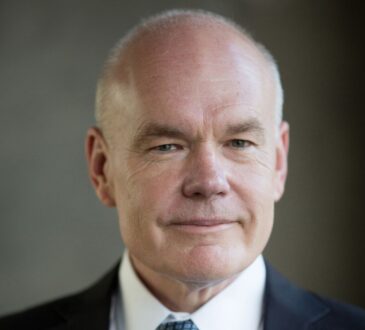

Scott Rechler restructured his “digital asset” at 75 Rockefeller Plaza — a major capital overhaul for a building that just three years ago seemed to have solved some of remote work’s challenges.

RXR brought in San Francisco-based hedge fund Farallon Capital Management as an investor in the 33-story tower that serves as RXR’s headquarters, sources told The Real Deal.

Farallon’s investment values the 627,000-square-foot tower at somewhere between $190 million and $200 million, according to a source familiar with the deal. That figure is significantly below the $260 million in debt that RXR put on the property in 2022, when it secured a refinancing from Bank of America and the Carlyle Group.

As part of this new deal, Rechler restructured the property’s debt. One person familiar said the lenders agreed to split the mortgage into a primary A note and a B “hope note” that will be repaid if the building performs well.

The deal is notable since Bank of America and Carlyle Group provided not that long ago, in the thick of the work-from-home era, when lenders were exercising extreme caution with office properties. Even deals from that period are in need of reworking today, as investors like Farrallon — and RXR with properties like 590 Madison Avenue — are still looking for deep discounts on office properties.

Rechler described 75 Rock as a “digital asset” that is 95 percent leased to companies like Merrill Lynch, American Girl and Guidehouse, with record rents exceeding $100 per square foot.

“We’ve never wavered in our belief in New York City’s office market, but we’re disciplined about backing the right assets,” he said in a statement. “The recapitalization of 75 Rock reflects our conviction that premier properties in world-class locations will continue to outperform.”

The RXR CEO said this marks the company’s seventh recapitalization in the past two years across 9 million square feet under its “3R” strategy of resetting basis, restructuring debt and re-tenanting space.

A representative for RXR declined to comment further on the deal. Representatives for Bank of America and Carlyle Group did not immediately respond to requests for comment.

A Newmark team led by Adam Spies and Adam Doneger negotiated the investment with Farallon.

The restructuring illustrates just how uncertain the current office environment is, even for those who thought they had figured out how things were settling.

If the 2022 financing were done at a conservative loan-to-value of 60 percent, that would’ve pegged the property then at around $433 million — meaning the valuation has dropped by more than half in just three years.

At the time, the deal was heralded as a sign of stability in the volatile Covid era.

“The asset is the epitome of what lenders require in today’s capital markets: A+ sponsorship, investment-grade tenancy and a superior capital-improvement program in proximity to tremendous lifestyle amenities,” Newmark’s Dustin Stolly, who negotiated the 2022 loan, said in a statement at the time.

The new pricemark is even farther off from the reported $500 million valuation RXR set when it bought the 99-year ground lease on 75 Rock in 2013. The company invested $150 million into renovating the tower in 2017.

Rechler announced a deal with Airbnb in 2019 to convert 10 floors in the building into 200 hotel-style units, but by the following year, the deal had fallen apart.

WeWork had leased about 300,000 square feet in the building, roughly half of the skyscraper, but terminated that lease as part of its 2023 bankruptcy restructuring.

Farallon was founded in 1986 by billionaire investor Tom Steyer, who stepped down in 2012 to focus on climate investments. Steyer — who ran in the Democratic presidential primary in 2020 — was a pioneer in merger arbitrage, investing in a corporate takeover target on the bet that a deal either will or won’t go through.

Farallon also has a significant real estate business. The company in 2023 raised its fourth real estate fund: a $650 million vehicle focused on U.S. opportunistic deals.

Its property arm is run by Avner Husen, a former manager of Blackstone’s BREIT investment trust, who joined Farallon last year. The hedge fund in July teamed up with Fetner Properties and MCB Real Estate to buy the 463-unit 240 Willoughby Street rental building in Fort Greene for $210 million.

Last year, Farallon did another deal with Fetner, buying the 74-unit luxury rental building at 85 East End Avenue for $75 million.

Read more

Rechler responds: RXR boss on health of his office portfolio

RXR lands $260 million refi for 75 Rockefeller Plaza

RXR Realty’s 99-year lease on 75 Rockefeller begins