Steward Partners Investment Advisory LLC decreased its holdings in Xcel Energy Inc. (NASDAQ:XEL – Free Report) by 4.2% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 34,236 shares of the company’s stock after selling 1,514 shares during the quarter. Steward Partners Investment Advisory LLC’s holdings in Xcel Energy were worth $2,120,000 at the end of the most recent quarter.

Steward Partners Investment Advisory LLC decreased its holdings in Xcel Energy Inc. (NASDAQ:XEL – Free Report) by 4.2% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 34,236 shares of the company’s stock after selling 1,514 shares during the quarter. Steward Partners Investment Advisory LLC’s holdings in Xcel Energy were worth $2,120,000 at the end of the most recent quarter.

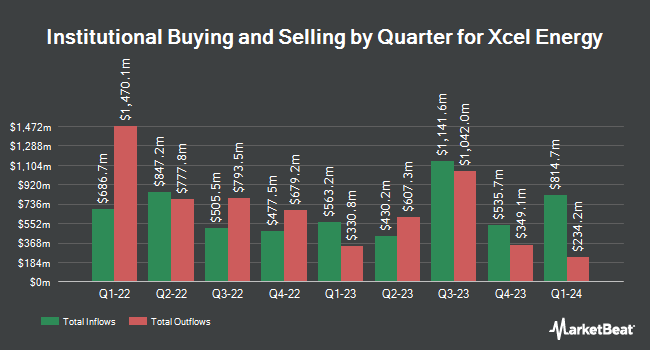

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in XEL. Vanguard Group Inc. raised its position in shares of Xcel Energy by 15.6% in the 3rd quarter. Vanguard Group Inc. now owns 64,062,856 shares of the company’s stock worth $3,665,677,000 after buying an additional 8,644,054 shares during the period. Massachusetts Financial Services Co. MA lifted its position in Xcel Energy by 16.0% during the third quarter. Massachusetts Financial Services Co. MA now owns 18,521,863 shares of the company’s stock valued at $1,059,821,000 after buying an additional 2,559,321 shares in the last quarter. Hsbc Holdings PLC grew its stake in Xcel Energy by 216.1% during the third quarter. Hsbc Holdings PLC now owns 1,627,320 shares of the company’s stock worth $92,981,000 after buying an additional 1,112,510 shares during the period. Jennison Associates LLC increased its position in shares of Xcel Energy by 184.9% in the fourth quarter. Jennison Associates LLC now owns 1,451,483 shares of the company’s stock worth $89,861,000 after acquiring an additional 942,097 shares in the last quarter. Finally, Federated Hermes Inc. lifted its holdings in shares of Xcel Energy by 247.8% during the 4th quarter. Federated Hermes Inc. now owns 1,284,305 shares of the company’s stock valued at $79,511,000 after acquiring an additional 915,046 shares in the last quarter. Hedge funds and other institutional investors own 78.38% of the company’s stock.

Xcel Energy Stock Up 2.1 %

NASDAQ:XEL opened at $55.45 on Friday. The stock has a 50-day simple moving average of $54.30 and a 200 day simple moving average of $57.28. Xcel Energy Inc. has a one year low of $46.79 and a one year high of $65.62. The company has a market capitalization of $30.81 billion, a price-to-earnings ratio of 16.65, a price-to-earnings-growth ratio of 2.44 and a beta of 0.36. The company has a debt-to-equity ratio of 1.48, a quick ratio of 0.74 and a current ratio of 0.86.

Xcel Energy (NASDAQ:XEL – Get Free Report) last posted its quarterly earnings results on Thursday, April 25th. The company reported $0.88 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.80 by $0.08. The business had revenue of $3.65 billion for the quarter, compared to analyst estimates of $4.12 billion. Xcel Energy had a return on equity of 11.03% and a net margin of 13.36%. The business’s revenue was down 10.6% compared to the same quarter last year. During the same period in the prior year, the company posted $0.76 EPS. Sell-side analysts predict that Xcel Energy Inc. will post 3.56 EPS for the current fiscal year.

Xcel Energy Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Saturday, July 20th. Investors of record on Friday, June 14th will be given a dividend of $0.5475 per share. This represents a $2.19 dividend on an annualized basis and a dividend yield of 3.95%. The ex-dividend date is Friday, June 14th. Xcel Energy’s dividend payout ratio is presently 65.77%.

Wall Street Analysts Forecast Growth

XEL has been the subject of several recent research reports. Barclays increased their price target on Xcel Energy from $56.00 to $57.00 and gave the company an “overweight” rating in a report on Tuesday, April 30th. TheStreet downgraded Xcel Energy from a “b-” rating to a “c+” rating in a report on Thursday, March 14th. JPMorgan Chase & Co. dropped their price objective on shares of Xcel Energy from $68.00 to $59.00 and set a “neutral” rating on the stock in a research note on Wednesday, March 13th. Wolfe Research raised shares of Xcel Energy from a “peer perform” rating to an “outperform” rating and set a $58.00 price target on the stock in a research note on Monday, March 11th. Finally, Morgan Stanley upped their price objective on shares of Xcel Energy from $59.00 to $65.00 and gave the company an “equal weight” rating in a research report on Tuesday, May 28th. Six investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of “Moderate Buy” and an average price target of $63.33.

Check Out Our Latest Stock Analysis on Xcel Energy

About Xcel Energy

Xcel Energy Inc, through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity. It operates through Regulated Electric Utility, Regulated Natural Gas Utility, and All Other segments. The company generates electricity through wind, nuclear, hydroelectric, biomass, and solar energy sources, as well as coal, natural gas, oil, wood, and refuse-derived fuels.

Featured Articles

Want to see what other hedge funds are holding XEL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Xcel Energy Inc. (NASDAQ:XEL – Free Report).

Receive News & Ratings for Xcel Energy Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Xcel Energy and related companies with MarketBeat.com’s FREE daily email newsletter.