Aggressive hybrid funds aim to strike a balance between capital growth and stability. Typically, they invest about 65–80 per cent of their assets in equities and the remaining 20–35 per cent in debt instruments. This blend allows investors to participate in market upswings while cushioning their portfolios against volatility—making these funds suitable for those seeking steady yet moderate-risk growth.

Bandhan Aggressive Hybrid Fund (BAHF) stands out for its strong comeback in recent times. Although it currently holds a 3-star rating as per bl.portfolio Star Track mutual fund ratings, BAHF’s performance has shown a marked turnaround over the past 15–18 months. It has emerged as one of the top two performers in its category over the last one-year period.

Equity Strategy

BAHF maintains its equity allocation consistently toward the higher end of the prescribed range, typically between 75 and 80 per cent. The fund’s equity investment philosophy rests on three pillars — a long-term outlook, reasonable diversification, and deep research. It evaluates businesses over a three-to-five-year horizon and typically holds stocks for five to six years, provided the original investment thesis remains valid. Diversification is maintained by holding around 55–60 companies, ensuring balanced exposure across sectors and themes. The fund focuses on parameters such as return on equity, growth potential, management quality and healthy capital allocation for adding to its portfolio.

The portfolio is currently overweight on three broad themes — consumer discretionary, domestic cyclicals, and healthcare. Within domestic cyclicals, sectors such as real estate, cement, banking, non-banking finance, insurance, and capital markets remain key focus areas. Lower interest rates and personal tax cuts have improved purchasing power, and several banks have already reported a revival in credit growth during the latter half of the year. These trends, the fund manager believes, support the outlook for domestic-oriented industries.

The fund dynamically balances risk across large-, mid-, and small-cap segments based on valuations. After mid- and small-cap corrections in early 2025, exposure to these segments increased; however, as they later outperformed, the portfolio gradually shifted toward large-caps, continually adjusting to the evolving risk–reward landscape. Its broader allocation remains roughly two-thirds in large-caps and the rest in mid- and small-cap stocks.

Debt allocation

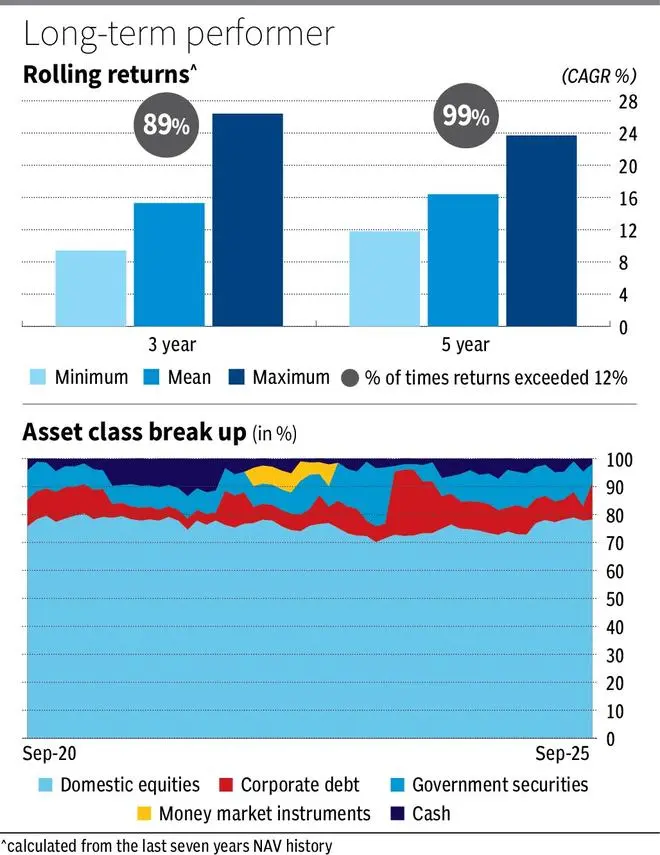

On the fixed-income side, the debt portion — roughly 20–25 per cent — is managed dynamically but conservatively. The fund takes duration calls based on the interest-rate cycle. Over the last five years, the portfolio’s Macaulay duration has ranged between one and seven years.

Investments include a mix of government securities, corporate bonds, and money market instruments. As per the latest portfolio data, the fund has allocated about 13 per cent to corporate debt and 6 per cent to government securities. There has been minimal exposure to non-AAA instruments — typically nil to four per cent at most over the past five years — as the fund does not focus on taking credit risk. Currently, it holds 1.5 per cent in AA+ rated bonds issued by Aadhar Housing Finance, Godrej Housing Finance, and Muthoot Finance.

The fund’s equity portion is managed by Prateek Poddar, while the debt portion is managed by Harshal Joshi.

Performance

The fund’s performance during 2022 and 2023 was close to the category average. However, it has delivered strong returns over the past 18 months, driven by timely portfolio moves and favourable market conditions. For instance, it increased exposure to consumer discretionary stocks ahead of GST-like incentives, anticipating a demand recovery supported by softer interest rates, good monsoons, and tax cuts. Holdings such as InterGlobe Aviation, Mahindra & Mahindra, Amber Enterprises India, and Greenply Industries contributed positively to performance.

However, performance measured by the three-year rolling returns over the past seven years shows that the fund broadly matched the category average (15.3 per cent versus 15.5 per cent). Returns are compound annualised. Notably, the fund delivered returns of over 12 per cent in 89 per cent of the rolling periods and exceeded 15 per cent in nearly 45 per cent of them.

From a cost perspective, the regular plan comes with an expense ratio of 2.14 per cent, slightly higher than the category average of 2 per cent. For investors opting for the direct plan, the expense ratio is 0.79 per cent, marginally lower than the category average of 0.81 per cent. The ideal investment horizon is 3-5 years.

Published on November 8, 2025