This article is an onsite version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning. Our top story breaks down what to expect today ahead of the launch of Labour’s election manifesto in Manchester, where Sir Keir Starmer will pledge to focus on “wealth creation” for Britain.

The opposition party will also promise to consult on its controversial plan to impose higher taxes on private equity bosses, with Rachel Reeves telling colleagues she is confident from her talks with the sector that there will be “no exodus” from the UK, according to Labour officials.

The shadow chancellor has previously called the “carried interest” tax loophole “absurd” and in 2021 said she hoped to increase taxes on the private equity sector by £440mn.

In February, Reeves’s spokesperson insisted a Labour government would charge the top 45p rate of income tax on profits private equity bosses earn on successful deals. At present, “carried interest” payments received by private equity executives are taxed at the 28 per cent capital gains tax rate. Here are more details on Labour’s manifesto.

-

Sunak vs Starmer: The prime minister acknowledged his party’s rocky record in office during yesterday’s Sky News debate, in which a snap YouGov poll showed his opponent performed better.

-

SNP’s shoestring bid: With Labour targeting Scotland, the Scottish National party is relying on an army of motivated activists as donations have been hit by a police probe into alleged embezzlement.

-

Centrism’s last chance: If he wins, Starmer needs to change swiftly from cautious challenger to confident premier if he is to halt the populist right, writes Robert Shrimsley.

Sign up for Stephen Bush’s Inside Politics newsletter to get the latest intelligence on the UK election. And here’s what else I’m keeping tabs on today:

-

Economic data: The EU has April industrial production figures, while the US has its May producer price index.

-

G7 summit: Leaders of member nations will gather in Apulia, Italy, where they are expected to discuss a deal to use profits from frozen Russian assets to aid Ukraine.

-

Companies: Tesla announces the results of a shareholder vote on whether to restore a mammoth pay package for chief Elon Musk. Adobe, Crest Nicholson, Virgin Money UK and Fuller, Smith & Turner report.

Five more top stories

1. Exclusive: Segantii Capital Management bet against Canada Goose after speaking to a Morgan Stanley banker whose desk knew of an impending share sale that threatened to hit the clothing brand’s stock price. US prosecutors had published details of the 2018 conversation as part of a probe that led to the Wall Street bank paying a $249mn penalty earlier this year, but Segantii and its portfolio manager Robert Gagliardi, who made the call, were not named. Read the full story.

2. Investment vehicles that scoop up risky loans are being launched at a record rate in Europe this year. More than €22.7bn of so-called collateralised loan obligations have been issued in the first five months of this year, according to Bank of America data, excluding deals that refinance existing CLOs at lower costs. Here’s why these previously shunned vehicles are being snapped up.

3. Revolut is moving its headquarters to one of Canary Wharf’s most prominent buildings as it presses ahead with expansion plans despite its failure so far to win a full banking licence. The UK fintech confirmed it would open its new global HQ in the former Thomson Reuters building in May 2025, increasing its office space by 40 per cent.

4. Exclusive: The world’s largest private capital firms have avoided income taxes on more than $1tn in incentive fees since 2000 by structuring the payments in a way that subjected them to a much lower levy, according to new research. The findings come amid increased scrutiny of carried interest pay in recent years. Here’s more from the Oxford university study.

5. The Federal Reserve’s first interest rate cut this cycle may still be nearly six months away, analysts said, and could come after November’s presidential election. The US central bank kept borrowing costs unchanged yesterday and signalled they would not fall as soon, or as far, this year, despite a slight drop in inflation in May. More from Claire Jones on yesterday’s rate announcement.

Want more on monetary policy? Sign up for our Central Banks newsletter by Chris Giles if you’re a premium subscriber, or upgrade your subscription here.

The Big Read

During their long tenure, the Conservatives have been buffeted by external shocks such as the aftermath of the financial crash, Covid-19 and the war in Ukraine. To that, they have added the self-inflicted upheavals of Brexit and chaotic premierships of Boris Johnson and Liz Truss. Today, Britain’s tax burden is at its highest level for 70 years and rising, debt is 90 per cent of GDP and rising — and so are the pressures on public services. With polls putting Labour 20 points ahead of Rishi Sunak’s party, what sort of country will Sir Keir Starmer be inheriting if his party gains power? What exactly have the Tories achieved during their 14 years in power?

We’re also reading . . .

-

Dollar doomsters: Those still claiming the US currency is headed for disaster are as wrong as they were two decades ago, writes Katie Martin.

-

EV tariffs: The EU’s increased duties on China’s electric vehicles will heighten trade tensions but are unlikely to stop the advance of the country’s carmakers.

-

EU migrants: The rise of the right makes it harder for Europe to deal with its real migration crisis: the need for foreign workers, writes Alan Beattie.

-

AI lobbying: OpenAI has rapidly built up an international team of lobbyists, joining rivals such as Google and Meta in seeking to influence regulation.

Chart of the day

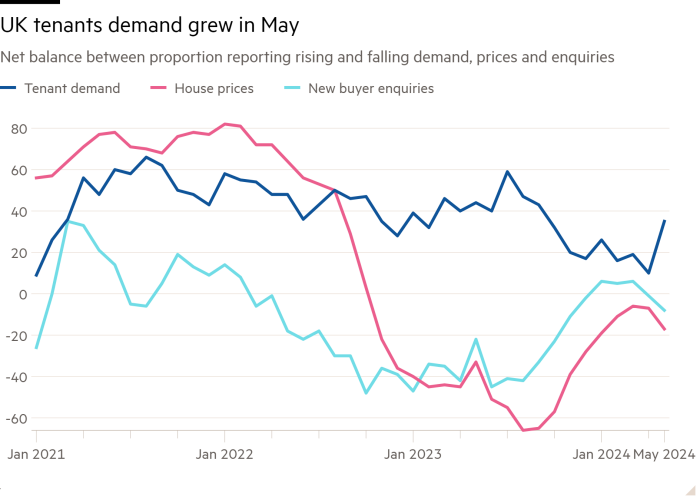

Britain’s rental market faces “growing challenges”, with rising demand and low supply, according to a closely watched survey by the Royal Institution of Chartered Surveyors. The results point to more pain for tenants as political parties focus on home ownership in the election campaign.

Take a break from the news

Move over, Margarita. This summer’s tequila cocktail is the Paloma: a cool glass of tequila, grapefruit soda, lime, salt and ice (no shaker required), traditionally served in a tall highball. Pile the ice high and garnish the drink with a fresh slice of pink grapefruit or lime.

Additional contributions from Sophie Spiegelberger, Benjamin Wilhelm, and Gordon Smith