and its allies agreed over the weekend to return some supplies to the market starting in October. Crude already had been weakening for more than a month amid lackluster demand and ebbing geopolitical risks, and trend-following algorithms accelerated the decline after the decision surprised some market participants.

Later in the week, OPEC+ ministers reiterated that the plan to revive some production depends on market conditions. The comments helped oil pare its losses for the week and could prompt a reversal in money managers’ positions in next week’s data.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.