Shareholders of Edinburgh Worldwide (EWI) are being called to vote on whether to replace the trust’s current board of directors with nominees picked by US activist investor Saba Capital, for the second time in little under a year.

Last February, a requisitioned general meeting ended in a clear defeat for Saba, which received just 36.2 per cent of the votes. Shareholders owning 64.7 per cent of the total shares had their say, well above the usual levels.

It could be a much closer call this time. Saba’s position in the Baillie Gifford-run trust has increased from about 25 per cent to about 30 per cent. If the same amount of shares are voted again, Saba would have around 46 per cent of the total – meaning that even a relatively small drop in turnout could tip the activist over the threshold of a majority.

Read more from Investors’ Chronicle

Last year, platforms said private investors, who are not typically very active when it comes to shareholder voting, came out in force against Saba. But the activist had targeted seven different trusts at the same time, and the industry mobilised through a very active campaign to encourage people to vote. Edinburgh Worldwide is on its own now, and although it has had significant industry support, it’s not quite the same.

So what if Saba wins? On the one hand, the activist has helped deliver tangible results for shareholders since getting involved with UK-listed investment trusts. Various boards providing cash exits for shareholders, for example.

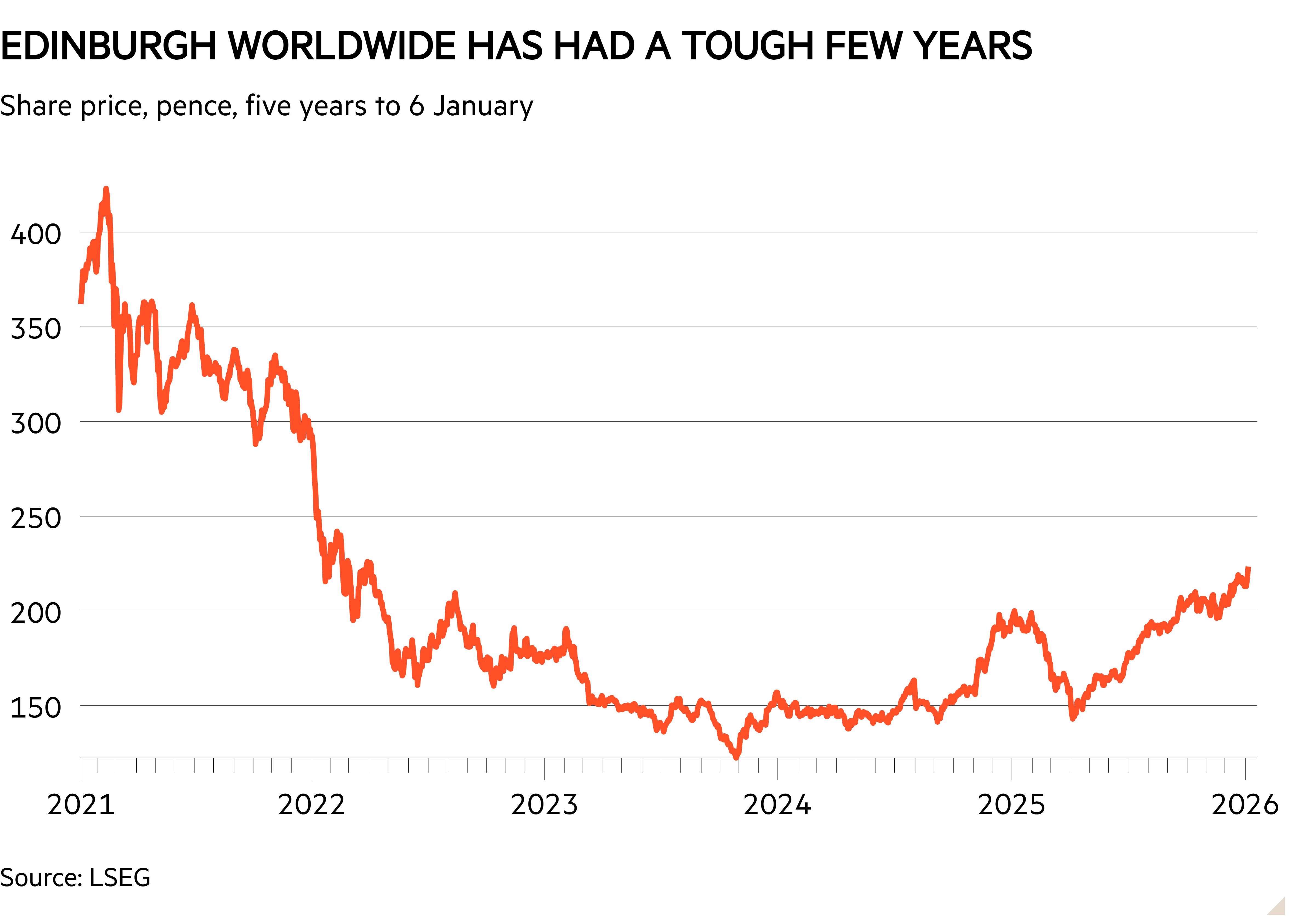

Plus, Saba argues that Edinburgh Worldwide’s performance has disappointed, and this is certainly true on a five-year basis – although over the past year the trust has done relatively well for a small-cap fund, with the net asset value rising 15 per cent in the year to 5 January.

On the other hand, it is unclear what Saba would do once it has control of the trust. The activist investor says the three board members it is proposing are independent. Others disagree. As QuotedData’s Matthew Read puts it, “despite Saba’s claims of the independence of its chosen directors, it is hard to believe it would have selected these individuals unless it felt that they would do its bidding”.

One of the nominees, Jassen Trenkow, is certainly a familiar face for the activist, having been put forward as a board member or trustee at various funds it has targeted over the past couple of years – including the UK-listed Herald (HRI) and a few US funds (such as the now-liquidated Eaton Vance New York Municipal Bond Fund and Eaton Vance California Municipal Bond Fund).

Last year, Saba planned to nominate itself manager of the trusts it attacked, which would then become funds of investment trusts. It also promised shareholders more liquidity events, such as tender offers.

At the time of writing, the activist had not publicly said whether its intentions are any different this time. If they are not, the fund-of-trusts approach would represent a huge change of strategy for Edinburgh Worldwide, and presumably was not what other shareholders had in mind when they first bought in. There is also the question of what would happen to the trust’s significant position in the unquoted SpaceX, which stood at 15.9 per cent of the portfolio as at mid-December.

The trust’s board says it has made several efforts to engage with Saba and proposed various “credible” solutions, including a tender offer and the proposed merger with Baillie Gifford US Growth (USA); but Saba rejected them all. The activist says that the merger offer “required Saba to sign a standstill [agreement] that presumably would have included other Baillie Gifford trusts”.

Regardless of where you stand, making your voice heard is important for what is likely to be a close vote. Familiarise yourself with your platform’s voting procedures, including voting deadlines – on Hargreaves Lansdown, AJ Bell and Interactive Investor this date is 15 January, with Hargreaves and II specifying a cut off time of 7pm. The general meeting will be held on 20 January.