Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A £5bn approach for Hargreaves Lansdown has fired the starting gun on what analysts are predicting will be a scramble for cheap UK wealth managers with “attractive” growth prospects.

Hargreaves Lansdown, the UK’s largest DIY investment platform, said on Wednesday that it had recently rejected an offer from a private equity consortium led by CVC Capital Partners, in the view that it “substantially undervalues” the business at 985p per share.

But analysts said the approach was a sign of more bids to come, as the value of UK stocks continues to lag behind international equities — providing an attractive opportunity to snap up cheap companies.

Over the past few weeks, the UK market has been subject to a series of takeover proposals and rejections, including Australian miner BHP’s bids for London-listed Anglo American, and Daniel Křetínský’s bids for Royal Mail owner International Distribution Services. Cambridge-based cyber security firm Darktrace is also set to be taken over by US private equity firm Thoma Bravo.

Michael Summersgill, chief executive of AJ Bell, another of the UK’s biggest investment platforms, told the Financial Times that takeover approaches show there was “an attractive market with attractive growth prospects — people want to make money”.

He added that even though there was “lots of doom and gloom around UK capital markets more broadly” he saw that “there’s a great growth opportunity” in the wealth management industry.

Rae Maile, an analyst at Panmure Gordon, said the offer for Hargreaves Lansdown “echoes the broader trend across the UK market of low valuations being exploited by investors with the freedom to take a longer view”.

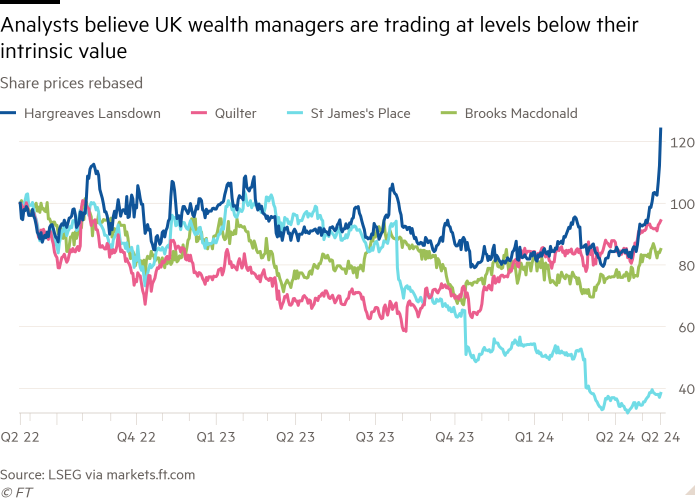

He said that other wealth managers, including Quilter, Brooks Macdonald and St James’s Place, are “trading at levels which do not reflect their intrinsic value”, providing a wider set of takeover targets.

A range of wealth managers have been bought in the past few years, including Royal Bank of Canada’s purchase of Brewin Dolphin and US investment bank Raymond James’s takeover of Charles Stanley. Private equity firms have also recently swooped in, with Pollen Street acquiring wealth company Mattioli Woods earlier this year.

Other large US private equity groups including Carlyle, Oaktree and Warburg Pincus have also completed deals for UK wealth managers in recent years.

Driving private equity appetite for these types of companies is the chance to use them as platforms to buy smaller wealth managers and consolidate a fragmented industry.

The strategy, known as a roll up, enables private equity to create a larger business, which it will seek to sell at a premium.

Although UK equities are under pressure from outflows, investment platforms, which offer ISAs and pension wrappers, have benefited from customers seeking to put their cash into international shares. AJ Bell reported on Thursday net inflows of £2.9bn in the six months to the end of March — up 45 per cent on the previous year — boosting assets to a record £80.3bn.

Analysts argue the industry can also capitalise on increasing longevity and the growing need for people to save for their own pension funds due to the shift away from final salary retirement schemes.

But the rise in deal activity means wealth managers could face a series of offers and counter-offers as businesses wrangle over price.

Analysts at Investec said that they “were not surprised” the board of Hargreaves Lansdown rejected the initial approach, which they believe represents a “significant discount” to the company’s worth and “materially undervalues” the “brand and long-term position of the group”.

Hargreaves Lansdown was founded by Peter Hargreaves and Stephen Lansdown about 40 years ago. It dominates the “direct-to-consumer” investment industry, with about 40 per cent of the market’s assets, according to Citi.

However, it has come under pressure from rivals — namely AJ Bell and Interactive Investor — which are poaching customers and flows partly by offering lower fees.